At a recent event in New Delhi, Prime Minister Narendra Modi lamented that when a number of people did not pay tax and found ways to evade it, "the burden falls on those who honestly pay their dues". "In the last five years, more than 1.5 crore cars have been sold in the country. Over 3 crore Indians went abroad for work or travel. But the situation is that only 1.5 crore people in our country of more than 130 crore pay income tax. Of this, only 3 lakh people have declared their annual income over Rs 50 lakh. Furthermore, only 2,200 professionals, including scientists, engineers, chartered accountants and Bollywod actors, declared their income above Rs 1 crore. Such is the state of affairs in India," the prime minister said at the Times Now summit on Wednesday.

However, PM Modi appears to have made a serious gaffe as the numbers seem to contradict the figures released by the Income Tax department. According to the data released by income tax department in October 2019, there were 49,128 taxpayers with salaried income of more than Rs 1 crore in India during the assessment year 2018-19. It is to be noted that the 'professionals' segment that the PM talked about falls under the 'salaried income' category. At the same time, the total number of individuals earning more than Rs 1 crore per annum was 97,689 during the same period.

In fact, the overall rise in individual income tax during the assessment year 2018-19 has been mainly driven by the salaried class. The average salary income declared stood at Rs 6.9 lakh in a year when the average declared business income was Rs 4.13 lakh.

In addition, the number of income taxpayers during the financial year 2018-19 was 8.45 crore, which rose from from 7.42 crore a year ago. So as per the official data, Modi has understated the figures by a significant number.

The prime minister's statement comes about a fortnight after Finance Minister Nirmala Sitharaman proposed a new income tax regime in Budget 2020. Taxpayers can opt for the alternative simplified tax regime if they are willing to forego deductions and exemptions under the previous regime.

Why Modi's claim of 'only 2,200 professionals' with income declared above Rs 1 cr is false

PM claimed that only 2,200 professionals have declared their income above Rs 1 crore

Web Desk

Updated: February 13, 2020 15:54 IST

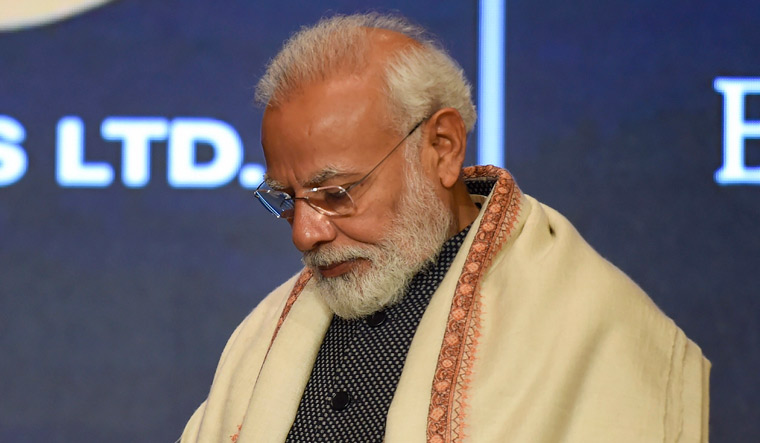

Prime Minister Narendra Modi | File

Prime Minister Narendra Modi | File

also read

- Andhra woman entrepreneur interacts with PM Modi in Telugu

- 'When father is alive...': Fadnavis dismisses buzz on PM Modi's successor

- All you need to know about IFS officer Nidhi Tewari, PM Modi's new private secretary

- Understanding significance of PM Modi's visit to RSS headquarters, Deekshabhoomi in Nagpur