In most of the developed countries round the globe, citizens rely heavily on cashless, electronic money transactions as opposed to traditional paper currency. Experts believe that there could be absolutely cashless societies in the world by 2020. Today, the world is curious to know how countries round the globe are reacting to the cashless trend. A study done by Forex Bonuses enlists the countries that are most cashless. The study takes into consideration things like the amount of debit and credit cards per member, the growth in popularity of cashless payment, and the overall awareness of mobile payment technology.

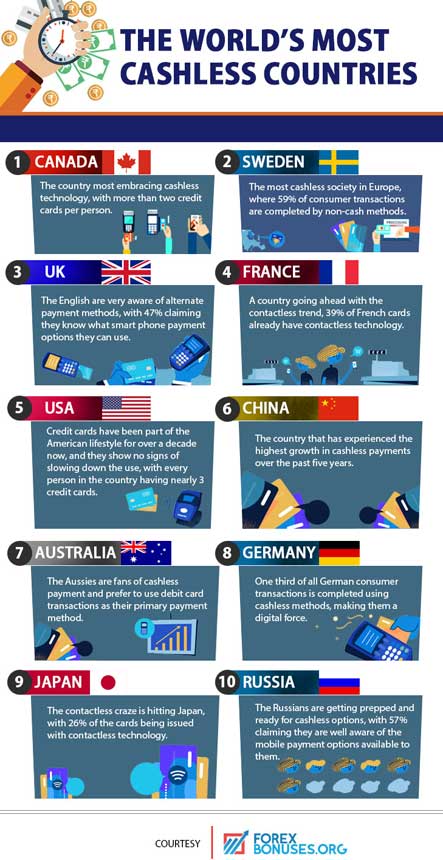

The study says that Canada, stands far ahead in embracing cashless technology, with an average of more than two credit cards per person. Sweden, being the most cashless society in Europe, came second in the list, where 59 per cent of consumer transactions are completed by non-cash methods. UK, the third in the list, is very well aware of alternate payment methods, with 47 per cent saying they know what smartphone payment option they can use. France is going ahead with the contactless trend. Being fourth in the list, 39 per cent of cards in France already have contactless technology.

Credit cards have been a part of the American lifestyle for over a decade now, and they show no signs of slowing down the use of the same. At fifth spot in the list, every person in the USA nearly holds three credit cards. Sixth in the list, China has experienced the highest growth in cashless payments over the past five years. Australians, seventh in the list, prefer to use debit card transactions as their primary payment method.

One third of all consumer transaction in Germany is completed using cashless methods, making them the eighth in the list. The contactless craze is hitting Japan, the ninth in the list, with 26 per cent of the cards being issued with contactless technology. Russia, the tenth in the list, is getting prepped and ready for a cashless economy, with 57 per cent claiming they are well aware of the mobile payment options available to them.

In the last decade of the 20th century, popularity of electronic banking made the use of cashless transactions popular among some of the most technologically advanced nations in the world. Digital transaction became well established across the global economy in the 2010s. As a direct effect of the wide spread growth and popularity, internet-based shopping, banking and alternate payment systems grew fast. With technological developments, many digital payments companies have been established, and aims to increase, improve and offer secure e-payment options.

The Indian government is also encouraging the people to go cashless and reduce dependence on cash transactions. Through the demonetisation drive in November 2016, the government attempted to bring people into the realm of electronic transactions, making paper currencies of higher denominations void, overnight. A call to adopt digital payment methods was pushed. A month after demonetisation, daily transaction volume from digital wallets such as Oxigen, Paytm and MobiKwik, reportedly went up by 271 per cent from 1.7 million to 6.3 million.

The key arguments in favour of cash-abandonment are that it would lead to more efficient service and carry a lower risk of theft, achieved with the aid of cryptography and digital signatures. A cashless economy is often marked by greater transparency, ease and convenience in monetary transactions. The security risks of keeping cash on-site, persuades one to opt for an alternate method. Also, a cashless system will help put a check on money laundering, paper-note counterfeiting and terror financing. The electronic cash transactions can be easily monitored by the government and banking agencies, with least possibilities of frauds.