SOON AFTER MILIND Borate cofounded Druva, a startup providing software as a service (SaaS), in 2008, he realised that his focus clients, those in the financial service sector, were reluctant to buy critical software from a small India-based company. Borate and his team quickly tweaked the company’s strategy and launched a product designed for general enterprise uses, especially remote offices and employees. The new product found many takers and its success paved the way for Druva’s first round of funding.

Today, the Pune-based company is one of the largest cloud data protection platforms and has customers across industries such as health care, manufacturing, media and entertainment, financial services and education. “We were the first data protection company to be fully offered as a service,” said Borate.

Druva is just one of the many Indian SaaS startups that are cashing in on the pandemic, which is forcing companies around the world to offer their services remotely. India currently has around 1,000 SaaS startups and ten of them are unicorns (those with $1billion valuation or more). Their combined annual revenue is around $3 billion, says a McKinsey report. This could go up to between $60 billion and $70 billion by 2030, accounting for 4 to 6 per cent of the global SaaS market.

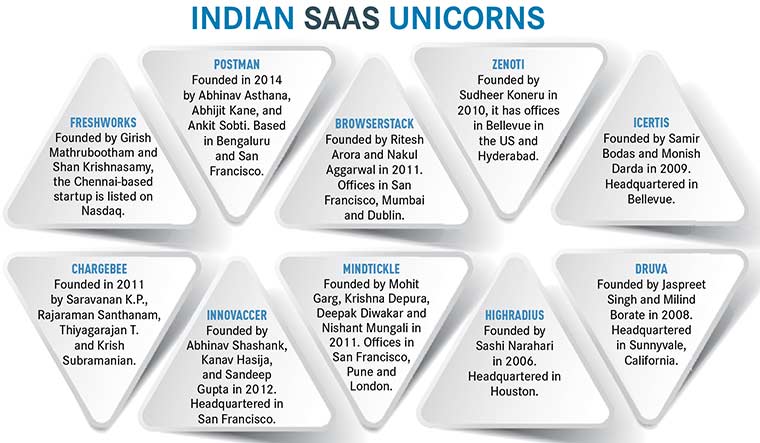

In 2020, Indian SaaS startups got about $1.5 billion in venture funding, including the $150 million that Postman, a unicorn, received. Chennai-based Freshworks, the first Indian SaaS unicorn, made its debut on Nasdaq on September 22, and is currently valued at around $13 billion. “It is time for the world to wake up to India’s product innovation,” said Girish Mathrubootham, chairman and CEO of Freshworks. “Indian SaaS companies will put India on the world map as a product nation.”

In the SaaS model, the software is licensed on a subscription basis to clients and it is hosted on cloud. It is managed digitally and centrally, reducing the dependence on human resources. It saves enterprises capital investment and the need for an entire technology team.

“There are so many different services that can be delivered through software. The large companies cannot possibly offer all of them or do all of the functions well,” said Krish Subramanian, co-founder and CEO of ChargeBee, a unicorn that provides billing services.

Launched in 2011, ChargeBee currently has customers ranging from e-learning companies to storage and food services. It supports more than 100 currencies and two dozen popular payment gateways. “We solve the issues around subscription billing, allowing customers to change pricing, run promotional campaigns easily and automatically solve issues around declined payments,” said Subramanian.

Many factors fuel the growth of the SaaS sector. “On the one hand, the SaaS business model helps move high capex (capital expenditure) to opex (operational expenses) from a business perspective. And on the other hand, it means a more predictable and recurring revenue business for software companies and their investors,” said Vaibhav Gupta, principal, practice head (private equity and principal investor), Zinnov management Consulting. “The flexibility it offers to businesses in functionality, scale, and remote productivity, in addition to the sticky revenue stream and capital efficiency, have made SaaS the first choice for both investors and entrepreneurs alike.”

Gupta said Indian SaaS players had reached a noticeable mass. “The pandemic has expedited five to seven years of transformation in just two years and has now increased the reliance on technology. As businesses and enterprises become more open to consuming technological interventions, SaaS demand will continue to grow. We also see immense potential in the Indian SaaS companies giving global giants a run for their money. India as an ecosystem offers all the key ingredients for SaaS companies to be global leaders,” he said.

Big IT players are focused on customer applications or system integration and work with platforms like Oracle, SAP or Microsoft Dynamics and provide a turnkey solution. This concept can work for large enterprises. But mid-size and small businesses usually do not have the budget to work with large IT players and would rather choose a SaaS provider. “SaaS from India has a significant advantage if they can provide a complete solution running on a cloud at affordable cost,” said Mohan Kumar, managing partner, Avataar Ventures, a venture capital firm.

Venture funds have been increasingly taking interest in funding SaaS startups. “We evaluate a SaaS company on its product differentiator with regard to its competition,” said Kumar. “Other factors include team, growth trajectory and market size. We also look if the company’s product has accelerated adoption, which is a big positive sign that it is essential and a must have for a business.”

Unicorn India Ventures, a Mumbai-based early-stage fund house, has a special focus on SaaS investments since its inception and has invested in SaaS startups such as Sequretek (cyber-security), Fedo (insurance), Gamerji (gaming), Probus (energy infrastructure) and OpenApp (access management).

“It remains to be seen what disruption and potential innovation will emerge in this space in the next five to ten years. In general, smaller companies and startups can be nimbler in execution of new ideas, have less inertia in the face of changing market conditions and are more perceptive to the articulated and unarticulated needs of the niches they serve. So that can be seen as possibly another reason for the faster than benchmark growth,” said Bhaskar Majumdar, managing partner of Unicorn India Ventures.

Venture funds also consider the fact that the SaaS model is globally scalable, non-capital intensive and has non-linear scalability. “There are no last mile execution challenges, unlike the conventional structure of businesses like consumer packaged goods and retail, making it the most sought-after area,” said Ankur Mittal, cofounder of Inflection Point Ventures, an angel investment platform. “SaaS products that come out of India are efficiently built, the business model is tested and sustainable, and can scale and generate revenue in global markets easily.”

The specialised SaaS players are expected to grow exponentially on the back of the demand from global small and medium-size enterprises. “We estimate that the SaaS market valuations in India will surpass that of IT services before 2030,” said Gupta.