Hitachi Payment Services unveiled the country's first UPI-based ATM at the Global Fintech Fest 2023 in Mumbai on Tuesday, allows customers to withdraw money via QR codes without using a bank card.

The UPI-ATM is a White-label ATM, which means it is owned and operated by non-bank entities. Up to Rs 10,000 can be withdrawn in a single transaction.

Anand Mahindra, chairperson of Mahindra and Mahindra, tweeted a video, with the caption, “This UPI ATM was apparently unveiled at the Global Fintech Fest 2023 in Mumbai on September 5. The speed at which India is digitising financial services & making them consumer-centric as opposed to corporate-centric (Alarm bell for credit card companies?) is simply dazzling. (I just have to make SURE I don’t misplace my cellphone! )”

Piyush Goyal, the Union Minister of Commerce and Industry, also shared the video, saying, “The future of fintech is here!”

How to withdraw money from UPI-ATM?

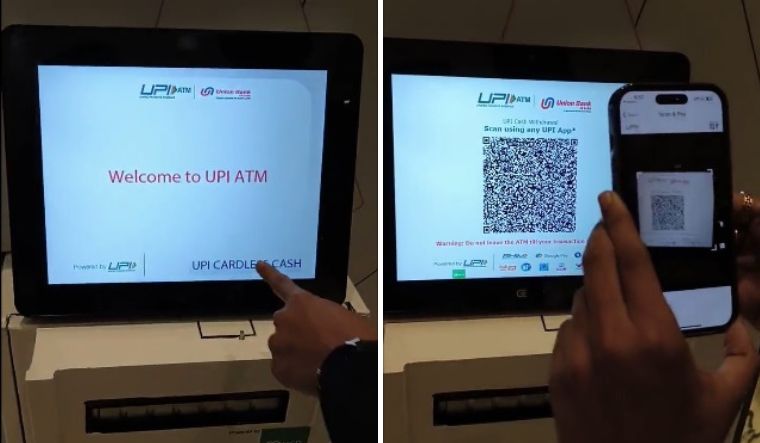

Click on UPI Cardless Cash.

Choose from the options of amounts provided or click Other Amount and type in your required amount.

Scan the QR code that appears using any UPI app.

Choose the bank account on your phone

Provide the UPI PIN on your phone after confirming transaction

Once the transaction is processed, collect your cash

What is the difference between UPI-ATM and cardless cash transactions?

In effect, UPI-ATM provides the same convenience of cardless cash withdrawals that are already facilitated by banks. While the earlier cardless cash transactions are mobile OTP-based, the new facility offers QR code-based withdrawal and the customer needs to have a UPI app.