Every year on July 24th, the Income Tax department of India commemorates Income Tax Day, also known as 'Aaykar Diwas', to mark the historic introduction of income tax in the country. This day serves as a reminder of the importance of taxes and their role in nation-building. As we celebrate the 164th Income Tax Day, here's a journey through history to explore the origins of this significant day and the pivotal role played by Sir James Wilson.

1860 - Birth of income tax in India

On July 24, 1860, Sir James Wilson, the first Finance Minister of the British Indian Government, introduced the concept of income tax in India. The objective behind this pioneering initiative was to compensate for the losses suffered by the British regime during the First War of Independence in 1857. The tax was imposed on incomes of British residents in India and was structured to be progressive, with higher rates applicable to higher income levels.

1865 - Temporary repeal

Despite its purpose, the income tax introduced in 1860 faced strong opposition from various sections of society. Many considered it burdensome and detrimental to trade and industry. As a result, in 1865, Sir Robert Napier, the successor to Sir James Wilson, temporarily repealed the income tax.

1886 - The resurgence of income tax

Budgetary constraints faced by the British government in India led to the reemergence of the income tax idea. In 1886, the British Indian government passed a new Income Tax Act, imposing the tax on individuals rather than companies. This version of income tax remained in effect until the early 20th century.

1918 - Tax reforms during World War I

During World War I, the Indian government raised income tax rates to meet the escalating war expenses. This move marked a significant step in the evolution of India's tax system.

1919 - Montagu-Chelmsford Reforms

The Montagu-Chelmsford Reforms granted greater fiscal autonomy to the British Indian government. The Government of India Act of 1919 gave the Indian Legislature the authority to levy income tax, further shaping the nation's tax landscape.

1922 - The Income Tax Act of 1922

In 1922, the British Indian government replaced the existing income tax legislation with the Income Tax Act of 1922. This comprehensive act redefined provisions related to income tax, introducing separate taxation for individuals, Hindu Undivided Families (HUFs), and companies.

Post-Independence era

After India gained independence in 1947, the Income Tax Act of 1922 continued to be in force with several amendments. The government made various changes to tax rates, slabs, and exemptions to adapt to the changing economic and social conditions of the country.

1958 - Direct Taxes Enquiry Committee

In 1958, the government established the Direct Taxes Enquiry Committee (DTEC) to review and propose reforms to the income tax system. The recommendations of the committee laid the groundwork for the Income Tax Act of 1961.

1961 - The Income Tax Act of 1961

The Income Tax Act of 1961 replaced the earlier legislation and has since been the backbone of India's income tax system. Over the years, it has been amended multiple times to accommodate various changes and reforms.

1991 - Economic Reforms

In the wake of economic liberalization in 1991, further changes were made to the income tax structure to encourage investment and economic growth.

2010 - Commemorating 150 years of income tax

In 2010, the Income Tax department decided to observe July 24th as Income Tax Day to celebrate 150 years of income tax in India. This annual celebration serves to raise awareness about the significance of taxes and encourages citizens to contribute to the nation's development by fulfilling their tax obligations.

2023 - Milestone achievements

As we celebrate the 164th Income Tax Day, the Income Tax department achieved a significant milestone by surpassing its target of filing 3 crore Income Tax Returns (ITRs). More than 91 percent of the ITRs filed have been e-verified, and a substantial number of them have already been processed, showcasing the increasing compliance and efficiency of the tax system.

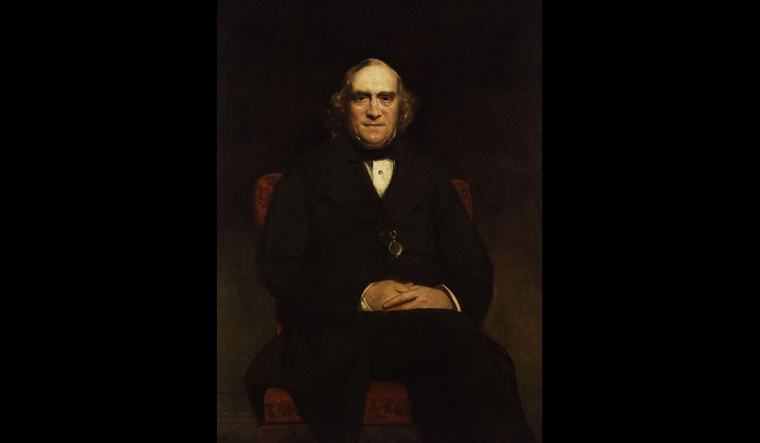

James Wilson, the British economist, and founder of the global banking giant Standard Chartered Bank, is rightly regarded as the father of income tax in India. His visionary introduction of income tax in 1860 laid the foundation for a crucial source of revenue for the Indian government. He died in India on 11 August 1860 and was buried at a cemetery at Mullick Bazar in Kolkata. His grave was located in 2007 by CP Bhatia, a joint commissioner of Income Tax. A tombstone, in his memory, has been restored at the cemetery.

A portrait of James Wilson, by Sir John Watson-Gordon, given to the National Portrait Gallery, London in 1928.

A portrait of James Wilson, by Sir John Watson-Gordon, given to the National Portrait Gallery, London in 1928.

The journey of Income Tax Day in India reflects the nation's progress and evolving tax policies over the years. As India continues to grow and develop, the role of taxes remains pivotal in financing essential services and infrastructure. With ongoing discussions on tax reforms, the government aims to simplify the tax system, broaden the taxpayer base, and promote economic growth for a brighter future.