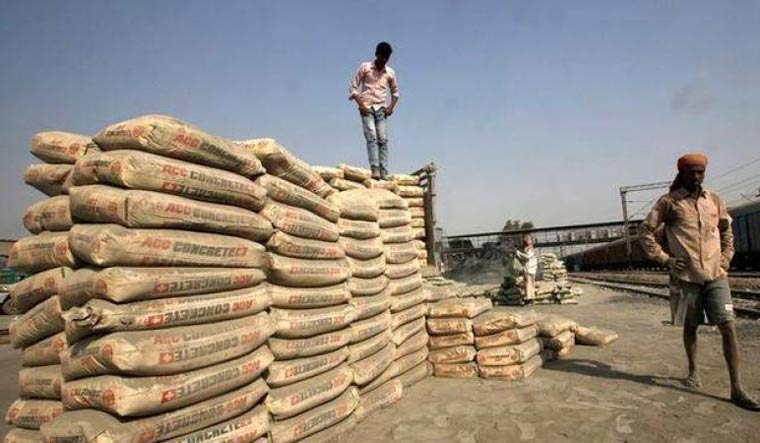

A slowdown in construction and infrastructure projects due to the COVI-19 pandemic had impacted the sales of cement over the last few months. However, it is expected that the demand in rural areas and a rise in affordable housing projects will give the much needed thrust to the sector and drive the overall sales in cement.

As per CRISIL, the rural off-take will stem a fall in cement demand to 12-14 per cent this fiscal. It is expected that cement sales will see recovery from a sharp contraction of 85 per cent seen in April to an estimated 7-10 per cent growth by the Q4 of FY 21. Interestingly, as per a study by Motilal Oswal Institutional Equities, the demand for cement in the eastern part of India has been the strongest among the region and has been attributable to affordable housing projects as well as increased labour availability as most of the migrant workers from the east (Bihar, Jharkhand, and West Bengal) have returned to their hometowns due to the pandemic.

A recent report by CRISIL found that rural demand for cement will ride on higher agricultural income and a sharp rise in spending under the Mahatma Gandhi National Rural Employment Guarantee Act to engage migrant workers who have returned home following the COVID-19 pandemic. Besides that, there are given expectations of another normal monsoon this year that will result in the third consecutive season of healthy agriculture income.

“The pandemic-led lockdown had resulted in a near washout of cement sales volume in April 2020, but rural demand vertically yanked up recovery in May and June. Demand recovery, however, has not been uniform across regions and bears a likeness to the intensity of the pandemic. East and central regions are more resilient, while west and south are more impacted,” observed Isha Chaudhary, director, CRISIL Research.

CRISIL further observes that despite the volume contraction and lower cash accrual, credit profiles of cement makers won’t be impacted. “The credit profiles of cement makers are resilient because of healthy balance sheets. In addition, adequate liquidity maintained by most cement makers will afford a bolster. Lower capital expenditure, and mergers and acquisition activity will also be supportive,” pointed out Nitesh Jain, director, CRISIL Ratings.

Cement makers had liquidity of Rs 23,000 crore as on March 31, 2020, which is more than their debt repayment due this fiscal. It is expected that in order to maintain liquidity, cement companies are likely to cut down capital expenditure by 30-40 percent this fiscal. Also, while cement companies have been acquisitive in recent past, the sector is now fairly consolidated and large sized M&A deals are unlikely in the near term. There could be ongoing challenges to the sector due to the rise in Covid-19 cases in the hinterland and intermittent lockdowns but it is likely that a revival of industrial capital expenditure and government spending on infrastructure will boost the sector.

A report by Motilal Oswal observed that there was a decline in cement demand and the prices too declined in August. However the report observes that August is seasonally the weakest month of the year for cement volumes as there is heavy monsoon rainfall across most parts of the country. Data for the past 25 years suggests that the August volumes are 12 per cent lower than the annual average.

Notably, however, similar to June and July, demand is still flat to positive on a Year on Year basis in the east, north and central parts of the country. Demand for cement remained weak in the southern part and in Maharashtra due to weak infrastructure demand and lower labour availability.

The seasonal weakness also resulted in a decline in cement prices across the regions of the country during this quarter by Rs 10-15 per bag of cement. The Motilal report also points out that cement demand in northern and central India has recovered from the impact of COVID-19 and the demand in the eastern region has been the strongest among all the regions. It has also been found that Maharashtra has been the worst impacted by COVID-19 among the Indian states and the demand is still down by almost 35 percent YoY on account of lower labour availability due to the mass migration, weak urban real estate demand, and slow infrastructure activity.