FOR LONG the preserve of scooters and some clunky motorcycles, India’s two-wheeler market revved up with the first sign of real action in the mid-1980s, when the Japanese rolled into the country through collaborations with local firms. Escorts brought in Yamaha, which launched the iconic RX100―adored and cherished to this day. Bajaj tied up with Kawasaki to launch a few models that extolled the virtues of speed and performance.

Yet, the one that laughed all the way to the bank was Hero, which tied up with Honda. While Yamaha and Kawasaki focused on style and power, Hero Honda catered to middle-class India’s primary concerns―affordability, manoeuvrability and, above all, mileage.

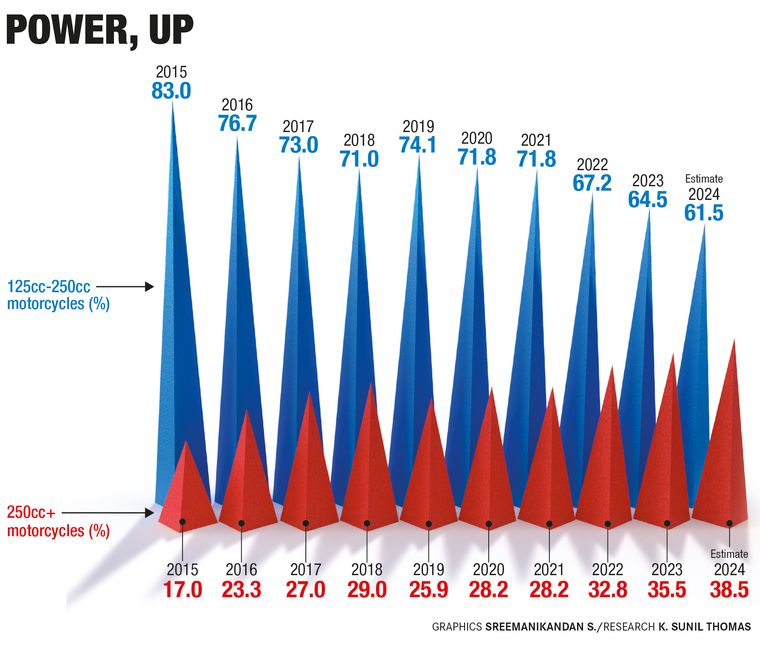

Through unforgettable campaigns like ‘Fill it, shut it, forget it’, Hero Honda became India’s, and then the world’s, largest selling two-wheeler brand. Hero retained its numero uno position even after exiting the partnership with Honda in 2011. And this continued value proposition meant competitors had to rework their strategies, as India over the decades became a commuter bike market firmly focused on low-power (mostly in the 100cc-125cc range) and high fuel efficiency.

That is, however, changing.

In July, Hero announced the first bike in its ambitious collaboration with the American motorcycle maker Harley-Davidson. While it is perhaps the most iconic two-wheeler brand in the world, Harley-Davidson had a tough time in India owing to crippling import duties and flat sales, and it left the country in 2020. But only to make a comeback in a tie-up with Hero, first for servicing and selling accessories and merchandise, and now as a joint manufacturer. The collaboration’s first product, the Harley-Davidson X440, was developed at Hero’s R&D centre in Jaipur.

“Harley-Davidson brings its iconic brand image, heritage and expertise in the premium motorcycle segment, while we have market leadership, strong distribution network, R&D, manufacturing capabilities, and a huge customer base and understanding of emerging markets,” said Ravi Avalur, head, Harley-Davidson business unit at Hero MotoCorp “By working together, we are creating a unique value proposition for customers in the Indian market and target a wider range of motorcycle enthusiasts.”

Just two days later, Bajaj also threw its hat into the ring, announcing the launch of the first two bikes under a partnership with the British motorcycle maker Triumph. Bajaj already has under its belt the premium bike brands KTM of Austria and Husqvarna of Sweden.

Why are the likes of Hero and Bajaj toying with 400cc and bigger bikes when their bread and butter is the 100-125cc range?

Rajiv Bajaj, CEO of Bajaj Auto, summed it up. “I don’t think it is we who are shaping the market. It is the consumer. Our job is to cater to it,” he said, adding a cheeky anecdote. “A bank robber was asked why he robs, and he said, ‘Because that is where the money is’. If the money is in Royal Enfield, then we have no choice but to rob that bank!”

Ever since Eicher and its maverick managing director Siddhartha Lal turned around Royal Enfield and made the 250cc plus category a hot selling one, Hero and Bajaj have been trying to get a share of the pie. Enfield singlehandedly expanded the premium bike category in the country―from less than one per cent of the motorcycle market in the 1990s, to close to 10 per cent now, with sales of eight lakh last year. Enfield straddles this segment with 93 per cent market share. “There is only one direction a 90 per cent marketshare can go―that is south. We are okay with that,” said Lal. “We believe the market will grow tremendously in the next few years. It is only 1 million, it can only grow. And premiumisation is happening (and) first-timers, kids who have never driven a motorcycle, are coming in.”

“Big bikes have become a sizeable market in the last six to eight years or so,” said Rajeev Singh, partner and automotive lead, Deloitte India. “The number of people in the higher income bracket is going up. An entire youth cult, with biking clubs, rallies and meet-ups has been created. And, infra in the country has also improved.”

It has also helped that post-Covid, consumers have increased spending. “There is a sudden drop in India’s savings rate from before Covid,” said Singh. “People were earning money before Covid as well, but the amount of money they are splurging now is significantly higher.”

This has resulted in an overall premiumisation of consumer behaviour, with more buyers going in for premium products. “We see this in designer bags, gems and jewellery, luxury watches and high-end mobile phones. All these segments are growing easily 20 to 25 per cent, higher than the GDP growth rate which is only 6.5 to 7 per cent,” said Singh.

Both Hero-Harley and Bajaj-Triumph have priced their India models around the sweet spot of Rs2.3 lakh. Not only does this make these models the most affordable Harleys and Triumphs anywhere in the world, but also puts them in the price range of Royal Enfield bikes.

It will not be easy, though. Royal Enfield has become a cult brand among aficionados in the country over the past few decades. With smart pricing, improved technology and the right marketing mix of nostalgia and the projection of a ‘cool’ alternative lifestyle promise, it has solidified its presence. That coupled with a robust dealer and supply chain network and a massive manufacturing presence (it has plants in India, Nepal, Argentina, Brazil, Colombia and Thailand), RE is a formidable competitor.

Just ask those who tried. In 2018, retro brand Jawa and Honda with its BigWings range made a move, but hardly caused a ripple. So did the tie-up between TVS and BMW.

“Our products continue to perform well across India and international markets, and we are optimistic that our exciting line-up of motorcycles will enthral pure motorcycling enthusiasts across the globe,” said B. Govindarajan, CEO of Royal Enfield.

It is no secret that every bike manufacturer in the country is gunning for the premium bike category. TVS, which had tested waters with the Apache 310 a few years ago, tried it again with the Ronin (225cc) last year. Most of the new launches from all domestic manufacturers over the past two years had been in the premium category, according to CLSA India Auto Sector Outlook. And the premium motorcycle segment is expected to grow at 15 per cent compared with the overall two-wheeler sales growth at just 9 per cent.

The reason is simple. “Motorcycling is changing… from a functional purpose to enabling self-expression, freedom and the willingness to explore,” said Vimal Sumbly, head of business (premium) at TVS Motors. “This is thereby transforming premiumisation into personalisation, creating a trend in the two-wheeler segment.”

Also, it is a vast untapped market. “The mass market bike segment is pretty crowded, and is seeing its own churn in the move towards electric mobility. But the performance bike segment is relatively less crowded,” said Singh of Deloitte. “Also, who would want to miss out on a segment that is growing at such a high rate? For India, premium bikes as a percentage of the overall market is even now significantly low, which only indicates there is a high potential to grow.”

A pleasant byproduct of all this flurry in the premium bike space has been a leg up for the ‘Make in India’ push. Hero is manufacturing the Harley 440X at its plant in Neemrana, Rajasthan. Deliveries are slated to start in October. The Triumph bikes are made in Bajaj’s plant in Chakan near Pune. Indications are that Bajaj will be exporting the Triumph models sooner rather than later. All this could boost the chance of India grading up in the ‘manufacturing-for-the-world’ sweepstakes.

Jochen Zeitz, Harley-Davidson’s chief executive, said that it was likely to use its manufacturing facilities in India to make products for other countries. “We were manufacturing our 750cc for the international market (here), so I am not ruling that out,” he told a publication.

“Tying up with a global brand and manufacturing in India suggests our manufacturing has quality,” said Nandip Vaidya, associate professor, ASMSOC, Narsee Monjee Institute of Management Studies. “We are moving up the curve. The very fact that we are improving, getting more competitive, exporting more means we can compete with global stalwarts, European, American and Japanese brands.”