December 29, 2021, was the 89th birth anniversary of Dhirubhai Ambani. Reliance Industries Ltd, the company he founded in 1973 and helped become an industrial behemoth, celebrated the occasion—as it does every year—as Reliance Family Day. Only that this time RIL’s 2.3 lakh employees got an indication of what the future would look like for India’s largest company, as Mukesh Ambani, chairman of RIL and Dhirubhai’s son, mentioned a “momentous leadership transition”.

Ambani, 65, has three children—twins Akash and Isha, 30, and Anant, 27. Though all of them have been involved in the family business, it was the first time that he had talked about succession. “We should guide them, enable them, encourage them and empower them... and sit back and applaud as they perform better than us,” he said.

The succession plan is well and truly under way. On June 28, Reliance announced that Ambani was stepping down as director of Reliance Jio Infocomm, a telecommunication services provider, and Akash was appointed chairman of the board of the company. Reliance Jio Infocomm is India’s largest telecom operator and a unit of Reliance Jio Platforms, the RIL subsidiary that houses all its digital businesses. Mukesh remains the chairman of Jio Platforms.

Isha has been given a leadership role at Reliance Retail, India’s largest retailer, and Anant is being groomed for bigger responsibilities in RIL’s new energy business. While a formal announcement of Isha’s elevation is yet to be made, Ambani mentioned it in no uncertain terms. “Akash and Isha have assumed leadership roles in Jio and retail, respectively,” he said, addressing shareholders at the company’s 45th annual general meeting on August 29. “Anant has also joined our new energy business with great zeal.” Anant is spending a lot of time in Jamnagar in Gujarat, where Reliance is developing a huge new energy complex.

There is clearly a well-thought-out plan. “Whether it is telecom, retail or new energy, they are all scalable, and quick scalability has been Reliance’s strength. Family and business incumbents want to give equal growth opportunity businesses to their scions so that there is fairness in division of wealth as well as responsibilities,” said Chitra Singla, associate professor, strategy area, Indian Institute of Management, Ahmedabad. “Assigning specific roles to children in scalable businesses is a good decision.”

Ambani had learnt the lesson the hard way. His father died intestate in 2002, and what followed was a bitter feud with brother, Anil, for the control of the businesses. Their mother, Kokilaben, brokered peace in 2005 by splitting the empire. While Mukesh got Reliance Industries (oil and gas, refining, petrochemicals and textiles), Anil was given Reliance Communications (telecom), Reliance Capital (financial services), Reliance Power (electricity generation and distribution), Reliance Infrastructure and the entertainment business.

Despite the split, the brothers continued sparring in court over the supply of natural gas to Anil’s power plants. But in 2010, they reached an agreement and cancelled all non-compete agreements they signed in 2006—but for the one on gas-based power generation.

Ambani clearly wants to avoid his father’s folly. “It is essential to demarcate businesses to heirs and prevent cross-holdings,” said Siddharth Mody, partner at the law firm Desai & Diwanji. “Most of the conflicts that take place during generational changes stem from interference in businesses from other heirs. Hence, when a diversified business is passed down, it is ideal for each heir to have complete ownership and control of the demerged/independent business.”

It was in 2014 that Akash, a Brown University graduate, and Isha, a Yale and Stanford alumna, were appointed to the boards of Jio Infocomm and Reliance Retail Ventures. “The transition had to happen at some point,” said Mayuresh Joshi, head of research at William O’Neil. At the AGM on August 29, both were on their own—Akash giving details of Jio’s big plans and Isha talking about retail and Reliance Foundation.

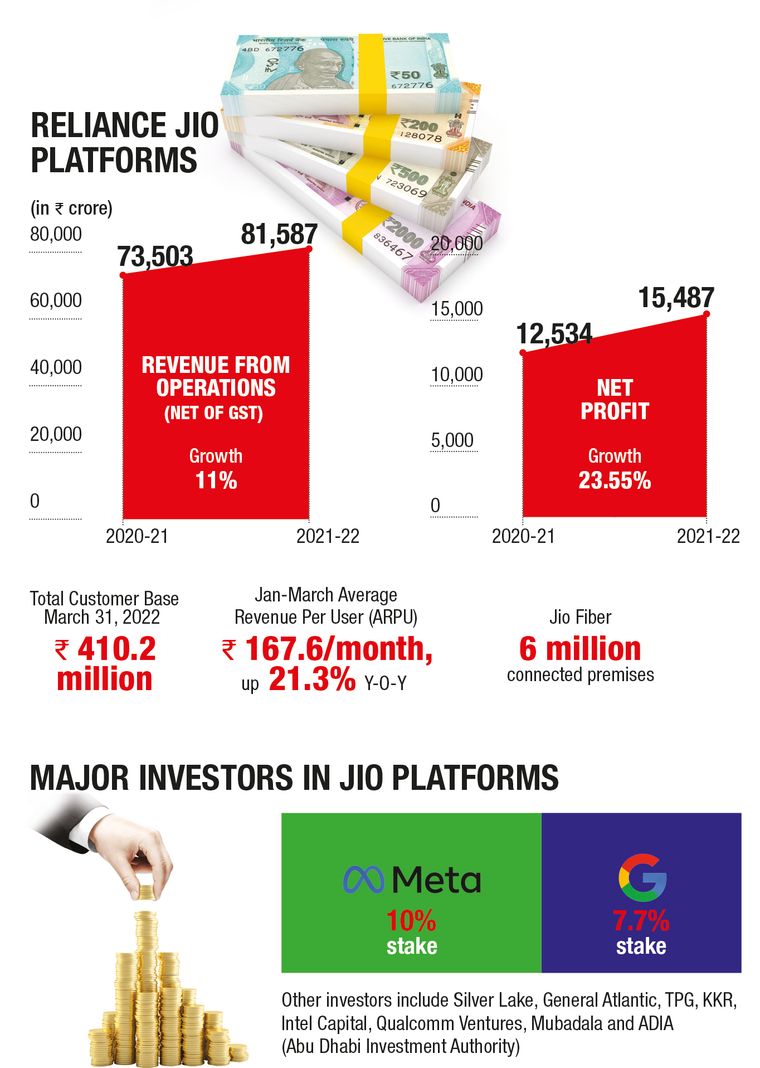

Akash and Isha have played a part in key decisions at Jio. It is said that Isha, tired of the poor internet speed in the country, nudged her father back in 2011 to start Jio. Both Akash and Isha were part of the discussions between Jio and Meta (parent of Facebook), which led to Meta picking up 9.99 per cent in Jio Platforms for Rs43,574 crore in April 2020.

Jio Platforms has got investment also from technology giants Google and Qualcomm, private equity players KKR and Vista Equity Partners, and sovereign wealth funds PIF of Saudi Arabia and Abu Dhabi Investment Authority.

Isha, who briefly worked at Mckinsey before joining the family business, was instrumental in the launch of the online fashion portal Ajio in 2016, and she played a key role in several deals and partnerships struck by Reliance Retail.

Despite being the biggest players in their sectors, Reliance Jio Platforms and Reliance Retail Ventures are subsidiaries of RIL. Mukesh remains the chairman of RIL and his wife, Nita, is on the board. She is also the chairperson of Reliance Foundation. P.M.S. Prasad, who has been with RIL for four decades, Hital Meswani, who was involved in the petrochemicals complex in Hazira and the refinery in Jamnagar, and Nikhil Meswani, who played a major role in making Reliance a petrochemicals giant, are also on the board.

The day-to-day operations of Reliance Retail is run by V. Subramaniam and Jio is headed by Pankaj Mohan Pawar. Akash and Isha will be assisted by young managers like Kiran Thomas, director of Jio, and Anshuman Thakur, the head of strategy at Jio. Reliance has hired many experienced executives from top retail companies as well. “In my opinion, giving children the chairperson’s role is more of a signal to the market and the Reliance stakeholders that the family would like to retain control over decision making,” said Singla.

Reliance has had many transformations in the past seven decades. What Dhirubhai started as a small textile business in the Masjid Bunder area in Mumbai became a major oil refiner and a petrochemical giant under Mukesh. Now, as the third generation of the Ambanis takes charge, the group is the largest telecom player in the country as well as the largest retailer, even as the legacy businesses continue to grow.

Akash’s elevation comes at a time the Indian telecom industry is on the cusp of a huge shift, with Reliance emerging as the biggest bidder in the 5G spectrum auctions in August. It spent Rs88,078 crore to acquire pan-India spectrum in the 1,800 MHz, 3,300 MHz and 26 GHz bands. Crucially, it also acquired spectrum in the sub-GHz bands of 700 MHz and 800 MHz, which could give it an edge over rivals. Jio’s spending on 5G spectrum was more than twice that of main rival Bharti Airtel, which spent Rs43,084 crore.

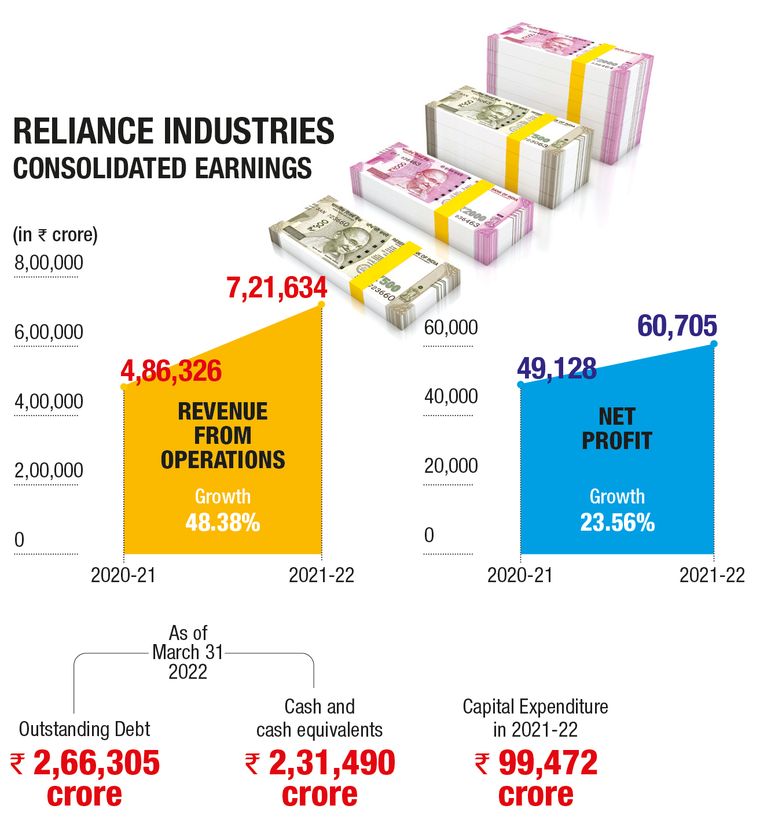

Jio’s customer base already is around 42 crore, ahead of Airtel’s 36 crore and Vodafone Idea’s 26 crore. Started just six years ago, Jio registered a revenue of Rs81,587 crore and a net profit of Rs15,487 crore in 2021-22.

Jio is planning to launch 5G services in Mumbai, Delhi, Chennai and Kolkata by Diwali. By December 2023, Ambani wants its 5G to reach every town in the country. It is spending Rs2 lakh crore to build the pan-India 5G network.

Akash, as chairman, will lead the company’s transition into the 5G era and its efforts to widen the subscriber base. While it is all set to tackle the first challenge, adding customers has become increasingly tough in the saturated mobile market. In the past few months, Reliance, like the other two competitors, has lost subscribers. In April, some 75 lakh people gave up their connections (mostly second SIM cards) after tariff hikes by companies.

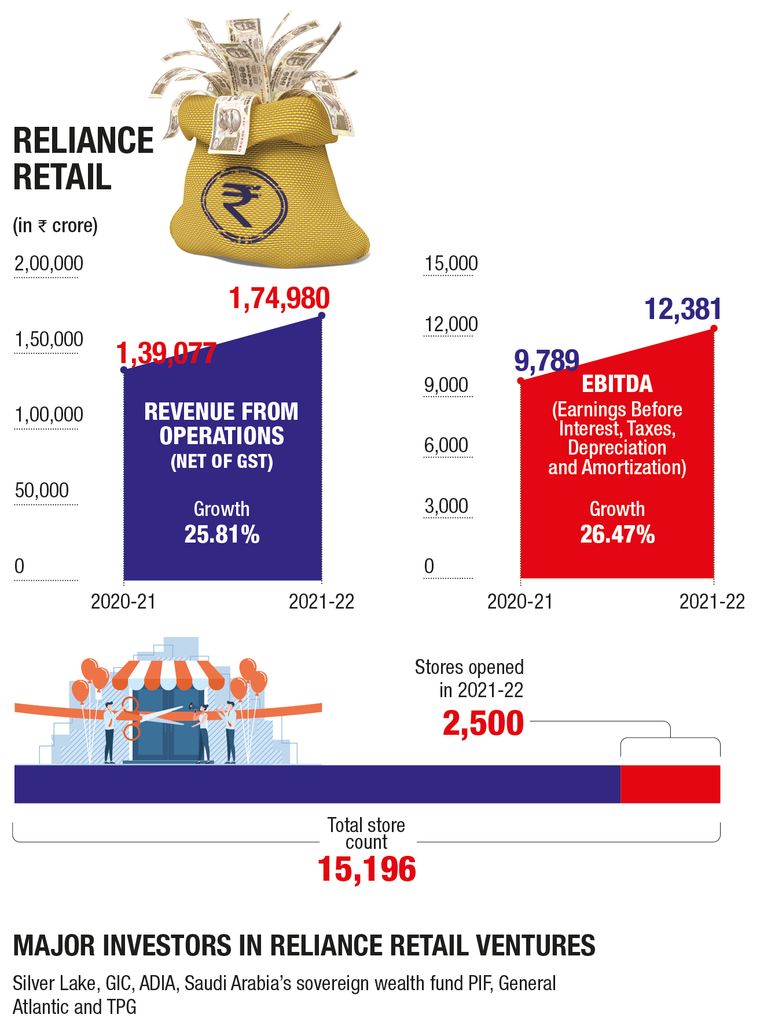

On the other hand, expansion in the retail sector continues unabated. Reliance Retail opened some 2,500 outlets last year, taking the total store count to 15,196, spread across super markets, wholesale markets and consumer electronics stores. It has also scaled up its digital business rapidly through platforms like Ajio and the grocery delivery service JioMart. Digital and new commerce now accounts for 19 per cent of its core retail sales.

“We undertook more than 220 million transactions during the (April-June) period. That is more than 60 per cent growth over the pre-Covid period. So, our business is growing on a strong note,” said Gaurav Jain, head of strategy and business development at Reliance Retail. He said that daily orders on the digital platforms had grown 64 per cent from a year ago and the merchant base on the new commerce side had scaled up three times in a year.

India’s retail sector is estimated to be worth $1.3 trillion by 2025. The share of organised retail is expected to double to about 15 per cent of the total market in that period. “Reliance Retail tried to do many different things in the initial years,” said Govind Shrikhande, an industry veteran. “But the blueprint became clear by 2015-16, and they decided to go in-depth across retail segments.”

Size, he said, mattered for Reliance. “Whenever they enter new businesses, whether they can reach a huge size is a big consideration for them. Also, there are business cycles that will keep coming. Any retailer needs the financial muscle to ride out these cycles. While many of them have struggled, Reliance didn’t have that worry given their finances,” said Shrikhande, former managing director of Shoppers Stop.

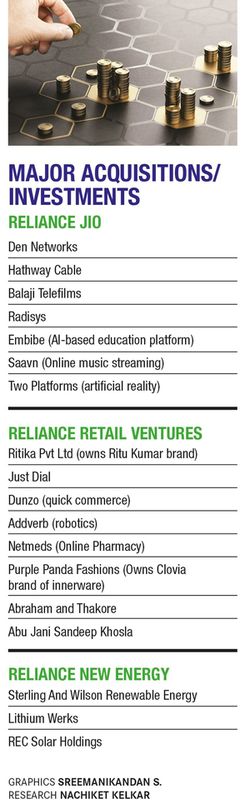

The financial muscle is quite visible in its acquisitions and partnerships. In 2019, it acquired the British toy retailer Hamleys. This year, it entered into a long-term partnership with GAP, to bring the American fashion brand stores to India. It has already partnerships with multinational brands like Marks and Spencer, Superdry, Steve Madden, Burberry and Vision Express, among many others. It is also bringing Britain’s popular sandwich and coffee chain Pret a Manger to India; a move that will see it take on the likes of Subway and Tata Starbucks Coffee.

Reliance has inked deals with several homegrown designer labels like Abu Jani Sandeep Khosla, Ritu Kumar, Abraham and Thakore, and Rahul Mishra, among others.

While scaling up the retail business, the company is also building a strong wholesale presence across categories like grocery, electronics, garments and pharmacy. Its decision to expand into the fast-moving consumer goods segment is key to this. “The objective of this business is to develop and deliver high quality, affordable products which solve every Indian’s daily needs,” said Isha at the AGM. It has also been making inroads in the wholesale pharmaceuticals business after the acquisition of online pharmacy NetMeds in 2020.

In the e-commerce space, Reliance faces tough competition from the deep-pocketed Amazon and Walmart-owned Flipkart. That might be about to change with JioMart partnering with instant messaging app WhatsApp. In what is said to be a global first, JioMart on WhatsApp will let users browse through its grocery catalogue, add items and make payments. “If executed well, RIL will be able to significantly leverage WhatsApp’s large user base in India to grow its new commerce business,” said Anil Sharma, analyst at Kotak Institutional Equities.

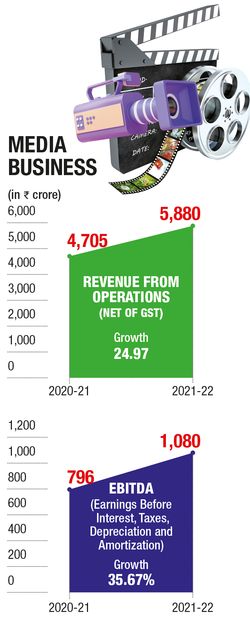

In April, RIL-backed Viacom 18 launched a dedicated sports broadcasting television channel and went on to acquire the digital media rights for the Indian Premier League (IPL) tournament. It has also bagged the broadcasting rights for this year’s FIFA World Cup in Qatar. It was not unexpected, as Akash is an avid sports fan and is often seen at the IPL matches of Mumbai Indians, the team RIL owns. He led Viacom’s charge for IPL digital media rights. IPL is the most-watched sports property in India (total viewership of about 350 million) and its digital rights will come in handy for the young Ambani in expanding Jio’s subscriber base and tapping more customers for its fibre broadband service.

Analysts, however, have a word of caution. “Viacom18’s winning bid of Rs58 crore a match for IPL 2023-27 implies cost of Rs63-65 crore a match including production/hosting costs. It looks like Viacom18 would incur losses in the initial years and perhaps break even in the 2026-27 season,” said Jaykumar Doshi, research analyst at Kotak Institutional Equities. Also, the competition between Disney (Star has IPL’s television rights) and Viacom18 for advertising money could reduce the bargaining power for both, unlike in 2018- 22, when Star owned both.

RIL’s biggest bet will be in the clean energy sector. It plans an investment of Rs75,000 crore, which includes Rs60,000 crore towards setting up four giga factories and Rs15,000 crore in value chain, partnerships and future tech. The goal is 100GW of renewable energy by 2030.

Ambani has a knack for scaling up quickly, and that is where acquisitions can play a big role. In the new energy business, RIL has acquired 40 per cent stake in Sterling & Wilson Solar, a company owned by Shapoorji Pallonji Group, and bought solar panel manufacturer REC Solar Holdings and the assets of lithium battery maker Lithium Werks. Reliance will have integrated manufacturing, from raw silica and polysilicon to finished cells and modules.

It has now announced a new giga-factory for power electronics (application of electronics to regulate electricity). “One of the key components linking the entire value chain of green energy is affordable and reliable power electronics,” said Mukesh at the AGM. “We are building significant capabilities in design and manufacturing of power electronics and software systems, integrating with our capabilities of telecommunications, cloud computing and IoT platform.”

RIL aims to start production of battery packs by 2023 and scale up to a fully integrated cell-to-pack manufacturing facility by 2024, which will have an annual capacity of 5GWh, expanding to 50GWh by 2027. It will also be setting up 20 GW of solar energy generation capacity for captive use by 2025 and will progressively begin transition from grey to green hydrogen from that year.

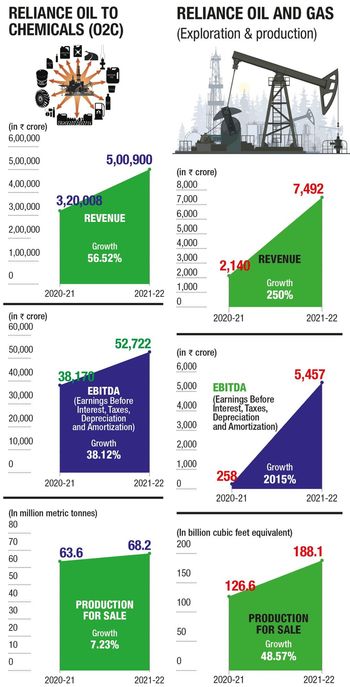

Separately, the company will invest Rs75,000 crore over the next five years to expand capacities in existing and new value chains in its oil-to-chemicals business.

Analysts at Motilal Oswal Financial Services say RIL’s consolidated revenue and EBITDA (earnings before interest, taxes, depreciation and amortization) could clock 13 per cent and 15 per cent compounded annual growth, respectively, over financial years 2022 to 2024. That is without factoring in any incremental growth from 5G capex and new energy. “Retail, telecom, and new energy can be the next growth engines over the next two-to-three years, given the large technological advancements and ambitious growth targets. However, the same can dent its existing single-digit return ratios in the near term,” said the analysts.

Currently, all the businesses of the group are held under the listed parent RIL. Ambani has in the past said that Jio and Reliance Retail would be separated and listed on the stock exchanges. The listing could smoothen the succession process and all his children may hold individually listed business, with the parent RIL overseeing the empire.

“When the businesses are in very different industries, listing them separately could help in better organisational structure and faster decision making. From a family point of view, listing businesses separately is a clear division of wealth. In Reliance’s case, Mukesh Ambani is trying to give equal opportunity businesses to his three children, and he wants to establish those businesses under his supervision. Therefore, advance planning is being done,” said Singla. One advantage RIL has is that its businesses are distinctive, barring a slight overlap in the retail and telecom businesses.

“RIL’s business segments are very well positioned to benefit from segment tailwinds, given its solid leadership position and well-integrated business structure,” said Avishek Datta of the stockbroking company Prabhudas Lilladher.

Big changes are coming to India’s largest company. The elevation of Akash as the chairman of Jio Infocomm and the big renewable energy push are just the beginning. And it will not just reinforce its pre-eminence among Indian corporates but also unlock significant value for its shareholders in the years to come.