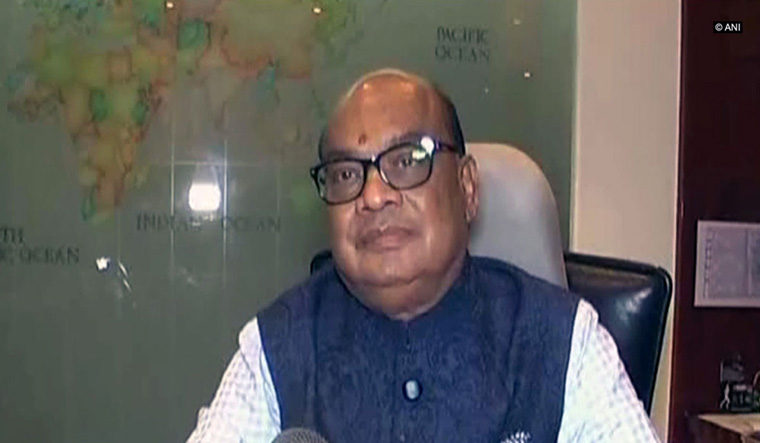

CBI questioned Rotomac Pen promoter Vikram Kothari in Kanpur, a few hours after he rubbished media reports claiming him to have left the country

The Kanpur-based company's owner had taken a loan of more than Rs 800 crore from over five state-owned banks.

Allahabad Bank, Bank of India, Bank of Baroda, Indian Overseas Bank and Union Bank of India compromised their rules to sanction loans to Rotomac, the sources said.

According to local media reports, the promoter said speculation of his fleeing the country was baseless. "I am a resident of Kanpur and I will stay in the city. However, I do have to travel to foriegn countries for business purposes," Kothari said.

Kothari took a loan of Rs 485 crore from Mumbai-based Union Bank of India and a loan of Rs 352 crore from Kolkata-based Allahabad Bank.

A year later, Kothari has reportedly not paid back either the interest or the loan.

Last year, Bank of Baroda (BoB), a consortium partner declared pen manufacturer Rotomac Global Pvt Ltd as "wilful defaulter".

The company moved the Allahabad High Court seeking removal of its name from the list of wilful defaulter.

A division bench comprising Chief Justice D.B. Bhosle and Justice Yashwant Verma had passed the order on a petition filed by the company, contending that it has been wrongly declared a "wilful defaulter" by BoB despite having "offered assets worth more than Rs 300 crore to the bank since the date of default".

Rotomac was declared a wilful defaulter vide an order dated February 27, 2017 passed by an authorised committee, as per the procedure laid down by the Reserve Bank of India.

The CBI has registered an FIR against Rotomac pen promoter Vikram Kothari on the basis of a complaint from Bank of Baroda for allegedly swindling over Rs 800 crore, officials said here today. The agency started searching his residence and offices in Kanpur from early in the morning, they said. There were no arrests in the case yet, CBI spokesperson Abhishek Dayal categorically said. He said Kothari, his wife and his son are being examined by the CBI, which is conducting the searches.

This is the second major financial scam to break out after the sensational Rs 11,400 crore fraud allegedly committed by billionaire jewellery designer Nirav Modi and his uncle Mehul Choksi, who is a promoter of Gitanjali group of companies. Both fled the country before the Punjab National Bank realised the depth of the alleged crime.

The PNB fraud pertains to issuance of fake LoUs to companies associated with billionaire jeweller Nirav Modi by errant PNB employees, which enabled these companies to raise buyers credit from international branches of other Indian lenders.

Last month, PNB had lodged an FIR with CBI stating that fraudulent LoUs worth Rs 280.7 crore were first issued on January 16. At the time, PNB had said it was digging into records to examine the magnitude of the fraud.

In the complaint, PNB had named three diamond firms – Diamonds R Us, Solar Exports and Stellar Diamonds – saying they had approached it on January 16 with a request for buyers credit for making payment to overseas suppliers.