The Union Budget 2023-24 is being presented at a time when the global economy is facing geo-political conflicts, rising inflation, and global recessionary fears. Despite the uncertainties, the year 2023 holds a positive outlook for India's pharmaceutical industry. The market has experienced significant growth during the past two decades, and pharma revenues worldwide totalled $1.42 trillion in 2021.

With the pandemic accentuating the significance of health and wellness, the Indian pharmaceutical industry is expecting an increase in the budget outlay and fund allocations for the pharma sector in the upcoming Union Budget (2023-2024). While the healthcare sector got a 16 per cent hike in the budget allocation last year due to the pandemic crisis, increase in the share of healthcare and pharma spending in the upcoming budget is imperative.

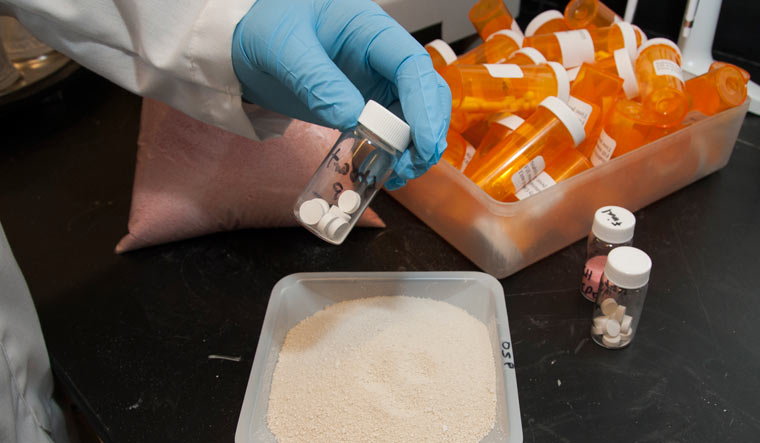

According to a recent EY FICCI report, in the wake of a growing consensus over providing new innovative therapies to patients, the Indian pharmaceutical market is estimated to touch $130 billion in value by the end of 2023. Meanwhile, the global market size of pharmaceutical products is estimated to cross the $1 trillion mark in 2023. Hence, it is essential to allocate separate funds for R&D, formulation, and API (active pharmaceutical ingredients). Additionally, there needs to be an increased focus on quality manufacturing, and adoption of innovation and technology in terms of formulation manufacturing, diagnostics, packaging, and medical devices among others.

The upcoming budget is also likely to focus on preventive healthcare, given the significant rise in non-communicable and lifestyle diseases in the country. Government incentives and grants for cost-intensive research are also anticipated. Besides, offering incentives to domestic API manufacturers and bringing about a reduction in GST and import duty on APIs is the need of the hour. Given the increased reliance on imports of medical equipment, incremental allocation for the manufacturing of healthcare equipment will help India become self-reliant. The government should come up with strategic plans to offer financial incentives to encourage the production of high-end medical devices in India.

Furthermore, the government can take measures to improve the ease of doing business in the pharmaceutical sector by simplifying the process and making it industry-friendly. Whilst the pandemic isn’t over yet, and its aftereffects may continue to remain, Union Budget (2023-2024) needs to continue focusing on strengthening the infrastructure of the healthcare sector and shift direction towards promoting Make in India pharmaceuticals for making India truly ‘Atmanirbhar’. We must become self-sufficient and competitive in KSMs (key starting materials) and APIs to boost the growth of this sector.

The year 2022 saw several collaborations between the industry and academia, with both playing a pivotal role in helping the sector further strengthen its position in the global market. The same is expected in the coming year as well, along with the government and the industry partnering together for the greater good. We must work together to ensure that Indian pharmacopoeia is acknowledged and appreciated worldwide. The government should make a roadmap and move forward so that more countries accept Indian pharmacopoeia.

The Pharmaceutical Inspection Cooperation Scheme (PICS) is bringing a great revolution in the GMP standards to establish high quality in the drug product and thus India should become the member of PIC/S to raise its GMP standards as it is recognised as the ‘power house’ of pharmaceutical manufacturing. And for that, both regulators as well the industry need to upgrade themselves. To get PICS membership, our regulators, both at the central as well as at the state levels, need to undergo intense training programmes and our research laboratories need to be upgraded.

At the industry level, pharma companies need to set up their facilities that comply with international regulatory requirements like the WHO GMP, the US FDA among others. A PICS membership reduces duplication of inspections, facilitates the industry in export, and provides huge market access among other benefits. As the industry expands its footprint across the world, it will need to continuously invest in upgrading manufacturing standards to keep its promise of being a high-quality, reliable supplier of medicines to the world. The government has a role to play in terms of expanding the PLI scheme so that more local manufacturers can access incentives and support needed to play in the API sector, as well as formulations to cater to regulated export markets. Also, considering the rising need for robust intellectual property (IP) law and rights, we will need to work towards harmonising our regulatory requirements to global standards.

India is the largest provider of generic medicines globally, occupying a 20 per cent share in global supply by volume, and is the leading vaccine manufacturer globally. We also have the highest number of US-FDA compliant pharma plants outside of the USA, and are home to more than 3,000 pharma companies with a strong network of over 10,500 manufacturing facilities as well as a highly-skilled resource pool. Major segments include generic drugs, OTC medicines, API/bulk drugs, vaccines, contract research & manufacturing, biosimilars and biologics.

The industry is highly optimistic about the upcoming budget and expects it to usher in a balanced combination of reforms and regulations, which will, in turn, boost the pharma industry, and contribute positively to India’s growth story.

(Sanjeev Jain, is the joint managing director at Akums Drugs & Pharmaceuticals)