A systematic investment plan (SIP) is a magical step in the journey of financial planning, in the effort to achieve financial goals spread across timeframes. Here, an investor invests a fixed sum of money every month, on a particular date, and is on the road to see its long-term benefits.

Given the volatile nature of equities as an asset class, it is natural to use this asset class to meet medium- and long-term financial goals, like building a retirement corpus. An investor can choose to systematically invest through the working years to build a retirement kitty. At such a stage wouldn’t it be great if there is a mechanism where the corpus continues to generate market-linked return and the investor could withdraw a particular sum every month?

ICICI Prudential Freedom SIP is a combination of a regular SIP, which ensures growth to the portfolio, along with the advantage of a systematic withdrawal plan (SWP). An SIP + SWP arrangement offers the twin benefits of a wealth creation journey while regular cash flow is ensured to meet necessary expenses as well. In other words, it takes financial planning to the next level where one can see both the active income (salary, business income, etc) and passive income (earnings through investments, savings, etc) grow and enhance the value of the overall corpus.

One may think that such an approach is complicated and risky; but the fact is that it is a simple and easy to understand product and it continues to offer the flexibility that any SIP-based financial planning offers.

It starts with a monthly SIP in an open-ended equity, hybrid or fund of funds scheme for a predefined tenure of eight, 10, 12 or 15 years. Once the SIP tenure is completed, the cumulative units are transferred to another scheme with a SWP option.

Investors can choose from a predefined list of schemes for both for starting the SIP and later switching to the SWP. Based on the investor’s risk appetite, one is free to choose the schemes for SIP. The options available for SWP are a tad conservative in nature given that the investors would be at a later life stage.

More importantly, Freedom SIP has been designed in such a manner that the investor would know the exact amount of the monthly pay-out post the switch to the SWP option. This assumes significance as typically the pay-out would begin at a time when the investor may or may not have a steady source of income and having a control on the amount at the time of making the investment can be of paramount importance.

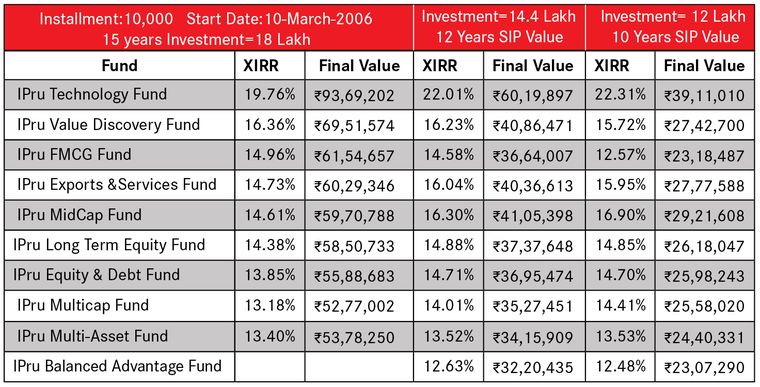

Following are some of the details that an investor needs to be mindful about. If an SIP has been started for eight years, then the monthly pay-out would be equal to the SIP amount. However, if the SIP tenure is 10 or 12 years, then the pay-out would be 1.5 times or two times the SIP amount, respectively. For SIP tenure of 15 years, the monthly pay-out after the switch to the SWP option would be three times the SIP amount.

For example, for an SIP of Rs10,000 for 15 years, an investor would get a monthly pay-out of Rs30,000. The pay-outs would be Rs10,000 and Rs15,000 if the SIP tenure is 8 and 10 years, respectively.

Furthermore, Freedom SIP offers all the other benefits that an SIP offers, such as multiple SIPs, additional purchase, top-up, pause, redemption /partial redemption along with an optional insurance cover as well.

Author is director & personal CFO, Fortune Planners Investment Service (P) Ltd.