Press Release

A similar amount in scheme benchmark yielded Rs.3.36 crores. The scheme benchmark is Nifty 200 TRI (65%) + Nifty Composite Debt Index (25%) + Domestic Price of Gold (6%) + Domestic Price of Silver (1%) + iCOMDEX Composite Index (3%).

One of India’s largest multi asset allocation fund, ICICI Prudential Multi-Asset Fund, has successfully completed 22 years. The Scheme has a Closing Asset Under Management (AUM) of Rs. 50,495.58 crores which accounts for nearly 48.29% of the total AUM in the multi asset allocation category. This indicates significant investor trust of investors in the scheme. Data as of September 30, 2024. (Source: Value Research).

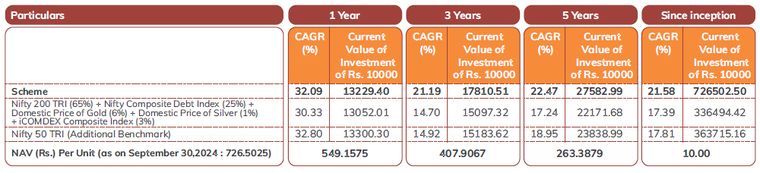

A lump sum investment of Rs. 10 lakhs at the time of inception (October 31, 2002), as of September 30, 2024, would be approximately worth Rs. approximately 7.26 crore i.e. a CAGR of 21.58%. A similar investment in Scheme benchmark - Nifty 200 TRI (65%) + Nifty Composite Debt Index (25%) + Domestic Price of Gold (6%) + Domestic Price of Silver (1%) + iCOMDEX Composite Index (3%) – would have yielded approximately Rs. 3.36 crores i.e. CAGR of 17.39%.

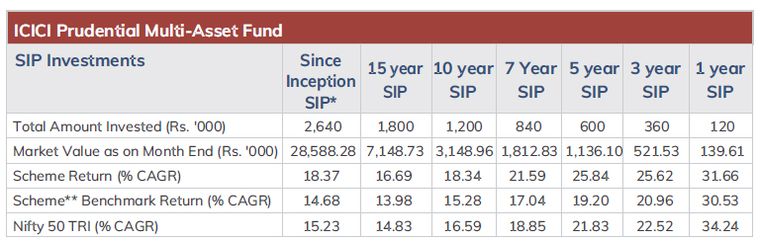

In terms of SIP performance, a monthly investment of Rs 10,000 via SIP since the inception, which would amount to a total investment of Rs. 26.4 lakh, would have grown to approximately Rs. 2.9crores as of September 30, 2024 i.e. a CAGR of 18.37%. A similar investment in the Scheme’s benchmark would have yielded a CAGR of 14.68%.

Please refer below for more details

Speaking on the occasion of 22 years’ completion, Nimesh Shah, MD & CEO of ICICI Prudential AMC says, “ICICI Prudential Multi-Asset Fund’s journey of wealth creation is a strong testament to the power of disciplined asset allocation across diverse asset classes. This approach has benefited our investors over the long term with rewarding investment outcomes.” He added, “At ICICI Prudential Mutual Fund, we rely on the expertise of a dedicated team comprising of fund managers across equities, debt, and commodities. This collaborative approach enables us to make well-informed allocation decisions, allowing the scheme to leverage our asset class expertise to deliver value to our investors.”

Speaking about the fund strategy, S Naren, ED & CIO, ICICI Prudential AMC said, “Over the past decade and beyond, the performance of various asset classes has demonstrated that the top performer often shifts from year to year. In this dynamic environment, spreading one's investments across different asset classes is an effective way to capitalize on the unique opportunities each offers. This diversified approach helps ensure that the portfolio can benefit from the potential gains of each asset class, regardless of market conditions. By adopting this strategy, investors can achieve a more favorable risk-adjusted return across market cycles. Moreover, diversifying a portfolio across multiple asset classes also plays a crucial role in managing volatility, helping to smooth out the fluctuations that can occur in individual markets.”

ICICI Prudential Multi-Asset Fund is an open ended scheme investing in Equity, Debt and Exchange Traded Commodity Derivatives/units of Gold ETFs/units of Silver ETFs/units of REITs & InvITs/Preference shares. The investment strategy spreads its money throughout several asset classes and market capitalizations in an effort to produce returns over a longer period of time. It allocates at least 10% of its assets across three or more asset classes.

---

For further information, please contact

Adil Bakhshi, Principal - PR & Corporate Communication

Email: adil_bakhshi@icicipruamc.com

Disclaimer

Returns of ICICI Prudential Multi-Asset Fund - Growth Option as on September 30, 2024

Notes:

1. Different plans shall have different expense structure. The performance details provided herein are of ICICI Prudential Multi-Asset Fund.

2. The scheme is currently managed by Sankaran Naren, Ihab Dalwai, Manish Banthia, Akhil Kakkar, Gaurav Chikane, Sri Sharma and Sharmila D’mello. Mr. Sankaran Naren has been managing this fund since Feb 2012. Total Schemes managed by the Fund Manager is 14 (14 are jointly managed).

Mr. Ihab Dalwai has been managing this fund since June 2017. Total Schemes managed by the Fund Manager is 4 (3 are jointly managed).

Mr. Manish Banthia has been managing this fund since Jan 2024. Total Schemes managed by the Fund Manager is 25 (25 are jointly managed).

Mr. Akhil Kakkar has been managing this fund since Jan 2024. Total Schemes managed by the Fund Manager is 6 (6 are jointly managed).

Mr. Gaurav Chikane has been managing this fund since August 2021. Total Schemes managed by the Fund Manager is 3 (1 are jointly managed).

Ms. Sri Sharma has been managing this fund since Apr 2021. Total Schemes managed by the Fund Manager is 6 (6 are jointly managed).

Ms. Sharmila D’mello has been managing this fund since May 2024. Total Schemes managed by the Fund Manager is 9 (7 are jointly managed).

Refer annexure from page no. 109 for performance of other schemes currently managed by Sankaran Naren, Ihab Dalwai, Manish Banthia, Akhil Kakkar, Gaurav Chikane, Sri Sharma and Sharmila D’mello.

3. Date of inception:31-Oct-02.

4. Past performance may or may not be sustained in future and the same may not necessarily provide the basis for comparison with other investment.

5. Load is not considered for computation of returns.

6. In case, the start/end date of the concerned period is a non-business date (NBD), the NAV of the previous date is considered for computation of returns. The NAV per unit shown in the table is as on the start date of the said period

7. The performance of the scheme is benchmarked to the Total Return variant of the Index. For benchmark performance, values of Nifty 50 TRI have been used since inception till 27th May, 2018 and w.e.f. 28th May, 2018 values of Nifty 200 Index (65%) + Nifty Composite Debt Index (25%) + LBMA AM Fixing Prices (10%) have been considered thereafter. The Benchmark of Scheme has been changed to Nifty 200 TRI (65%) + Nifty Composite Debt Index (25%) + Domestic Price of Gold (6%) + Domestic Price of Silver (1%) + iCOMDEX Composite Index (3%) w.e.f. July 1, 2023.

8. Mr. Anuj Tagra has ceased to be the Fund Manager of the Scheme w.e.f. January 22, 2024.

Click Here to view performance of other schemes managed by fund managers of the scheme.

Refer to the details below. Past performance may or may not be sustained in future. *Inception date is 31 Oct 2002. **Nifty 200 TRI (65%) +Nifty Composite Debt Index (25%) + Domestic Price of Gold (6%) + Domestic Price of Silver (1%) + iCOMDEX Composite Index (3%). The performance of the scheme is benchmarked to the Total Return variant of the Index.For benchmark performance, values of Nifty 50 TRI have been used since inception till 27th May, 2018 and w.e.f. 28th May, 2018 values of Nifty 200 Index (65%) + Nifty Composite Debt Index (25%) + LBMA AM Fixing Prices (10%) have been considered thereafter. The returns are calculated by XIRR approach assuming investment of Rs 10000/- on the 1st working day of every month. XIRR helps in calculating return on investments given an initial and final value and a series of cash inflows and outflows with the correct allowance for the time impact of the transactions. The investment value shown above would have varied based on the amount of SIP, the investment period of the investors and continuity of SIP. The returns shown are not indicating/assuring in any manner and is not an indicator of future returns. ICICI Prudential Mutual Fund does not provide guaranteed returns.

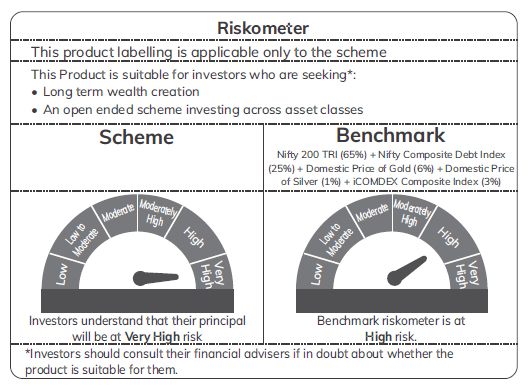

Riskometer

ICICI Prudential Multi-Asset Fund - An open ended scheme investing in Equity, Debt and Exchange Traded Commodity Derivatives/units of Gold ETFs/ units of Silver ETFs/units of REITs & InvITs/Preference shares

Please note that the Risk-o-meter(s) specified above will be evaluated and updated on a monthly basis. The above riskometer is as on October 31, 2024 Please refer to https://www.icicipruamc.com/news-and-updates/all-news for more details.

The portfolio of the scheme is subject to changes within the provisions of the Scheme Information Document of the scheme. Please refer to the SID for investment pattern, strategy and risk factors.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.