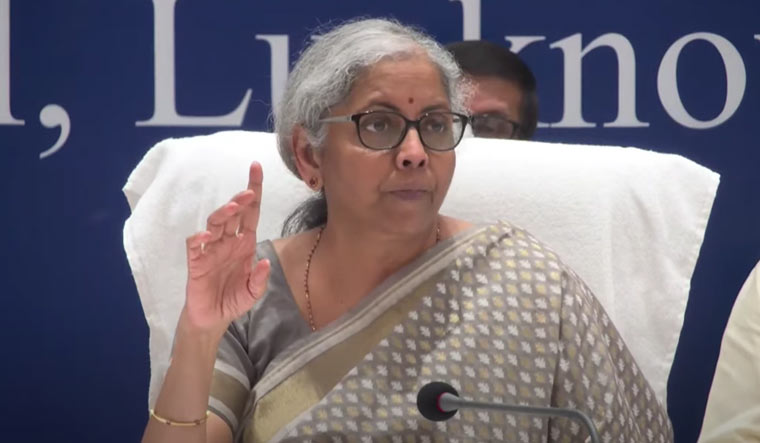

Finance Minister Nirmala Sitharaman on Monday said the ABG Shipyard account turned into a non-performing asset (NPA) during the erstwhile UPA regime and the banks took lesser-than-normal time to detect the fraud perpetrated by the shipping firm.

“in this particular case with that kind of a measurement, actually, I should say to the credit of the banks, they've taken lesser than what is normally an average time to detect these kinds of frauds,” Finance Minister Nirmala Sitharaman said at a press conference after addressing the members of the RBI board.

The minister said normally banks take 52-56 months of time to detect such cases and initiate follow-up actions.

The Central Bureau of Investigation (CBI) recently booked ABG Shipyard Limited, its former chairman and managing director Rishi Kamlesh Agarwal and others for allegedly cheating a consortium of two dozen lenders led by ICICI Bank.

The ABG Shipyard fraud is much higher than the one perpetrated by Nirav Modi and his uncle Mehul Choksi, who allegedly cheated the Punjab National Bank (PNB) of around Rs 14,000 crore through issuance of fraudulent Letters of Undertaking (LoUs).

Sitharaman also said that during the NDA regime, health of banks had improved and they are in position to raise funds from the market.

also read

- Finance Minister Nirmala Sitharaman's move to hike GST on sale of used cars could boomerang

- Finance minister Nirmala Sitharaman assures disaster-affected states of more funding under SASCI scheme

- Congress amended Constitution to help Gandhi family: Nirmala Sitharaman in Rajya Sabha

- Lok Sabha passes Banking Bill; Indian banks remain healthy, says Sitharaman

Addressing the press conference, the RBI Governor Shaktikanta Das asserted that RBI's inflation projections are quite robust. He further said the momentum of inflation, from October 2021 onwards, is on a downward slope. “It's primarily the statistical reasons the base effect, which is leading to higher inflation especially in third quarter, and the same base effect will play in different ways in the coming months,” Das said.