Higher fuel price, seemingly pinching only the middle class now, is likely to become a bane for the entire economy soon. Unless the government takes firm decisions on its revenue management, high price of crude oil is expected to result in higher inflation and deficits for the government.

An increase in the oil price by $10 per barrel can lower GDP growth by 0.2-0.3 percentage point, quicken inflation by about 1.7 percentage points and worsen India's current account balance by about $9-10 billion, said a report titled 'The Economic and Social Survey of Asia and The Pacific 2018', released on Tuesday jointly by United Nations Economic and Social Commission for Asia and the Pacific (UNESCAP) and the Indian Council for Research on International Economic Relations (ICRIER).

"While the price is expected to moderate to about $60 per barrel, higher oil prices pose downside risks for large oil importers, such as India, which benefited greatly from the low oil prices for the last three years, but now is experiencing higher inflation and wider current account deficit," the UNESCAP Annual survey said.

In India, the recently introduced goods and services tax, together with weak corporate and bank balance sheets, resulted in moderate economic growth, but signs of recovery emerged in the second half of the fiscal year, the report said.

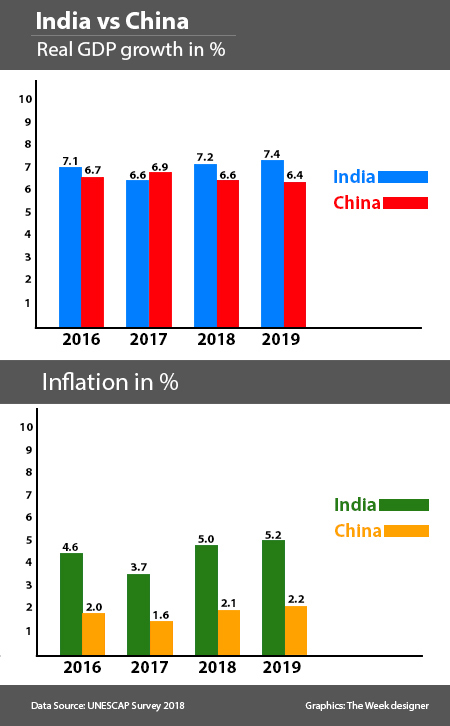

India's GDP is projected to grow at 7.2 per cent in the 2018-19 fiscal, from 6.6 per cent last year. However, the ESCAP survey said India’s potential growth has declined over the past decade because of a sharp slowdown in capital accumulation. “Recent estimates of the country’s potential growth range from 6 to 8 per cent,” it said.

The Union government's rising fiscal deficit was also pointed out as a bane in the report. “India has been on a gradual consolidation path, with the goal of lowering government debt to 60 per cent of GDP by fiscal year 2022-23. However, its deficit has overshot targets, “ said Jaimini Bhagwati, Reserve Bank of India Chair professor, ICRIER.

"Another reason for the wider deficit was the debt restructuring of state power distribution companies," the report pointed out. India's budget deficit target for the 2018-19 fiscal year is 3.3 per cent of GDP, lower than the estimated 3.5 per cent deficit in 2017-18, but higher than all previously set targets in the past decade.

In India, the last three years proved a 40 per cent drop in private consumption from its highs of 2016, just before demonetisation. Level of fixed investment, on the other hand, jumped in 2017 from the lowest depths they were in 2016, thanks largely to government efforts. The annual economic survey credits the new bankruptcy code and the recapitalisation package for public sector banks initiated by the Centre for the improved levels of investment. Both the measures are expected to support a gradual recovery in private investment, it said.

India's investment performance was relatively weak in recent years, much in line with global uncertainties clouding the overall investment climate. But a weaker corporate and bank balance sheet also contributed to the sharp slowdown in investment, the report concluded.

"Thus, simply lowering policy interest rates was not enough to revive investment in the country," the UNESCAP report said, adding that over the past year, there has been a welcome recovery in investment. In line with firmer global demand and stronger trade, investment in export-oriented manufacturing sectors picked up.

It said, going ahead too, the RBI would need to keep a close watch on limiting inflation, as oil prices are expected to rise further, as India's economy is expected to see a gradual recovery.

"In India, a gradual recovery is expected; private investment is expected to revive as the corporate sector adjusts to GST, infrastructure spending increases and corporate and bank balance sheets improve with government support," the UNESCAP survey said, crediting India's finance ministry's decision to re-capitalise banks.

Potential growth has declined in India over the past decade owing to a sharp slowdown in capital accumulation; recent estimates of the country’s potential growth range from 6 to 8 per cent.

also read

- Oil prices enter a tipping zone: Good news for India?

- OPINION | The evolving dynamics of India's gig economy: Policy challenges and the path forward

- Markets in red: Sensex, Nifty, and rupee continue slide in morning trade

- SBI report pegs GDP growth at 6.5% in Q2; sees some incipient pressure on domestic economy

On climate change and poverty, the UN report highlighted poignantly how risking our ecology drives us closer to poverty. "Climate change induced agricultural loss is substantial; in India, it was found that such losses can reduce annual agricultural incomes by 15-18 per cent."

"Moreover, inefficient and unplanned urban expansion has resulted in the conversion and loss of forests, wetlands and other ecosystems and has increased the already high exposure to disasters," it said.

The UNESCAP survey of 2018 notes that while China is rebalancing towards services, many countries, including India, are trying to expand their manufacturing base, to realise the demographic dividend and further diversify their economies.

"The report is a timely reminder of the need for Asia-Pacific countries to maintain macroeconomic stability, along with effective macroprudential policies, in the face of possible headwinds of trade protectionism, interest rate hikes in the United States and Eurozone and rising oil prices," said Bhagwati. "Against this backdrop, countries like India should focus on providing an enabling environment to raise adequate financing and fuel sustained growth, while reducing inequality," he added.