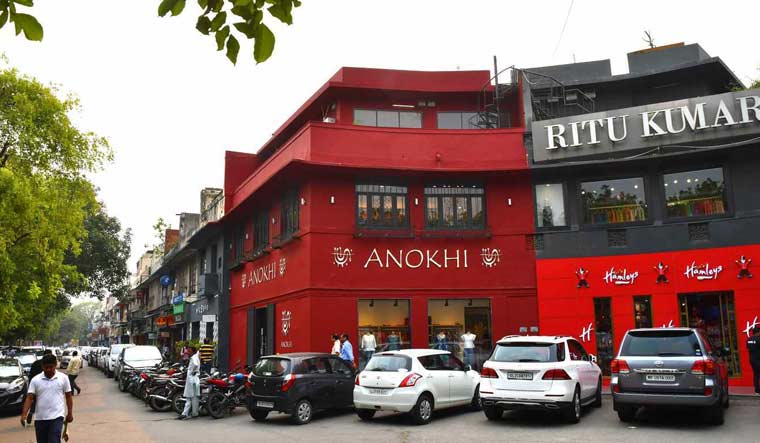

Delhi's upscale Khan Market has moved up one position to become the world's 20th most expensive retail location, according to global property consultant Cushman & Wakefield.

In its latest report 'Main Streets Across the World 2019', the consultant said that Khan market is ranked 20th in the list of the most expensive retail locations with an annual rent of $243 per sq ft. Last year, Khan market was at 21st place with a rent of $237 per sq ft a year.

Causeway Bay in Hong Kong retains the number one ranking, commanding an annual rent of $2,745 per sq ft.

New York's Upper 5th Avenue is at second position ($2,250 per sq ft), followed by London's New Bond Street ($1,714 per sq ft) and Avenue des Champs Elysees in Paris ($1,478 per sq ft).

Via Montenapoleone in Milan, Italy ranks fifth with an annual rent of $ 1,447 per sq ft, the report said.

The rankings are based on rentals during the second quarter of 2019 calendar year. The Cushman & Wakefield report tracked 448 locations across 68 countries.

On the India market, the report said that "rental trends over the past year have largely been pointing upwards, with the lack of availability in the best shopping malls pushing more brands to seek out prominent, high footfall locations in the main commercial corridors".

While high street rents in the bigger cities of Mumbai, Delhi-NCR and Bengaluru have experienced only marginal increases, other cities such as Chennai, Pune and Kolkata, which have a more vibrant high street culture, have recorded much stronger rental uplift, it added.

The consultant highlighted that the growth sectors include food and beverage (F&B), clothing and accessories, along with hypermarkets and e-commerce retailers opening physical stores.

Some large store formats are also experimenting with standalone outlets close to key commercial and residential markets along major roads, it said.

The short-term outlook is upbeat, with rents expected to edge up in the major high streets where supply remains constrained, the report said.