While aspects of the Union Budget are likely to affect consumers in many ways, the most significant impact is always the change in prices for common goods.

This year, in a bid to boost the Make in India initiative, Union Finance Minister Nirmala Sitharaman announced a hike in customs duties on a range of products so as to give the domestic industry a "level playing field". At the same time, certain products are set to get cheaper.

While Sitharaman mentioned a few items in her speech, a more detailed list is available on the official budget website. Here is a list of what gets costlier and what gets cheaper.

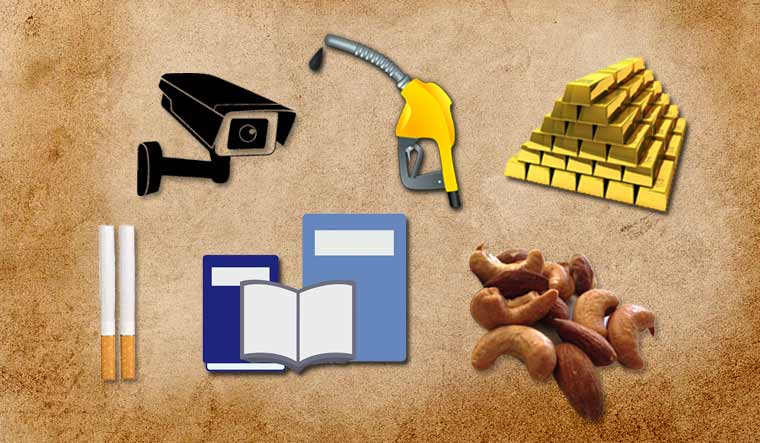

Cashewnut: Under the new customs duty, tariffs on cashewnuts have been increased from 45 per cent to 70 per cent.

Gold: The customs tax on precious metals including gold has been increased from 10 per cent to 12.5 per cent.

Oil: For the second year in a row, petrol and diesel are set to get more expensive after the Union Budget. The scheduled additional duty on customs is set to increase by Rs 2 per litre on imported motor spirit (petrol) and high-speed diesel. However, the effective rate increase will be by Rs 1 per litre.

Imported books: The Basic Customs Duty (BCD) is being increased on printed books, covers and manuals. This will have an impact on books printed outside of India. However, printed books imported for personal use, as defined under section 9804, will be exempted from duty.

Gold and silver: The BCD on both gold and silver is being increased from 10 to 12.5 per cent. This will affect gold bars, silver medallion and both gold and silver coins. Other precious metals like platinum will also see a BCD increase of 2.5 per cent.

Cigarettes and tobacco: These products will see a range of price increases, from Rs five per thousand for cigarettes to a 0.5 per cent hike for chewing tobacco and gutka.

Poly Vinyl Chloride (PVC): The BCD on PVC is being increased from 7.5 per cent to 10 per cent.

Butyl Rubber: Otherwise known as synthetic rubber, this is commonly used in sports equipment like footballs, the inner lining of vehicle tires, as well as in speaker systems. The BCD is being raised from five to ten per cent.

Marble slabs: The tariff rate has been increased to 40 per cent for marble slabs.

Vehicle components. Friction materials, commonly used in the manufacture of clutch plates, are having their tariffs raised from 10 to 15 per cent. Additionally, the rates for petrol, diesel and air filters are being hiked by 2.5 per cent. Catalytic converters, found in internal combustion engines, will also see their BCD hiked by 2.5 per cent.

Hinges and locks: Tariffs for items coming under tariff item 8302 as well as for locks used in motor vehicles are being increased by five per cent.

Split-system air conditioners: A ten per cent hike in BCD will affect imports of these systems, for both indoor and outdoor units.

Digital Video Recorders (DVRs): A somewhat unfamiliar item for many, these devices are used to copy and burn data onto DVDs or other media. The exemption on tariffs for them as well as for Network Video Recorder (NVR) and CCTV cameras is being dropped, which will result in a 15 per cent BCD being levied on their import.

Loudspeakers: The BCD on these is being increased by five per cent.

Imported vehicles: The BCD on Completely Built Units (CBU) is being increased from 15 per cent to 20 per cent.

Newsprint: The exemption for BCD on imported newsprint is being withdrawn, which will result in a duty of ten per cent being levied on newsprint. This may have an impact of newspaper and magazine prices.

Here are the items that will get cheaper:

Uranium ore: Yes, this is not an everyday product. But it remains so that the Basic Customs Duty (BCD) on uranium is being reduced from 2.5 per cent to nil, if it is for use in nuclear power plants. This may have an impact on power prices. Additionally, other tariff items (coming under 2844 20 00) that are intended for use in nuclear plants will see their duty drop from 7.5 per cent to zero.

Wooly items: The BCD on wool fibre and woolen tops is being reduced from five to 2.5 per cent.

Artificial kidneys: The raw materials, parts and accessories used to manufacture these, as well to make the micro barriers used within these, will now be exempted from BCD. Disposable dialyzers will also benefit from this exemption.

Getting a liquor license: An exemption for paying the service tax on a liquor licenbse is being proposed under clause 116 to 118 of the Finance Bill, 2019. This may make it cheaper to set up a bar or establishment serving alcohol.

Made in India items: Many exemptions have been made for items and products that are made in India. This includes for PCBs and a sim-card holders for the mobile phone industry.

Military imports: In a single sentence, Sitharaman mentioned an important detail about the future of defence imports. “Import of defence equipment that are not being manufactured in India are being exempted from basic customs duty.” The minister did not dwell on this point and moved on to listing items like cashew and petrol which would face price increases. According to the customs and duties section of the budget, “BCD is being exempted on specified military equipment and their parts imported by the Ministry of Defence or the Armed Forces, subject to specified conditions” with the notification itself valid for till 2024. This has significant implications for the modernization of India’s outdated military equipment and may speed up the process.