The country's apex banking institution, the Reserve Bank of India (RBI), announced on Friday a sharp cut to the GDP growth forecast for the current fiscal year. RBI now sees the GDP growth at 6.6 per cent versus the earlier outlook of 7.2 per cent.

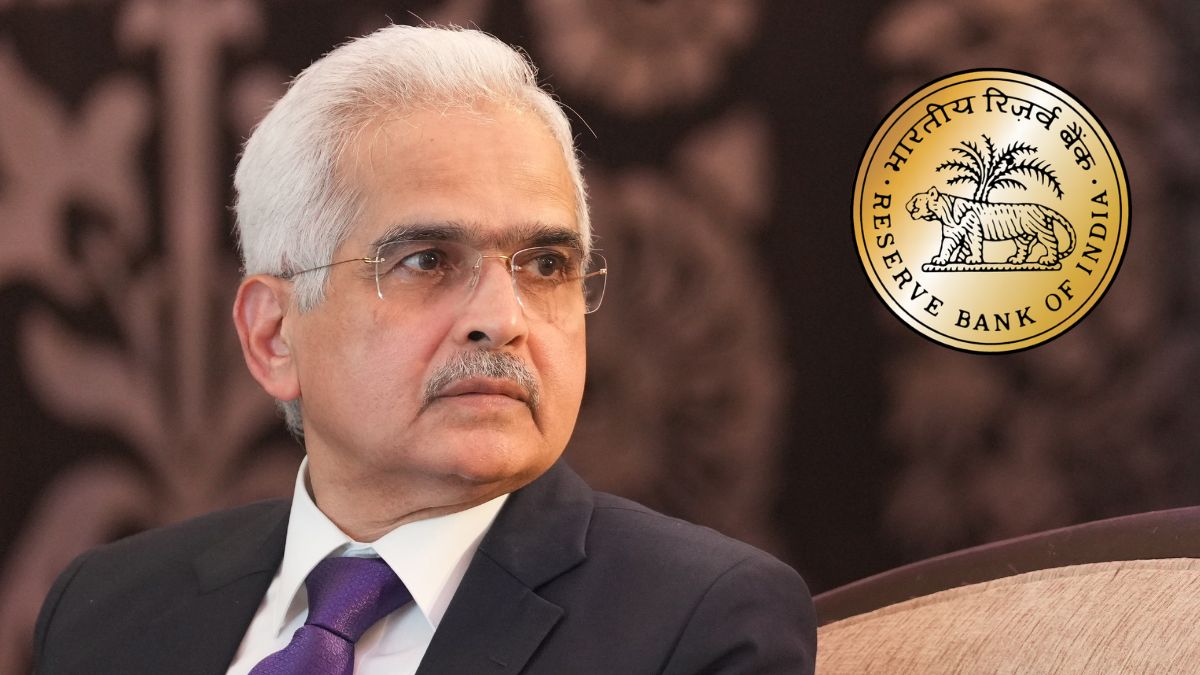

RBI Governor Shaktikanta Das announced the fifth bi-monthly monetary policy for the current FY, maintaining the key lending rate, or the repo rate, at 6.5 per cent for the 11th straight time since February 08, 2023.

India's central bank put a pause to the rate increase cycle last year following six back-to-back hikes, amounting to a 250 basis-point hike since May 2022. Despite maintaining a status quo on the repo rate, the September-ending quarter this year saw GDP growth falling to 5.4 per cent—the lowest in the past seven quarters.

Das also added that the Monetary Policy Committee (MPC) decided to keep the policy stance unchanged at "neutral", while looking out for new macroeconomic data.

RBI also slashed the cash reserve ratio (CRR) to 4 per cent in a bid to make more cash available to banks for lending. However, the standing deposit facility rate and the marginal standing facility rate were not changed.

A repo rate cut would have been beneficial for sectors such as real estate, but unchanged home loan rates are expected to balance it off. Sterling Developers chairman Ramani Sastri weighed in, “The RBI decision to keep the repo rate unchanged is on the expected lines providing much-needed stability to the housing market.”

“While a rate cut would have been favourable for the real estate sector, unchanged home loan rates will also help sustain buyer interest and preserve the positive sales momentum... Going forward, the RBI should consider reducing rates as it will further boost investment in the real estate sector,” added Sastri.