We have been building a new Kerala for the last five years. Projects that have been talked about and were dormant for decades are now coming true in front of the people of Kerala. Development projects are currently progressing in all 140 assembly constituencies of Kerala that were unlikely to materialize even in the next ten or fifteen years.

Kerala is setting a new model of development for the country which is beyond traditional methods. The Government is implementing 889 projects through KIIFB with an investment of Rs43,250 crore. In addition to this, Rs20,000 crore has been sanctioned for land acquisition for various projects. Thus, development projects to the tune of Rs63,250 crore is being achieved the State, something which is unprecedented in the history of Kerala.

The work done to raise funds for these projects is also a model for the whole country. The Kerala Infrastructure Investment Fund Board has become the first State Government agency to enter the international financial market through the sale of its Masala Bond. It has received widespread acclaim as a historic milestone. This reflected the will of the Government in meeting the priorities of development. The investor confidence in KIIFB’s operations and system has enabled it to raise money at the best rates, despite being a state-level agency. It is a good sign that many other financial institutions are coming forward to invest money, attracted by KIIFB’s transparency and efficiency.

Along with big infrastructural projects, areas like education and health also need to be developed. Even in that regard, the state government is working with a clear sense of direction. This is evidenced by the 45,000 high-tech classrooms set up in public schools across the state and the high-tech labs set up in thousands of schools. 141 schools have become centres of excellence at a cost of Rs705 crore. In addition, 336 schools were renovated at 03 crore each, and 446 schools were renovated at a cost of Rs50 lakh to 01 crore each. The situation is not different in the health sector. KIIFB is financing and completing the construction and renovation of 50 dialysis units, 10 cath labs and 23 hospitals.

KIIFB ensures funding for development activities in all constituencies in Kerala, without any political prejudice. The Government is not just a mere spectator after handing over funds for the projects. Strict measures are also taken to ensure the quality of the projects. Once substandard works are detected, there is no compromise in stopping them, suggesting solutions and ensuring that they are completed as envisaged.

Kerala has been repeatedly afflicted by challenges, including floods and epidemics. It is gratifying that Kerala is moving in the right direction of development, despite the disasters. With just a few weeks to complete our term, this Government has kept its word to the people of Kerala, of achieving the comprehensive and sustainable development of the State. It evokes a lot of joy and pride, and I share it with you all at this time.

Kerala is now witnessing unprecedented development since its formation after independence- the prime engine for this spectacular progress is the Kerala Infrastructure Investment Fund Board (KIIFB) set up by the Government of Kerala as a statutory body and body corporate. The Legislative Assembly unanimously passed the KIIFB Amendment Act. KIIFB has been able to achieve glorious achievements as this state government enters its final months. KIIFB has already sanctioned 889 projects worth Rs63250 cr. under various administrative departments. An amount of 20,000 cr. has been sanctioned for land acquisition for projects including industrial parks. More than Rs8300 cr. has been already spent on various projects. KIIFB is built on ideas that combine foresight and practicality

The KIIFB model may well be the most innovative financial initiative used by any State in India for resource mobilization. KIIFB is the first financial institution of a state government to raise money from the international market through masala bonds. The successful issue of the masala bond under the ECB route of RBI was a fitting answer to those who doubted whether the KIIFB model itself would find favour with investors. Even those who have accused KIIFB of exaggerating its stated goals have been silenced as they watch projects after projects getting underway. Later, there were moves from some quarters to question the legality of KIIFB’s very existence. Government strong responded to that. But what which has in fact silenced its critics, is the actual results themselves on the ground – with hundreds of projects being completed successfully. This has foiled the designs of a few to attack KIIFB and thereby derail the development of the state.

The projects undertaken by KIIFB are a direct testament to the strong will of the State Government to strive for a developed Kerala, without waiting for possibly several decades. This is where fund raising by KIIFB comes into play. If these projects were to be delayed by two decades, the project cost would have been many times higher – and the current generation would have been denied the fruits of the unparalleled development that is taking place before them. Despite this there could be critics who might be reluctant to see the truth and appreciate the tremendous savings in interest costs achieved by this strategy. Kerala is at the forefront of social development indicators in the country in terms of health, education and living standards. But we cannot claim this achievement in infrastructure development. KIIFB is in fact, this government’s strategy to level this gap.

When the National Highway Authority slowed down taking projects in the State citing high land costs, the State Government offered to fund Rs5374 cr. through KIIFB- a quarter of the total land acquisition cost required for the development of National Highways. The hill highway and the coastal highway are among the mega transport sector projects already approved by KIIFB.

Transgrid 2.0 project is now a reality with an investment of Rs5200 cr. in the power transmission sector. KIIFB has financed 70 drinking water projects at a cost of Rs4380 cr.

The land for the petrochemical park, which has the potential to change the industrial development picture of the state itself, has been acquired from the Government of India for Rs977 cr. An amount of Rs346 cr. has been transferred by KIIFB to KINFRA for acquisition of land for the first phase development of Kochi-Bangalore Industrial Corridor. KFON, a fibre network project to ensure internet access to the people of Kerala, is progressing with an investment of Rs1517 cr. Apart from this, various schemes worth Rs6000 cr. implemented by other departments are also in progress.

KIIFB’s inspection systems have been able to ensure transparency and quality and helped adoption of latest project management systems. Along with the quality of projects and the efficiency of operations, KIIFB relies on a state-of-the-art Asset Liability Management system. This emphasis on transparency and commitment to professionalism ensures that KIIFB enjoys a brand name among investors and the public. This is what has enabled KIIFB to attract the attention and interest of national and international financial institutions.

KIIFB: A blend of efficiency and transparency

Very focused changes in the structure of KIIFB - aimed at leveraging the possibilities presented by modern financial markets in line with the rules stipulated by the regulatory agencies like SEBI, RBI etc., were incorporated in the amendment act approved by the Legislature in 2016.

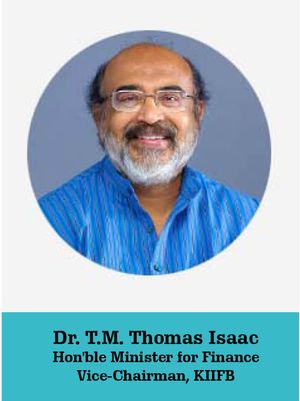

KIIFB is governed by a board comprising experts. The high degree of professionalism makes it stand out distinctly from other sister institutions in the country. The Board of KIIFB comprises independent members having national and international exposure, expertise and experience in governance and financial matters. There might be no other Board of 100 per cent a Public Sector Agency or Company with equal number of independent members and public officials. The Chief Minister is the Chairperson, and the Minister for Finance is the Vice Chairperson of the Board. The Planning Board Vice Chairman, the Chief Secretary, the Finance Secretary, the Law Secretary are the members of the Board. Thus, the governance and control mechanisms of KIIFB are very powerful and robust.

Prior to the amendment of the KIIFB Act, the fund that was mobilized by KIIFB was kept with the state treasury. Consequently, the funds used to get diverted to meeting the liquidity needs of the State Government! As a result, Government found it difficult to release funds timely to meet infrastructure spending. For this reason, primarily, the ultimate objective of KIIFB to finance new infrastructure projects suffered. But, through the new amendment of the KIIFB Act, legal restraints were introduced that explicitly prohibited diversion of funds thus mobilized and mandated that these funds were to be invested prudently in safe and secure investments outside the Government treasury. To enable KIIFB to service its long term and short-term liabilities and to ensure the confidence of investors, 50 per cent of the motor vehicle tax and petroleum cess received by the State Government was earmarked for KIIFB through legal provisions in the Amended Act in 2016. These constitute the main income of KIIFB.

Another fundamental structural innovation that was introduced was to set up the Fund Trustee Advisory Commission (FTAC). This Commission is an arm’s length regulatory cum advisory body. The KIIFB Act protects its identity and autonomy. This new and innovative institutional arrangement serves a powerful monitoring mechanism that exercises regulatory oversight the functioning of KIIFB. Former C&AG Vinod Rai is the present chairman of FTAC. Noted financial experts, Usha Thorat (former Deputy Governor of RBI), G Padmanabhan (Former Executive Director of RBI) are the other members. The main responsibility of FTAC is to review the fund mobilization and expenditure of KIIFB and to issue fidelity certificate biannually. FTAC ensures that the interests of the public, the Government, and the investors are protected. FTAC members must be persons with proven expertise and experience nationally or internationally in any of the fields of banking, financial regulations, financial markets, Governance or Economics.

FTAC functions as the trustee of KIIFB. FTAC ensure that all the investments by KIIFB conform to the objectives mentioned in the acts and ensures that the deposits with the Board are not diverted to meet any other irrelevant expenses. Fidelity certificate is issued every six months for certifying that the amounts are utilised in KIIFB in accordance with the regulations of the Act and Scheme and the balance amounts are deposited prudently and securely. It is the FTAC which has powers to supervise the implementation of the conditions regarding the security issued by KIIFB for fund mobilization. One of the primary responsibilities of FTAC is to take necessary steps to protect the interests of the depositors with KIIFB. FTAC is empowered to take all necessary measures for redressal of complaints, if any, of the investors. FTAC also ensures that the funds are raised conforming to the legal provisions in the KIIFB Act. FTAC also exercises oversight that the funds with KIIFB are prudently invested. The system of KIIFB is remarkably transparent and powerful. This historic Amendment Act was passed by the Legislative Assembly unanimously in November 2016.

CAG has undertaken its audit of KIIFB during the year. They have completed full audit up to the period 2020. KIIFB is one of the few organizations in Governments anywhere in India where almost 100 per cent of its transactions are done digitally. KIIFB threw open its office and its IT systems to the CAG for their audit - which lasted eight months. Thus, audit by CAG progressed freely even during the lockdown period following Covid-19. In addition, KIIFB has a multi-layered audit structure. It has appointed peer review auditors, an internal audit wing and have taken steps to bring in Risk Based Internal Audit. KIIFB has raised Rs505 Cr through KSFE Pravasi Chitty and NORKA Pravasi dividend scheme. Even during the Covid 19 pandemic period, NRIs continued to show keen interest in KSFE Pravasi chitty and the Dividend Scheme. The NRI community thus gets to become part of the development of the state. KIIFB has so far mobilized Rs15315.25 cr. as investments and utilized more than 08300 Cr for various projects. The ALM model adopted by KIIFB, ensures that there will be no additional fiscal burden on the State Government, beyond the yearly funds that it has set apart in the Budget for KIIFB. Thus, the design of the model itself ensures that the Government or KIIFB will never fall into a debt trap - as alleged loosely by some critics.

E-Governance system at KIIFB

KIIFB was able to function WFH ‘Work from home’ successfully even during the peak of the epidemic in the lockdown period through the safe, secure and efficient e-Governance facility built up. It is noteworthy to say that not even a single bill payment of any of the contractors was blocked during this period.

Paperless office

All the transactions of KIIFB are totally IT enabled. All activities like evaluation of the projects, collection of related information from the implementing agency, preparation of detailed appraisal reports, dissemination of KIIFB Board Orders and regulations, conveying information to KIIFB about technical sanctions issued by implementing agency, tenders, agreements, inspection of projects, assessment of funds required in each period for project payouts, implementation schedule of works, changes and deviations in the project schedules, technical or financial revision of the project, etc are handled by the Project Finance and Management system or PFMS. KIIFB’s Finance Management system (FMS) channels payments to the implementing agency and to the contractors online. A bill tracking system enables the contractors to view the status of their bills due and monitor it. There is a Project Monitoring and Alert System (PMAS) to identify the progress of the projects. A sophisticated Asset Liability Management (ALM) system is commissioned to analyse fund availability and payout liabilities and predict the borrowing schedule using advanced Machine Learning (ML)/Artificial Intelligence (AI) algorithms. All activities of KIIFB are through the paperless office system called DDFS.

How the quality of the projects is assured in KIIFB

Modern methodology is adopted in planning, designing and implementation of projects financed by KIIFB. The inspection authority of KIIFB ensures adherence to prescribed quality standards. Inspection Authority officers continually visit the sites to inspect the quality of the works in progress. KIIFB has developed 4 modern facilities for these tests.

Mobile Laboratory for Auto Lab testing

Mobile lab has been set up for material testing and site level testing. This auto lab helps the inspection team to move around among different sites for effective inspections. Auto lab also functions as a base station for the visual data collection. Main testing is done at the worksite itself and the implementing agency is alerted on deviations and quality violations.

Quality assurance /progress evaluation using drones.

KIIFB has introduced modern methods of quality assurance using LIDAR and conventional drone based technologies, among others. This helps address the limitations of the traditional quality checking systems in geographically wide and complex development projects.

Central Lab and Network for the confirmation tests

A central lab has been set up at the headquarters of KIIFB to test the samples collected from the worksites to assess the quality of the construction materials. These tests are being carried out by quality control engineers with proven expertise and experience. KIIFB uses a network of specialized labs for higher level and more sophisticated tests.

Quality monitoring Studio

A quality monitoring studio has been set up at the KIIFB headquarters for evaluating the construction activities by monitoring real-time visuals from work sites. From this studio, senior Quality Assurance officers evaluate the progress of the construction works. Tests and inspections carrying out on the field can also be evaluated using onsite video cameras.

Achievements of KIIFB: At a glance

KIIFB – powered by its new organisational structure and the autonomy conferred though the amendment of the legislation in 2016 - presents a new development model for the country. KIIFB has initiated an impressive range of development projects which are currently in different stages of progress. The government proposes to use KIIFB for an unparalleled and massive development surge in Kerala.

KIIFB has already approved 889 projects of Rs63250 cr. in different sectors. Over Rs8300 Cr. have already been spent on different projects. This includes some very vital projects to address the difficulties faced by the transport sector. The National Highway Development project in Kerala has been languishing for over a decade on account of paucity of funds for land acquisition. The State Government has resolved this deadlock by agreeing to bear 25 per cent of this cost through KIIFB. Rs5374 cr. will be made available to NHAI to fast-track highway construction in Kerala. 377 projects of Rs17375 cr. under public works department are being implemented with KIIFB financing. This includes 201 roads, 9 bypasses, 80 bridges,49 rail overbridges, 20 stretches of high range highway, 4 stretches of coastal highway,13 flyovers. High range hill highway of 1200 km length is being constructed at Rs6500 cr. The coastal highway of 550 km at an outlay of Rs6500 cr. is in progress. The construction of Kundannoor, Vytila flyovers – a boon for Kochi – is completed and opened for traffic.

The state was able to contain the mortality on account of the Covid-19 pandemic because of its sustained investment in the public health infrastructure. KIIFB’s share in infrastructural development in the health sector is significant. Modernization projects of 37 government hospitals at an estimate of Rs2979 cr. are in progress. The aim is to establish Cath labs in 10 hospitals, dialysis facility in 44 hospitals. This project with an investment of Rs149 cr. is being completed. 5 Cath labs and 41 dialysis units have been started. A massive modern taluk hospital at Punalur is completed and the first phase of Ernakulam General Hospital, is ready for inauguration.

In the education sector, significantly large investments have been made through KIIFB to improve the standard of public schools in the state. Various projects with KIIFB financing for Rs2428 cr. under the School Education Department are in progress. Out of this the Smart Lab, Smart Class projects with an outlay of Rs785 cr. have been completed. 45000 classrooms in the High School/ Higher Secondary sector have been converted into Hightech classrooms. Smart Labs in 11000 LP, UP schools have been established. Centers of excellence in 141 Government schools at a cost of Rs705 Cr. is completed. 336 schools taken up for infrastructural development at a cost of Rs3 cr. each have been completed. Infrastructural development in 446 schools at a cost of Rs1 cr. each are taken, of which 111 are completed. KIIFB has already spent Rs1050 cr. on projects under School Education.

In the Power sector, Transgrid 2.0 project is being implemented with financial investment from KIIFB. This project focuses on ensuring uninterrupted and quality electricity across the State in Northern Kerala. It comprises three 400 KV sub stations, twenty-two 220 KV sub stations, 4390 km transmission lines. As part of the project, the capacity of the existing transmission line and sub stations will be enhanced. Along with this, several new sub stations and transmission lines will be established. The construction works of Kothamangalam, Chalakkudy, Aluva, Kaloor, Kunnamangalam sub stations, transmission lines such as Kochi lines, Kolathunad lines, North Malabar lines, Kottayam lines, Thrissivaperur lines for Rs7500 cr. will be completed during the financial year 2020-2021.

85 Drinking water projects for Rs5177 cr. for the benefit of those who have no access to clean drinking water are in progress. The projects to bring drinking water to Kasargod, Koyilandi, Thanoor, Ponnani Municipal areas will be completed during the financial year 2020-21 itself.

Land for a massive Petrochemical Park has been acquired with funding from KIIFB. The acquisition of the land for the Industrial Parks is underway. This will also pave the way to the development of Kannur as an economic hub centred around the new international airport.

The fibre optic network project (KFON) of the state that will become the backbone of the digital communication in the State in the near future is under implementation. With that Kerala will become the first state to recognize the right to free internet of every citizen. The construction of the first phase of the IT innovation zone to be established in Kochi will be completed soon. The first building of the Technocity in Trivandrum is completed. This is expected to usher in opportunities to several lakh trained youth.

KIIFB will ensure funds for KSRTC to buy E-Buses – a first of its kind green initiative in the state transport utility.

Various projects for Rs4500 cr. implemented by other departments are in progress. These include the improvement of the physical facilities of the higher education institutions including Cochin University of Science and Technology, District stadiums, the renovation of waterway canals in Kochi, building a modern well equipped Zoo in Thrissur, fisheries harbour at Parappanangadi, Elephant Protection and Wildlife Centre at Kottoor, District level Cultural Centres, Educational Institutions for Scheduled Castes and Scheduled Tribes.

KIIFB’s State-of-the-art Asset Liability Management System

KIIFB developed a sophisticated AI/ML based Asset Liability Management (ALM) System to manage its liquidity risks. The ALM system is intended to help the KIIF Board and the management team to predict the ever-changing funding needs that arises from the hundreds of development projects being executed, as well as to ensure sufficient availability of funds for the repayment of the liabilities (both project related and debt servicing) in the immediate future and over the long term.

KIIFB uses what it has defined as the “Controlled Leverage Model” (CLM) which rides on the Asset Liability Management framework (ALM) of KIIFB. It is the CLM that guides KIIFB to take prudent and efficient borrowing decision, to ensure that outflows (such as project disbursements, debt service liabilities) from KIIFB are balanced out with inflows to KIIFB from the various sources (such as allocations from Government, repayments of loans by Special Purpose Vehicle etc).

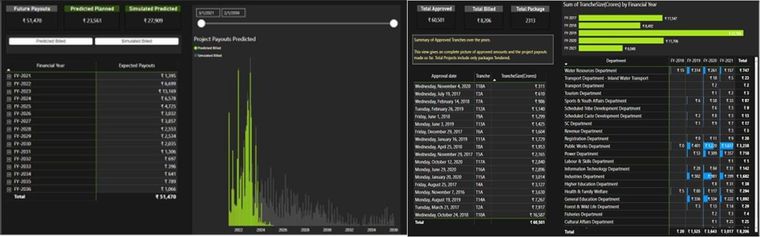

Snapshots of KIIFB’s ALM System.

Chart 1 – Approved Project Details

The below chart indicates the details of all the approved projects (projects in KIIFB are approved in Tranches)

The ALM System indicates approved project amounts sector-wise and year wise.

Chart 2: Predicted/ Simulated Project disbursement schedule:

Inherently, the execution of an infrastructure project in the State depends on a lot of factors such as (a) sector the project corresponds to (Roads, Buildings, Transportation, Water, Cultural, industrial parks et al), (b) the efficiency of the Special Purpose Vehicles/ Contractors implementing and executing the project, (c) the characteristics of the respective administrative departments, (d) the area/ region in the state where the project is being implemented et al.

Accurately predicting the project pay-outs is crucial to KIIFB as KIIFB needs to have sufficient liquidity at any point in time to meet the project pay-out requirements on demand. The ALM system uses AI/ML based algorithms to estimate the pay-outs for approved projects of KIIFB taking into account the factors which significantly impact the pace of project execution.

The above chart is a snapshot of the predicted pay-outs from the ALM system of KIIFB.