Planning to join a top institute for a master's in business administration? There are many things to consider such as the options and the opportunities the institute offers. But, cost is also a key consideration.

A typical two-year programme in an institute such as IIM Ahmedabad or IIM Bengaluru costs around Rs23 lakh. Add to this travel and other sundry expenses. At some of the newer IIMs and at some top private b-schools, the fees are lower. But, even then, it can be around Rs10 lakh to Rs15 lakh. Clearly, not many will be able to afford the fees out-of-pocket. Educational loans can be handy here.

Most banks offer education loans for higher degrees. Now, banks even have products for specific courses and institutes. For instance, State Bank of India’s SBI Scholar Loan Scheme covers courses in IIMs, IITs, NITs and other similar institutes. IDBI Bank has exclusive education loan products for courses in premier institutions, with low interest rates, said Sanjay Deshpande, executive director at the bank. Also, many students are enrolled under the management quota, which lead to higher expenses; banks like IDBI Bank offer exclusive products for these students, too, Deshpande said.

Interest rates on education loans differ from bank to bank. SBI currently charges from 6.85 per cent to 8.15 per cent. IDBI Bank charges between 6.75 per cent and 8.75 per cent. These interest rates are floating (changes based on the market). A few other state-owned banks charge between 8 per cent to 10 per cent. Interest rates at private banks start at around 10.5 per cent for secured loans; unsecured loans are expensive and can stretch up to 16 per cent.

For loans up to Rs8 lakh, banks may not ask for additional security or collateral, if there is a co-borrower (a parent, for instance). For amounts bigger than that the borrower will have to furnish additional tangible security, like a property. Loans offered by banks for courses in domestic institutes can go up to around Rs40 lakh. Typically, there is a moratorium on repayments through the duration of the course, and additionally up to a year. The loan needs to be repaid in up to 15 years, excluding the moratorium period.

Are there specific criteria for applying for a loan? How much do grades and entrance exam results matter? “CAT score is not the criterion for securing an education loan or lower interest,” Deshpande told THE WEEK. “Accreditation of the institution, merit-based selection and the level of studies undertaken are the key criteria.”

Lenders would also look at the institute's consistency in performance; “key parameters” from previous years are analysed. And this is said to be a key criterion. Some banks may interview to gauge the student's prospects. Therefore, a strong academic record, high grades, admission to a reputed institution, the financial background of the co-borrower or the family, and good career prospects are things that will lead to a loan being approved, especially if the amount is in excess of Rs10 lakh to Rs15 lakh. This will, however, not have a huge bearing on the interest rate charged by the bank, as that depends on the prevailing market rates.

Education loans constituted 1.3 per cent of total retail loans in terms of portfolio outstanding as of March 2021, according to CRIF Highmark. In terms of active loans, education loans constituted 0.7 per cent. In recent years, non-performing assets in education loans have also risen. As of March 31, NPAs in education loans across India’s banking industry had touched 12.77 per cent, said Deshpande. Over 9.5 per cent of education loans extended by state-owned banks were categorised as NPAs as of December 31, 2021, according to government data.

A senior public sector bank executive, who requested anonymity, said that NPAs had risen especially in the sub-07.5 lakh segment, where no collateral was required. “Typically, where a student has availed a loan for a course in a premier institute, such situations don’t arise as the student gets good job opportunities and therefore the loan repayment is also on time,” he said.

The situation nosedived because of the pandemic as many people lost jobs or saw their salaries being slashed; fresh graduates could not get a job. Now, however, as economic recovery is gathering pace, the situation is expected to improve. Banks are also starting to expand their horizons and are looking to bankroll other courses that have industry demand.

Loan application checklist

1 Mark sheets: Class 10, 12, graduation and entrance exam results

1 Offer letter or admission letter from the institution

2 Schedule of expenses for the course

3 Details of scholarships, if any

4 Asset-liability related documents of the guarantor or co-borrower

5 Bank statements of parents and/or guarantors

6 For salaried people applying for loans for higher education: Recent salary slips and IT returns

7 Details and document proof of the security/collateral being offered

Dheeraj Sharma

Director, IIM Rohtak

Managers need to be decisive. Completely accurate data is never going to be available. Hence, the ability to take decisions with available data, while balancing risk, is what makes an excellent manager.

Sonal Rungta

General secretary, Rungta Group of Institutions

A futuristic manager should be an effective change handler, as organisations are becoming more versatile. Future managers need to have the capability to foresee challenges in order to help the company retain its relevance.

Ashok Mittal

Chancellor, Lovely Professional University

The manager should be able to establish mutual trust with the stakeholders for retention of workforce, productivity in different units and regular enhancement in outcomes. He or she should also be able to handle pressure efficiently.

Mayank Dhaundiyal

Dean, Jindal Global Business School

Rapid and profound changes across the world are altering the nature of work. To make a positive impact, managers must possess strong domain knowledge and the ability to prioritise tasks; they must be empathetic, effective communicators, and must have the right mindset.

Bidyut Majumder

General manager, Business Development, JIS Group

The most important quality that a manager should possess is knowing how to get better outcomes. They must focus on the strengths of employees, build a positive work culture and know how to communicate effectively.

Kiran G. Reddy

Founder and principal, AIMS Institutes

The manager of today should have sharp business acumen and should be ready to find opportunities to create a competitive advantage while facing disruptions. So, we emphasise experiential learning pedagogy, simulation and industry-integrated projects.

Bharat Bhushan Singh

Director, Vishwa Vishwani Institute of Systems and Management

Management is a social process. People have diverse and varied emotional quotients. Therefore, understanding the social and emotional aspects of managing is more important than the orthodox hard skills.

Rajeev Ranjan

Chief administrative officer, Chandragupt Institute of Management Patna

A manager is not one who does things exceedingly well. Fundamentally, a manager is one who can ‘get things done’ through the team a shade better than what one can do alone.

Vishwa Mohan Bansal

Chairman, NDIM

The manager has to be cool and courageous in handling uncertainty and increased expectations every day. They have to learn new skills and emerging technologies irrespective of their age and experience.

Vandana Arora Sethi

Group director, Lloyd Group of Institutions

Managers are made by ownership of completing work and delegating it. They should be aware of the complete picture and timelines, but at the same time, should be able to ensure productive output.

Shyam A.V.

Principal, Amrita School of Business (Coimbatore)

Managers have to be trustworthy. They should be proactive in gauging opportunities. They should have the willingness and humility to be life-long learners. So, in addition to knowledge and skills, a value system must be imparted to budding managers.

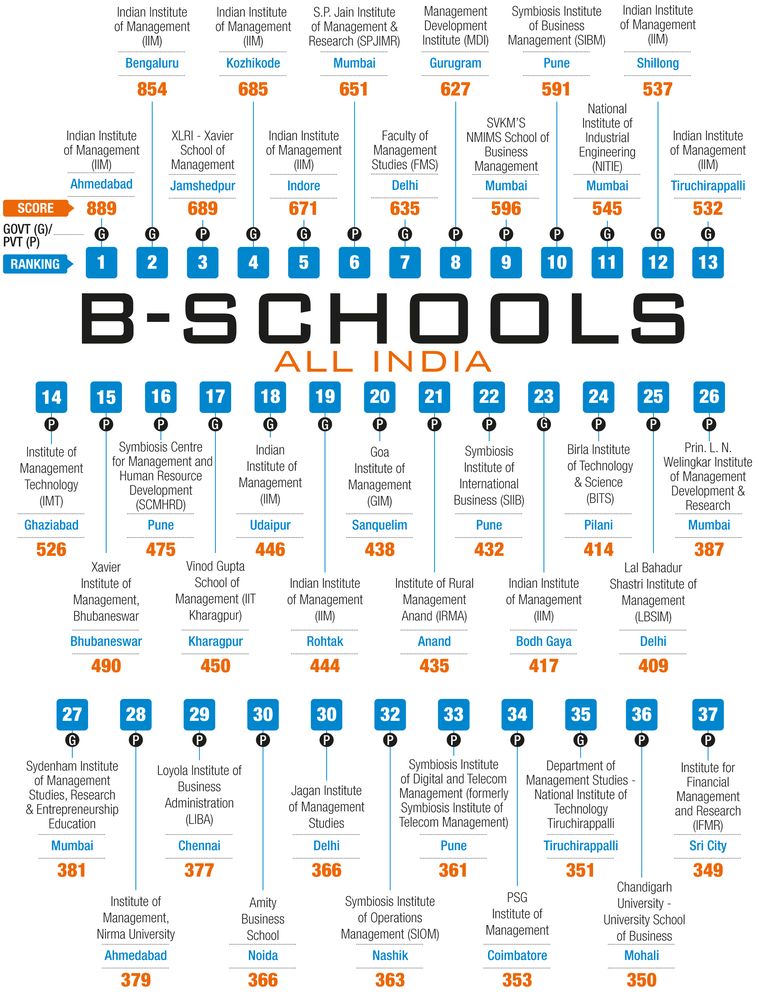

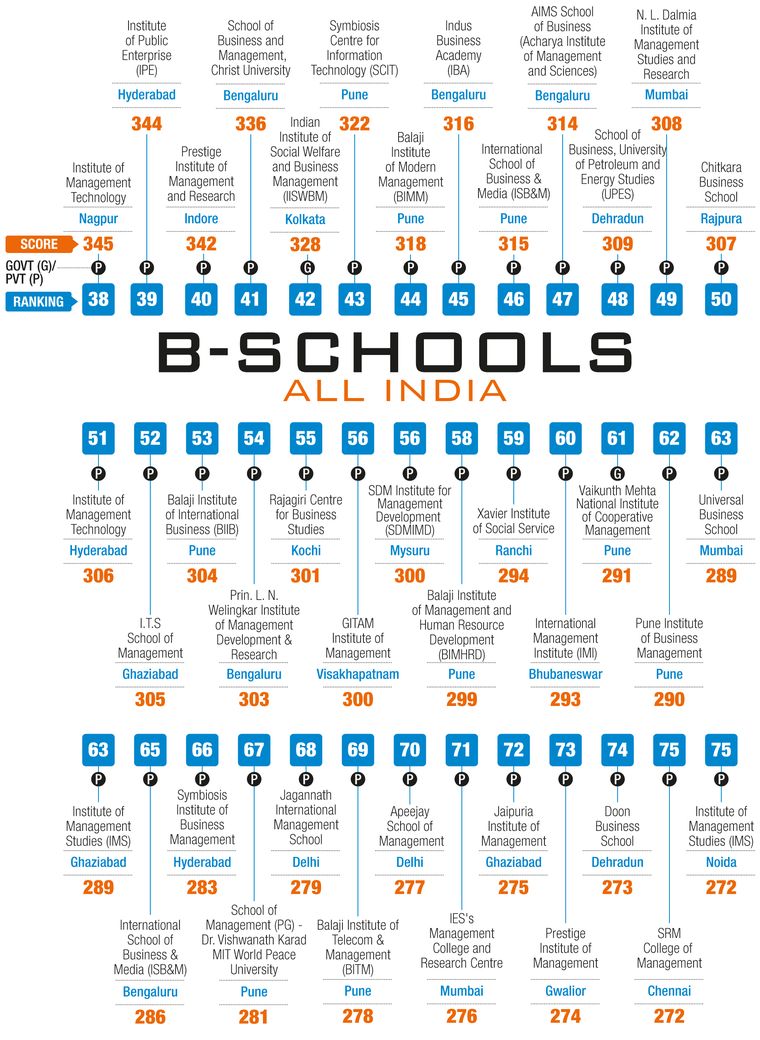

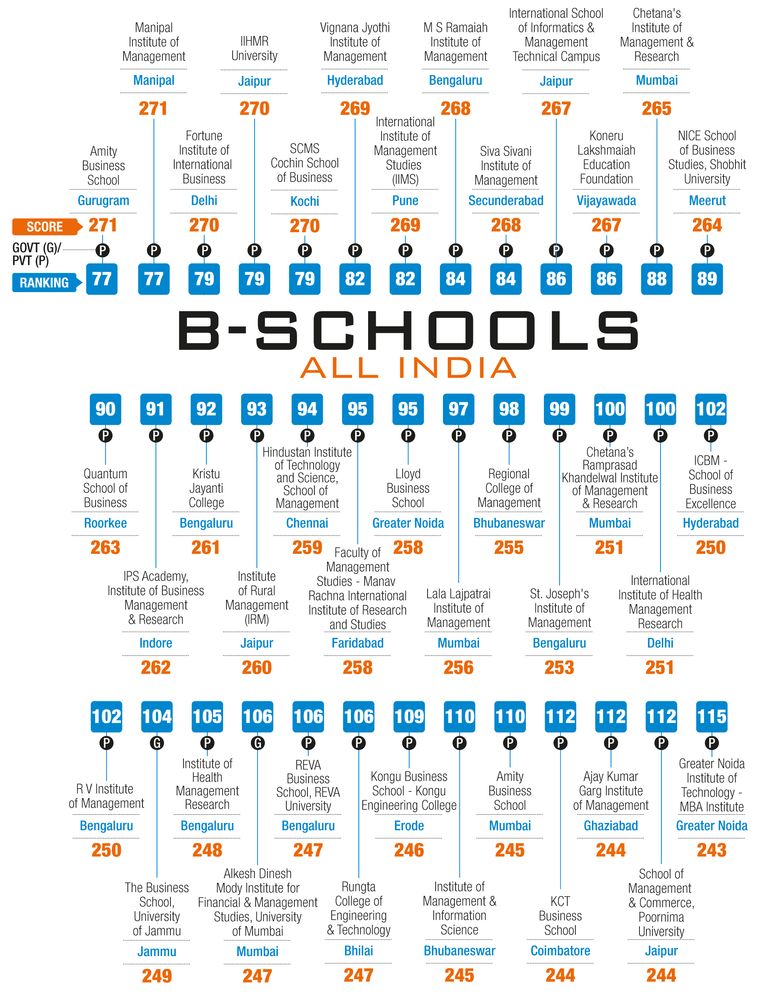

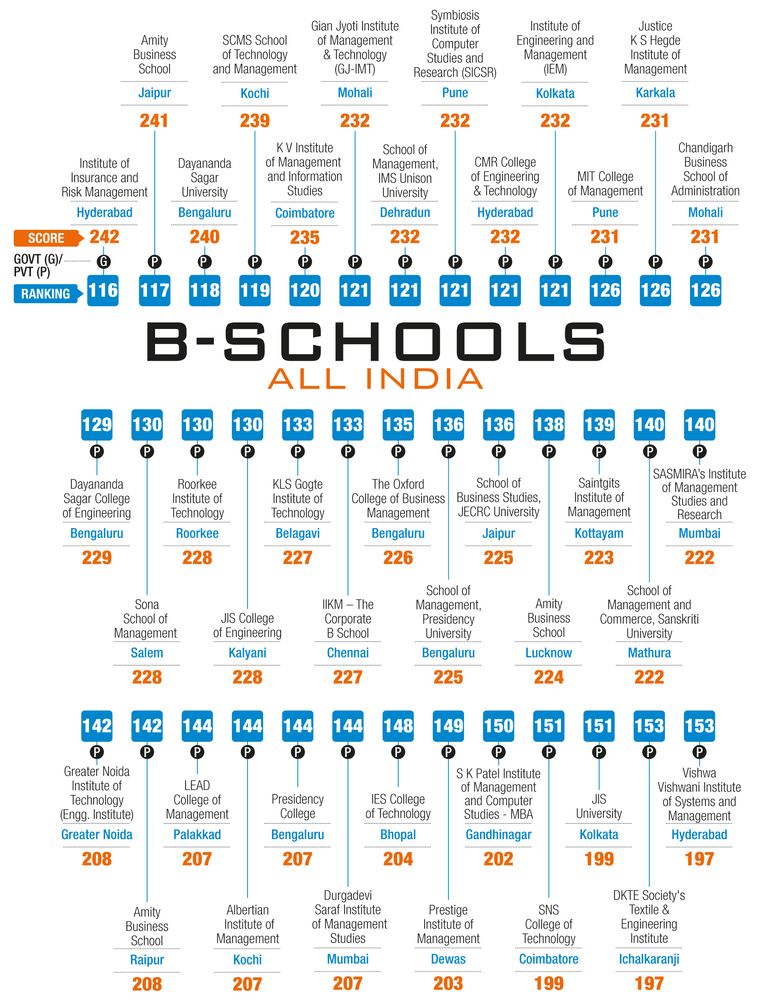

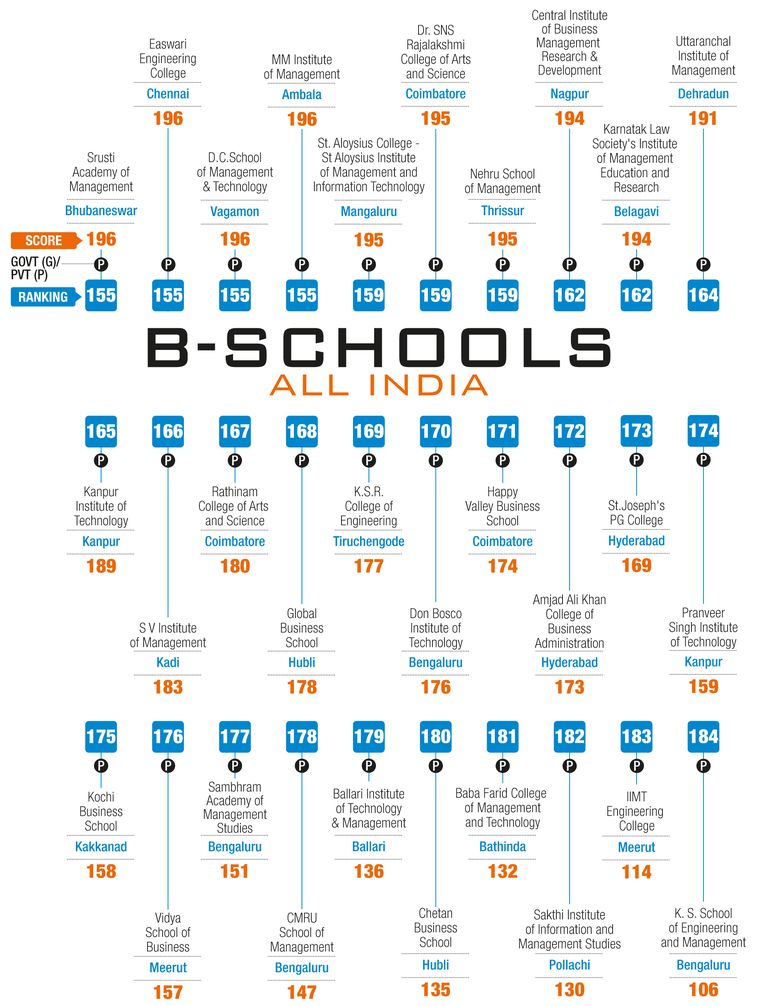

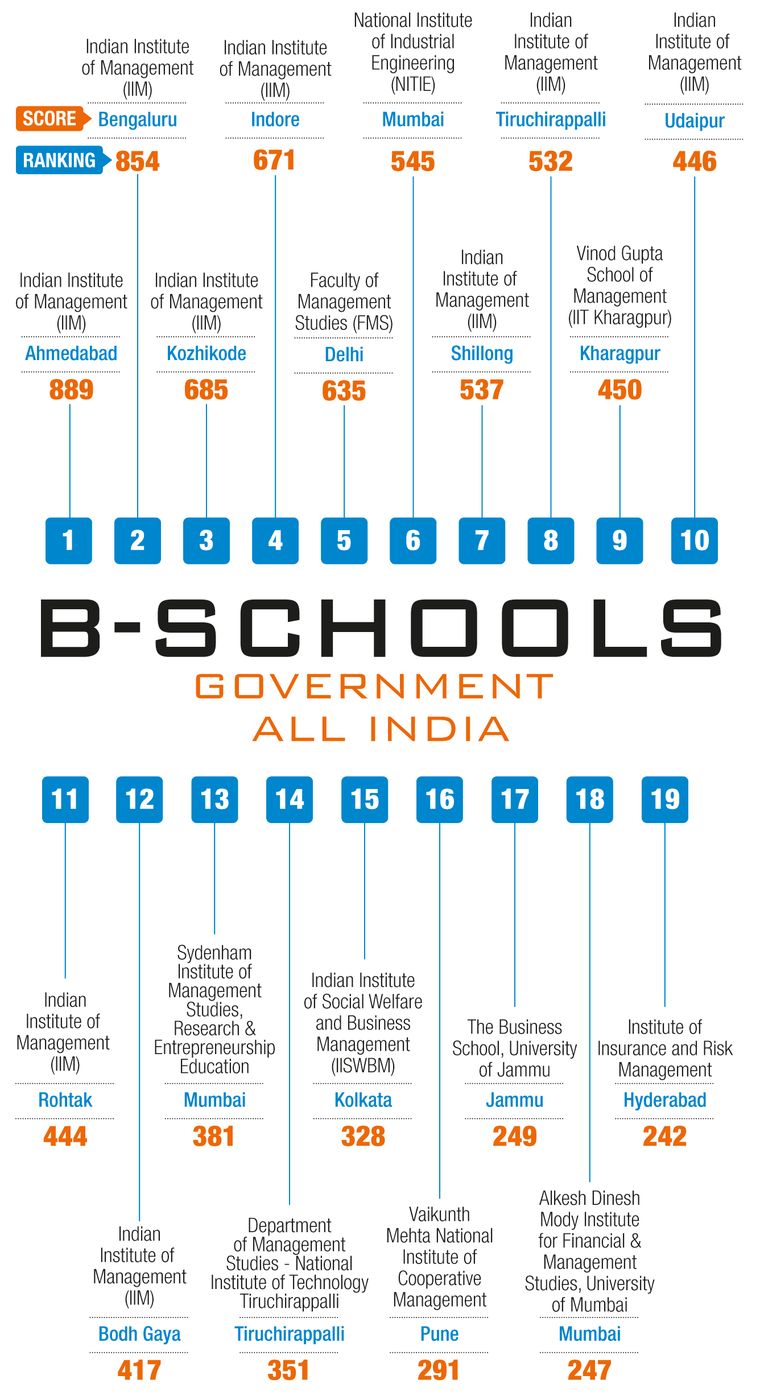

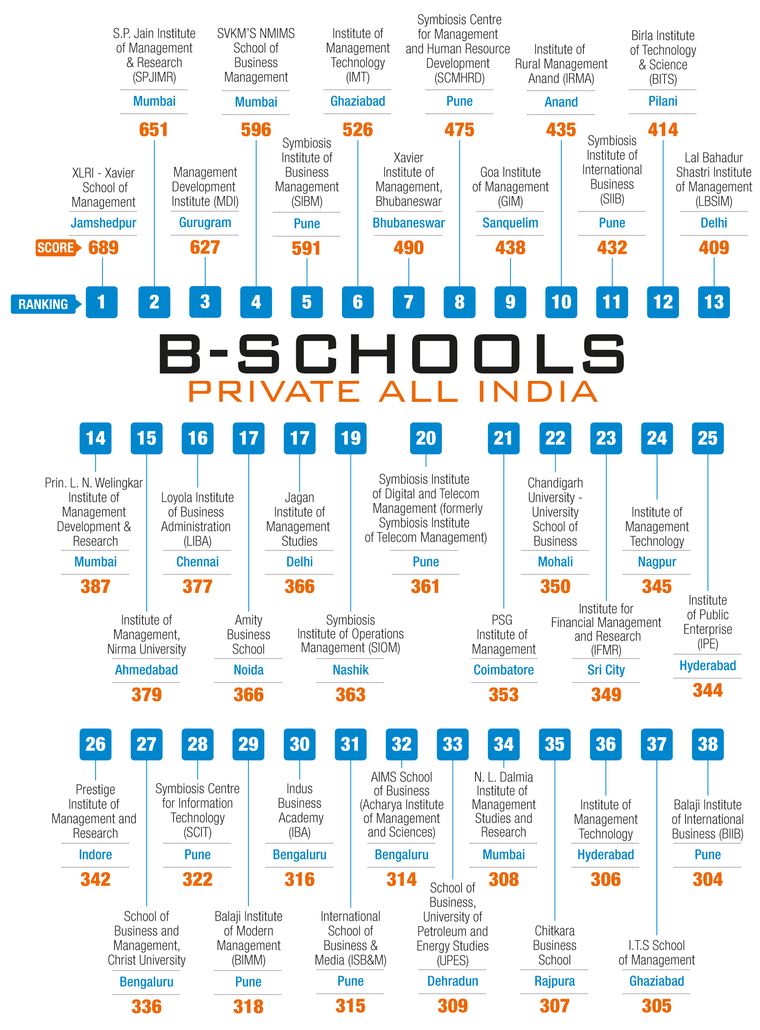

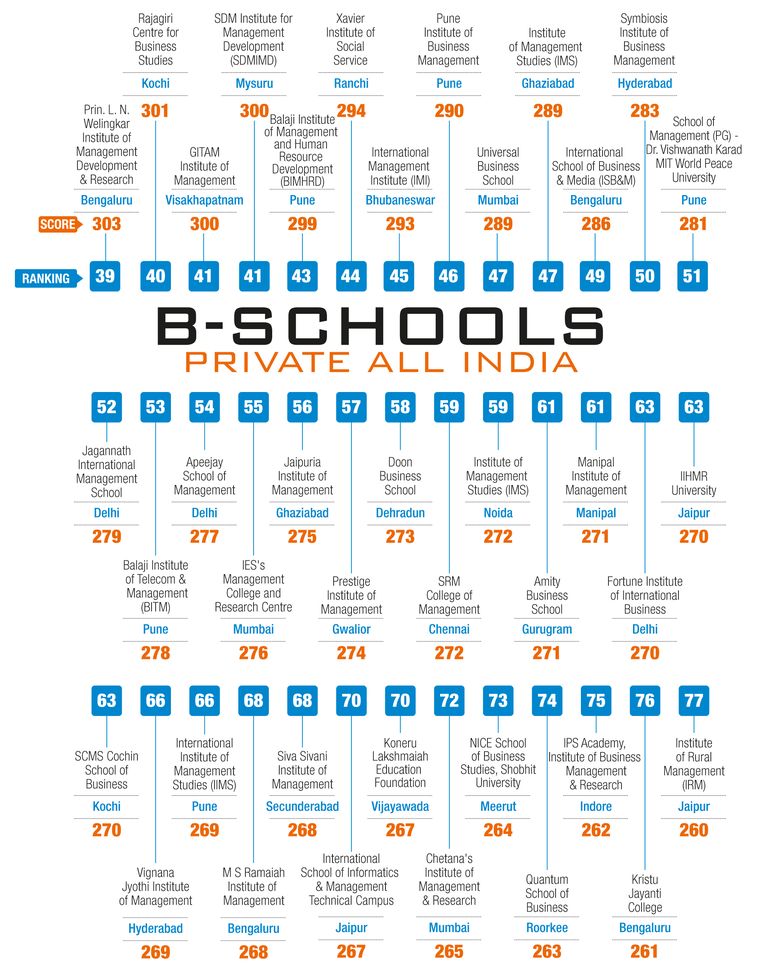

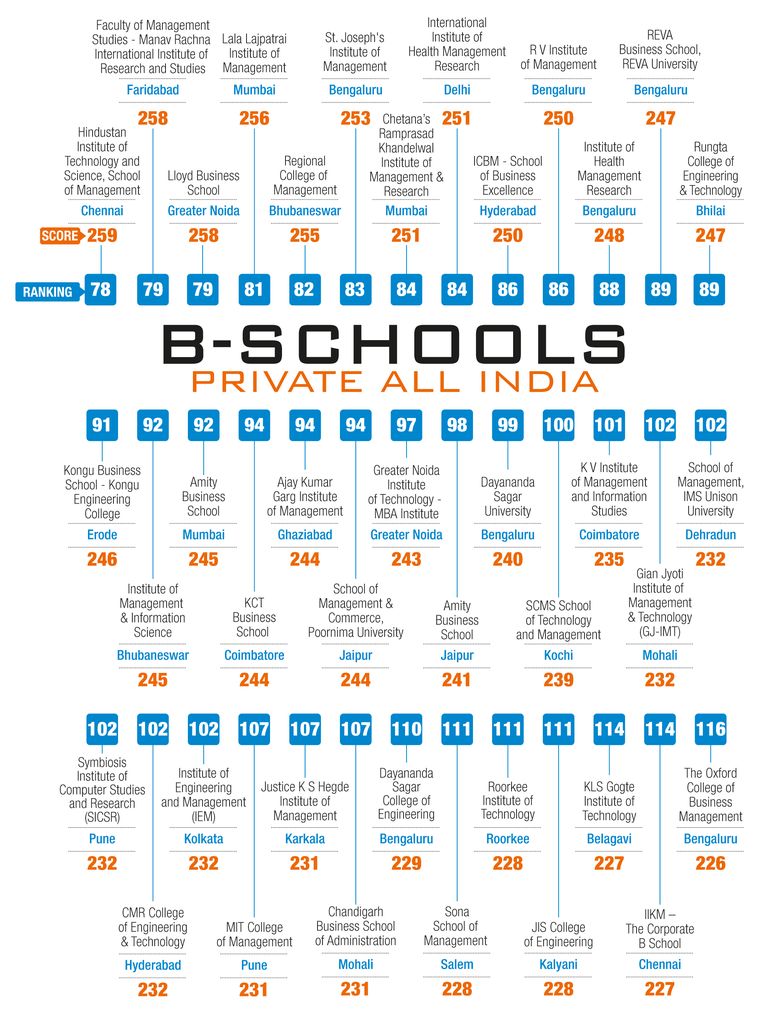

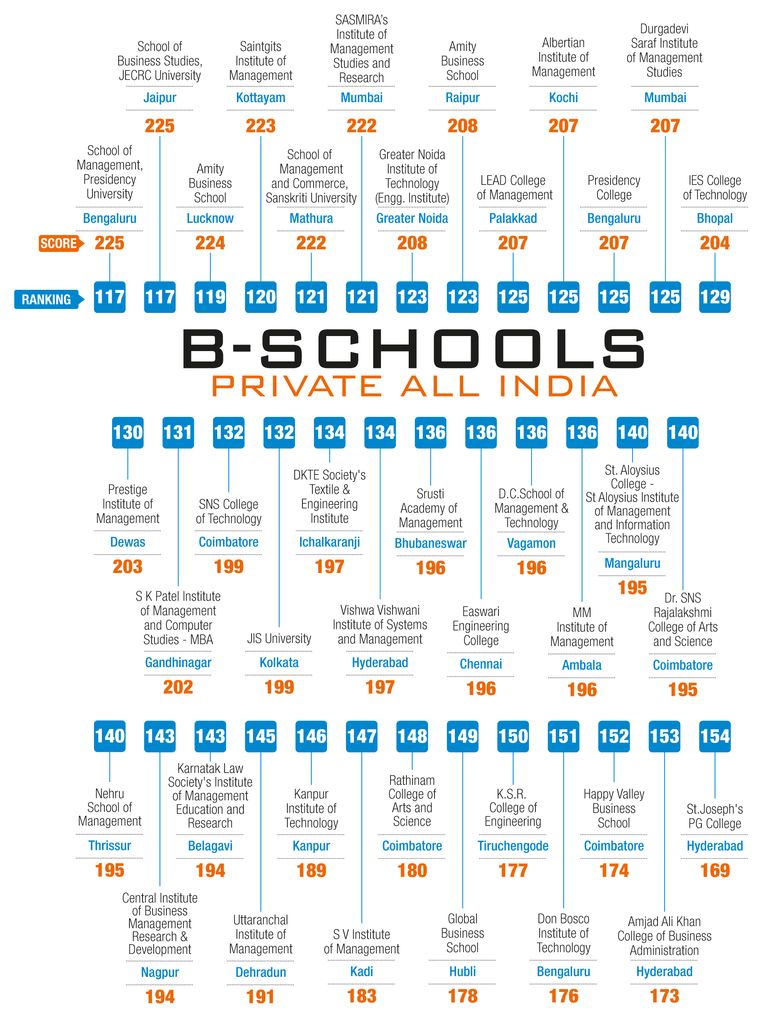

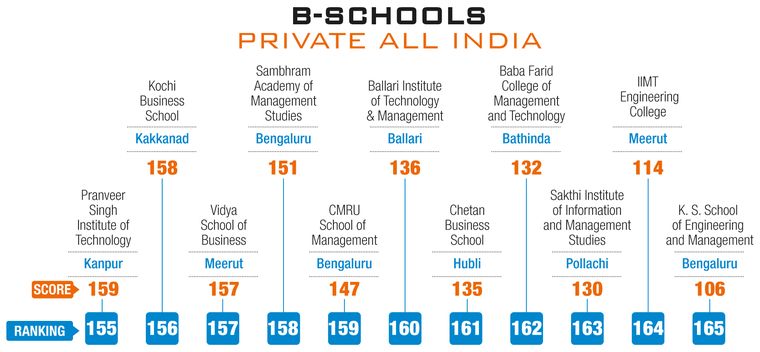

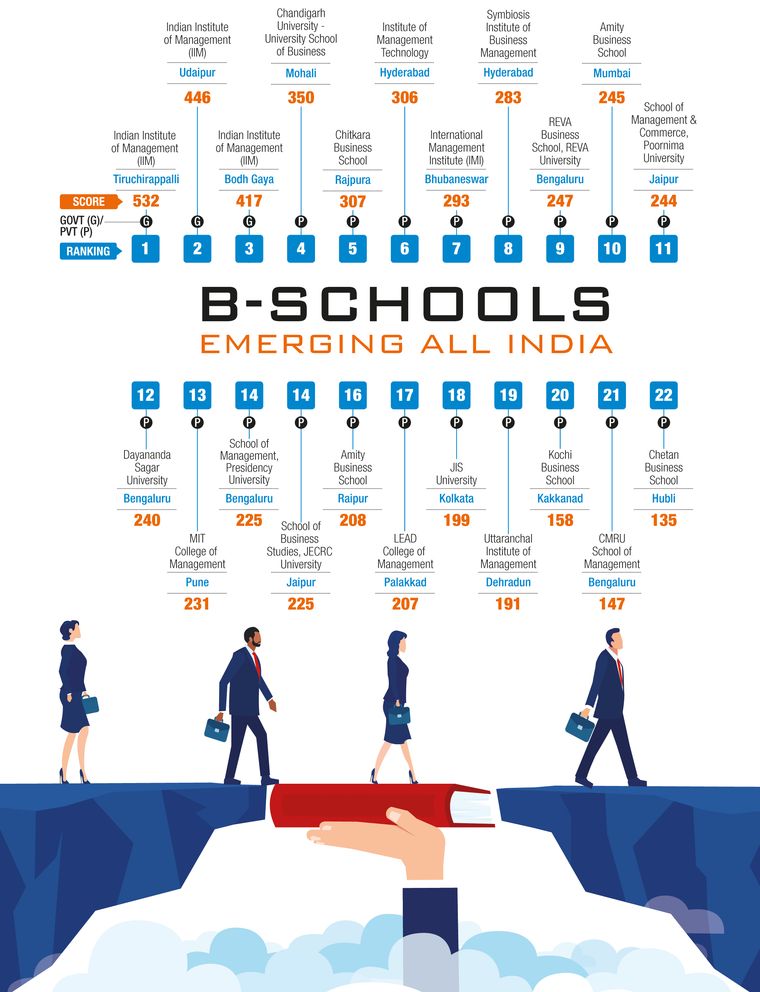

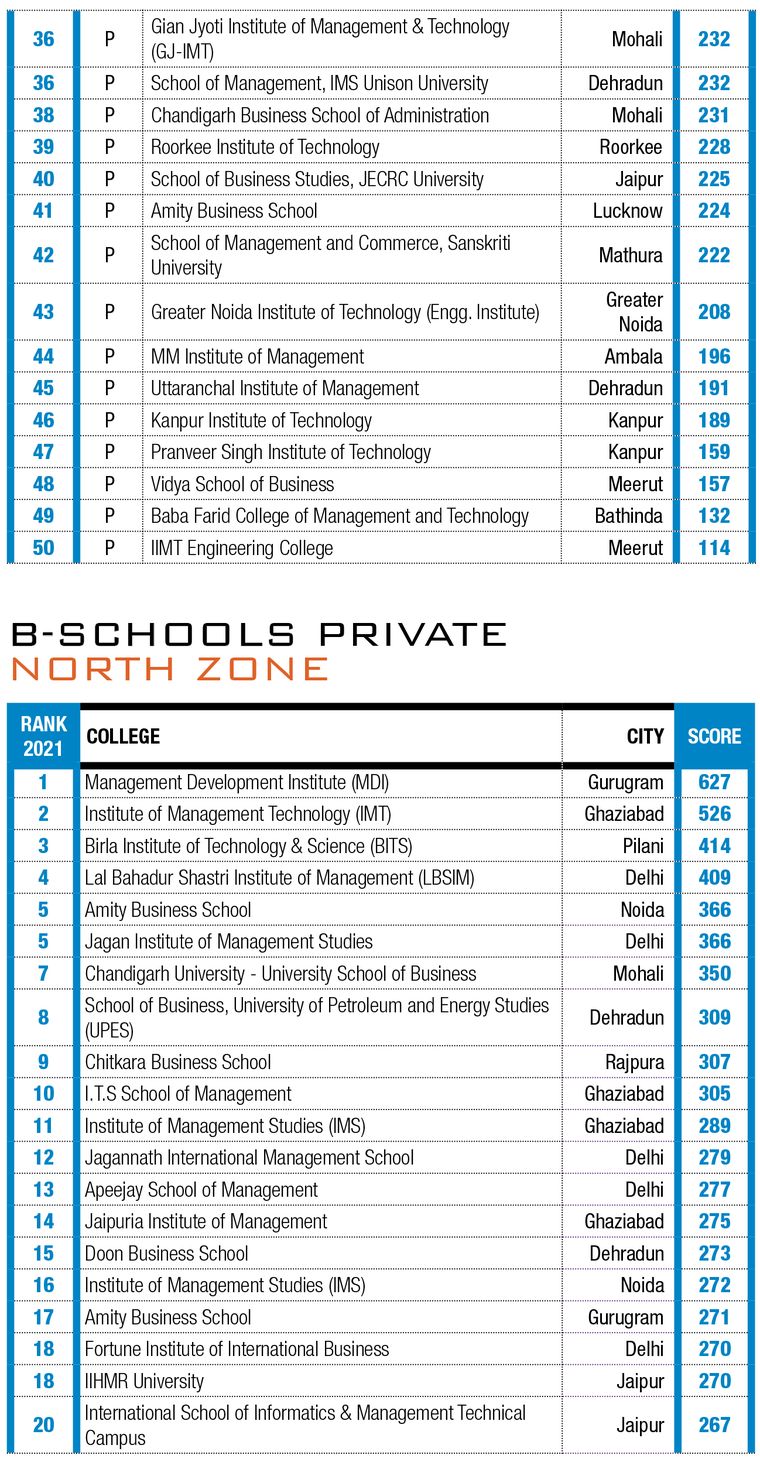

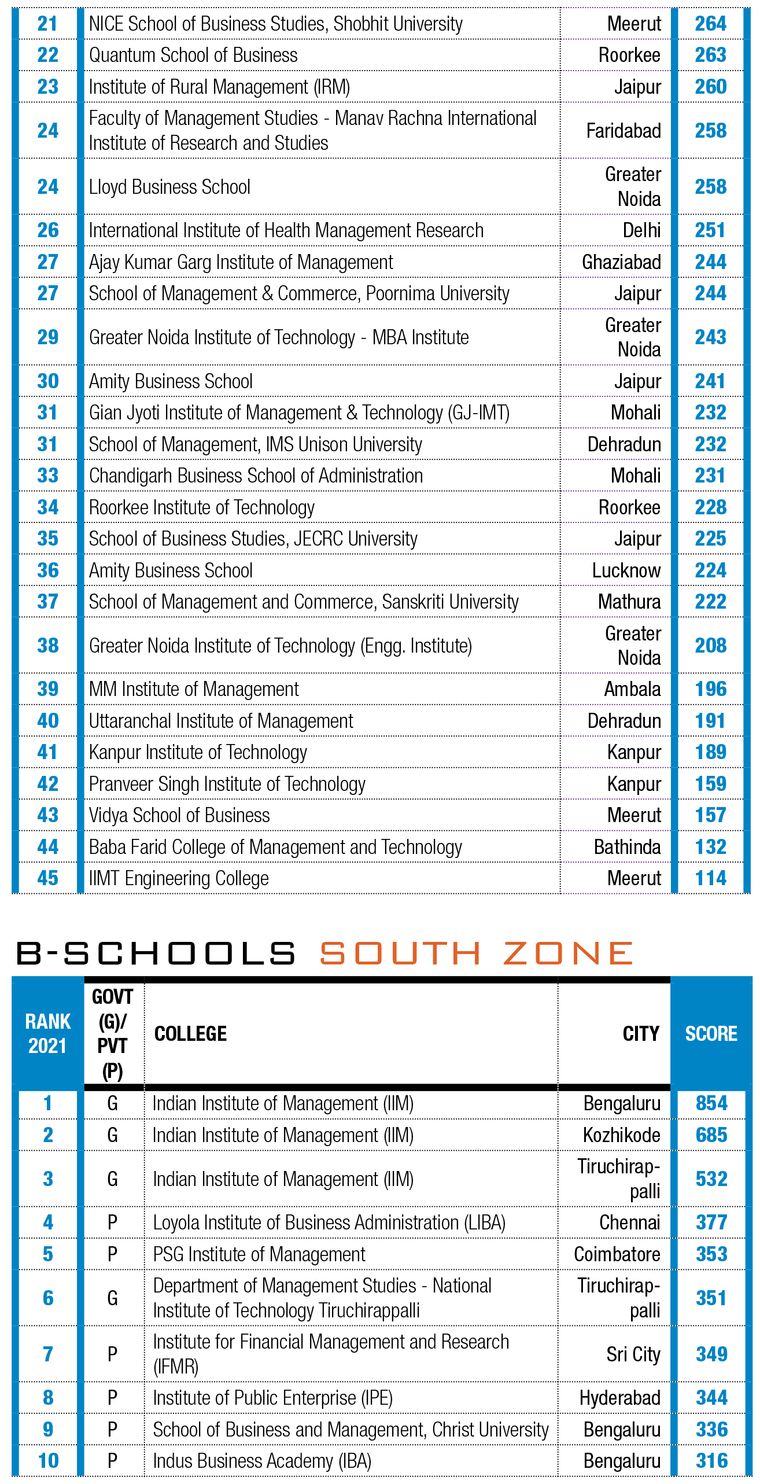

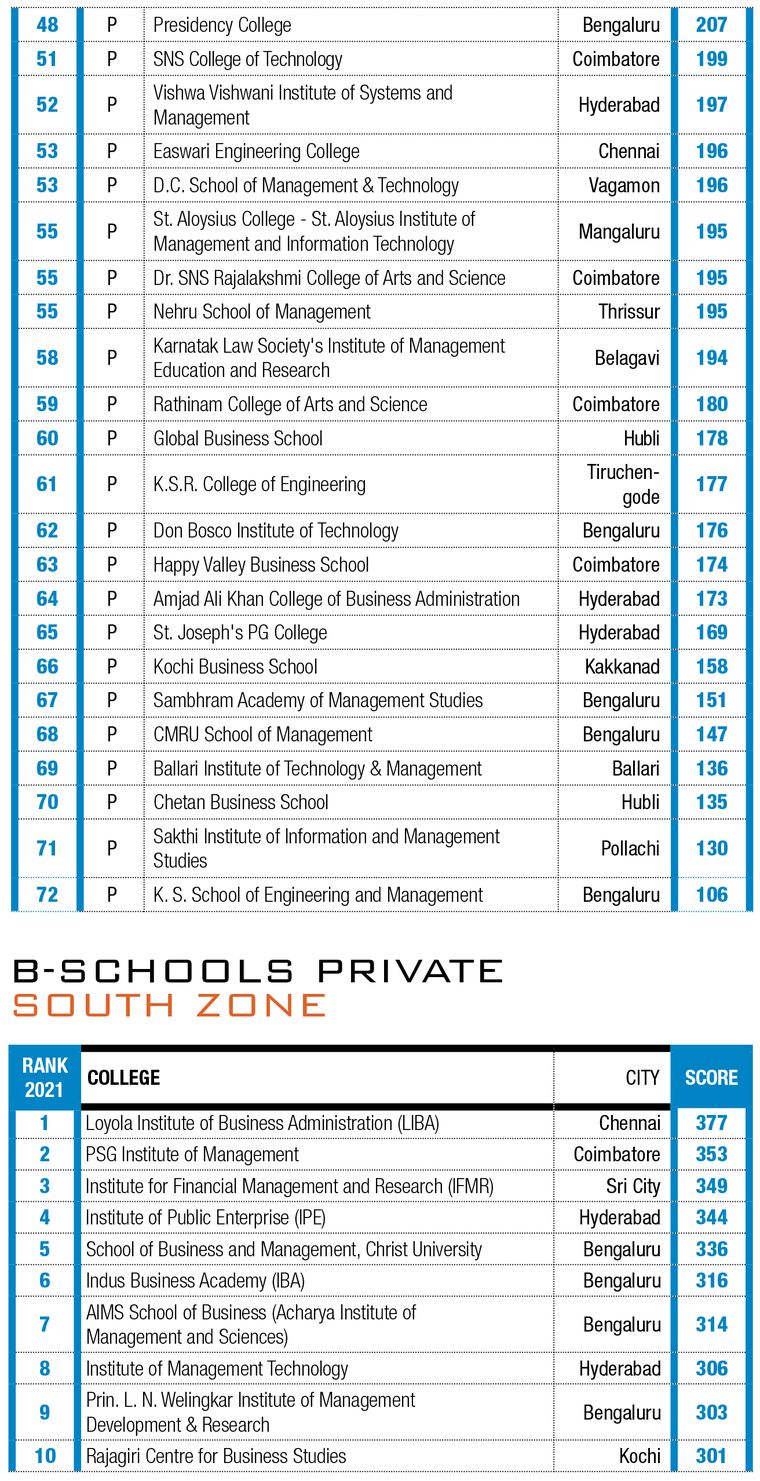

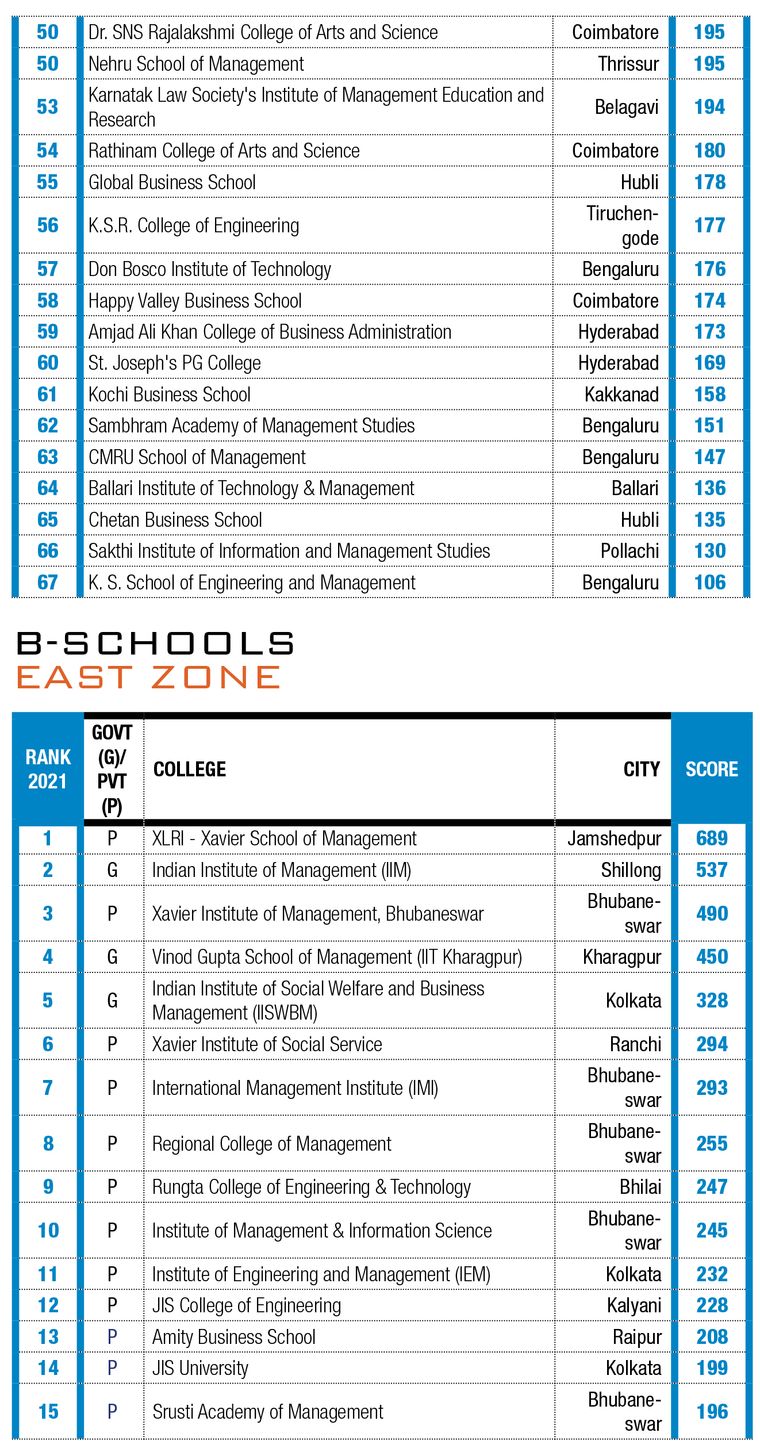

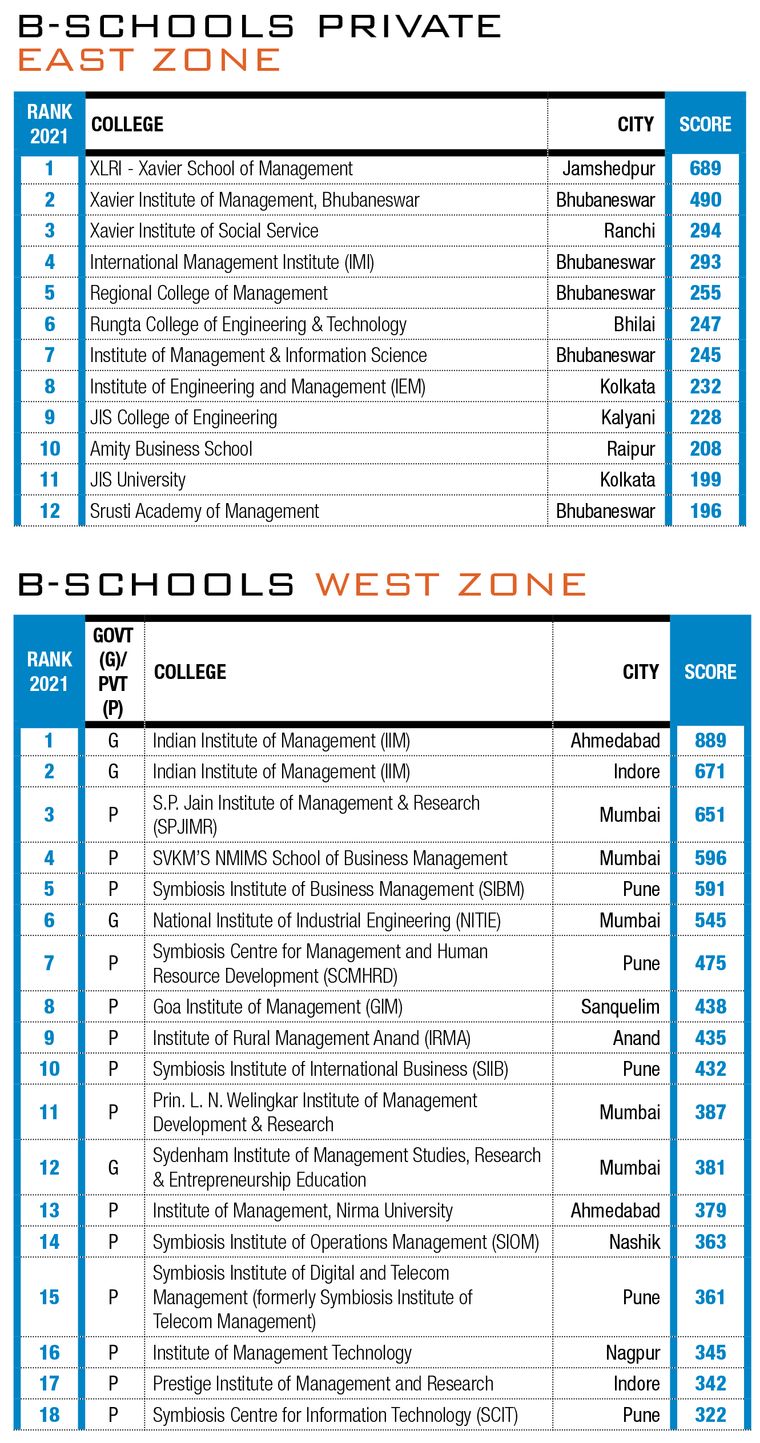

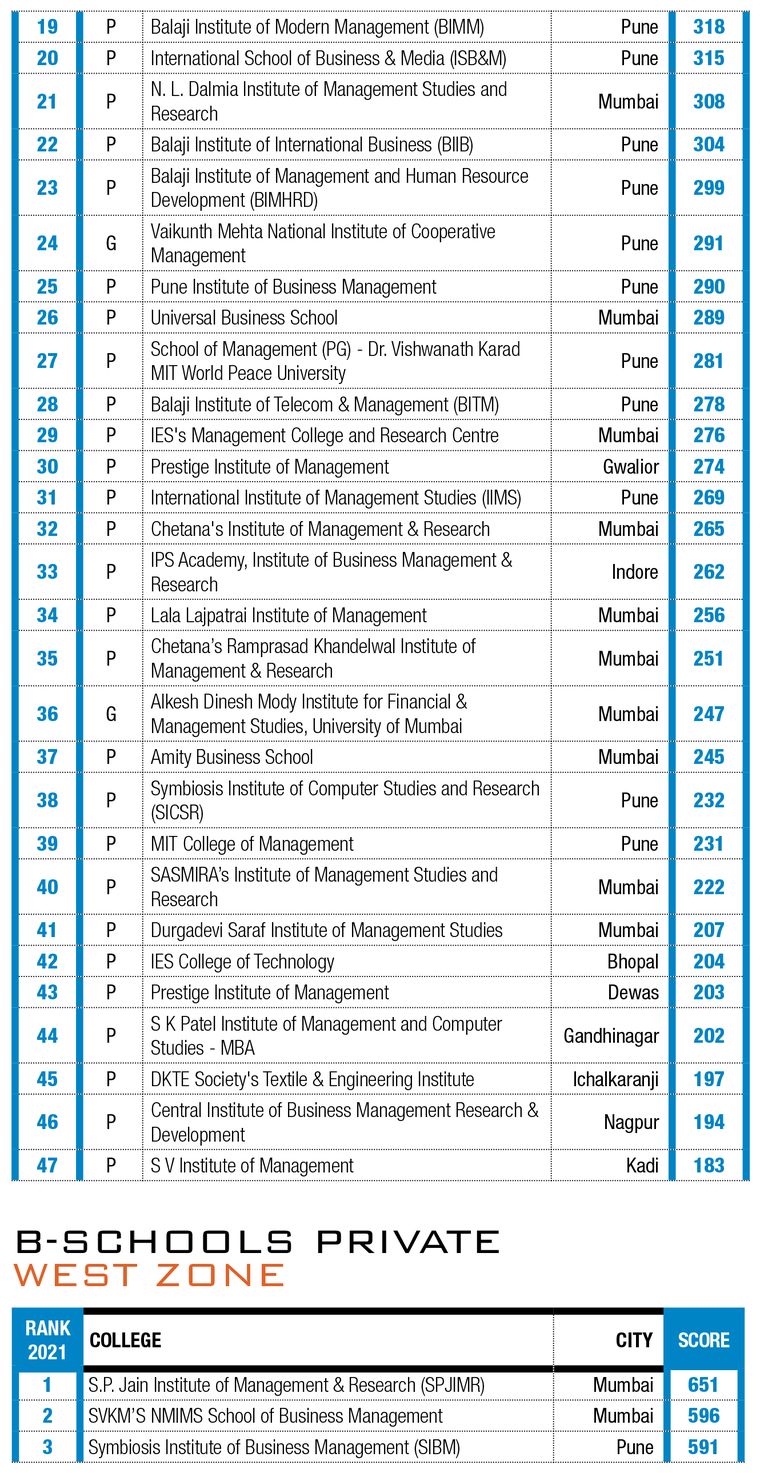

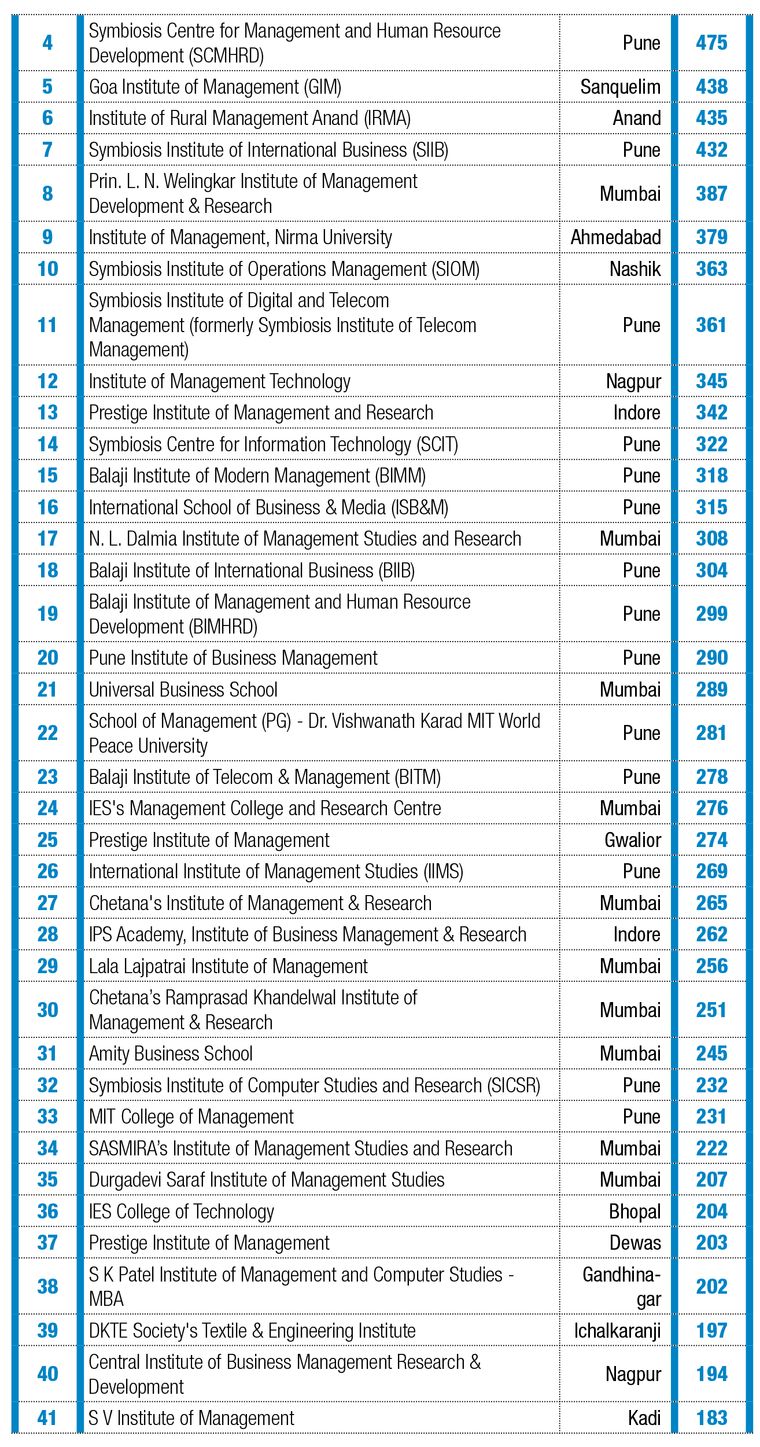

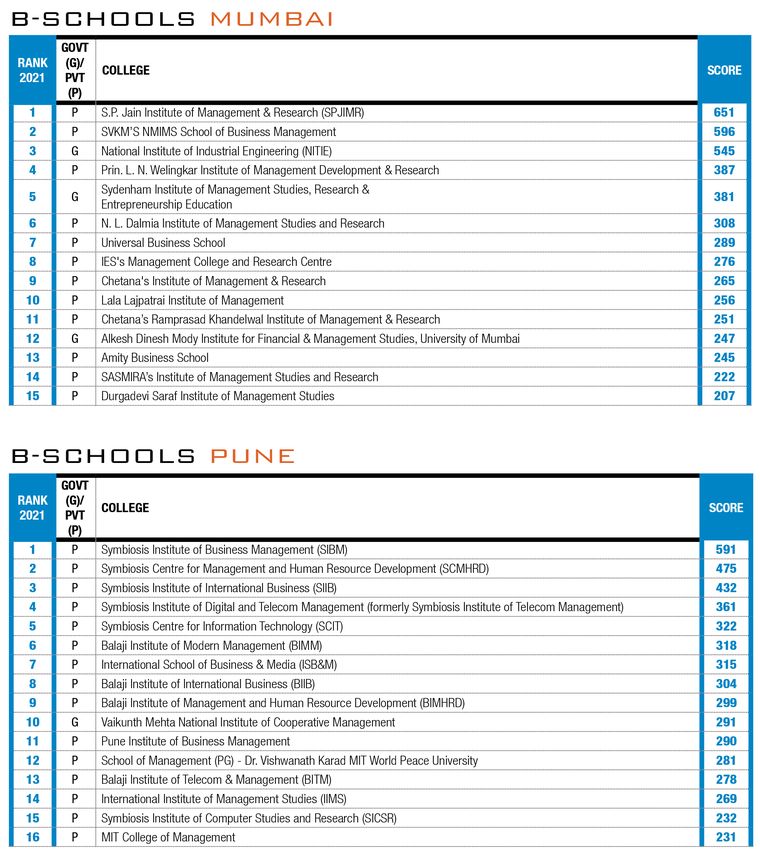

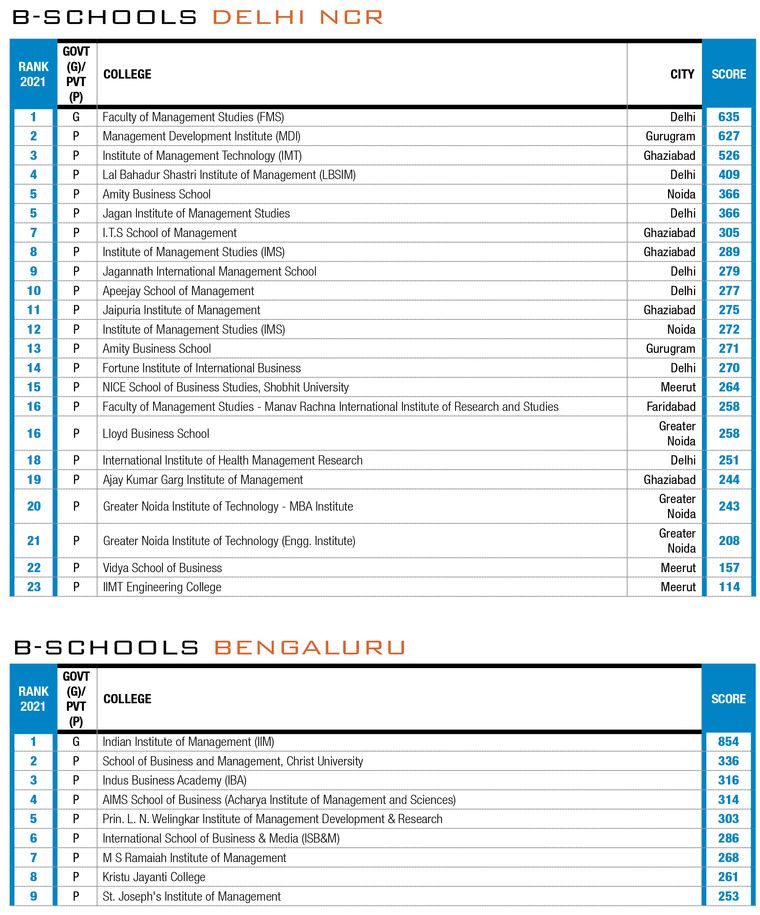

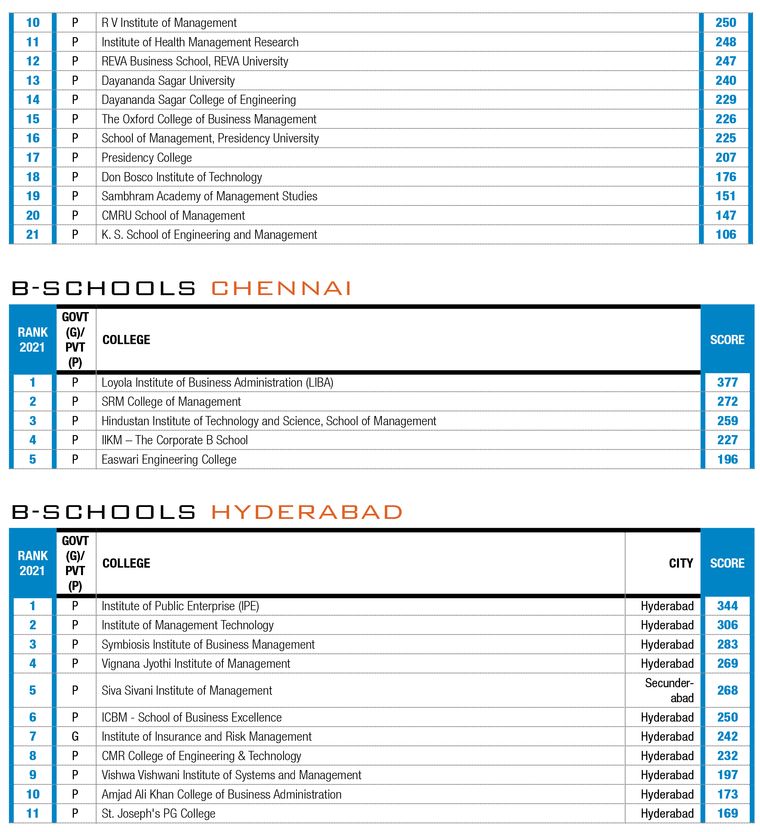

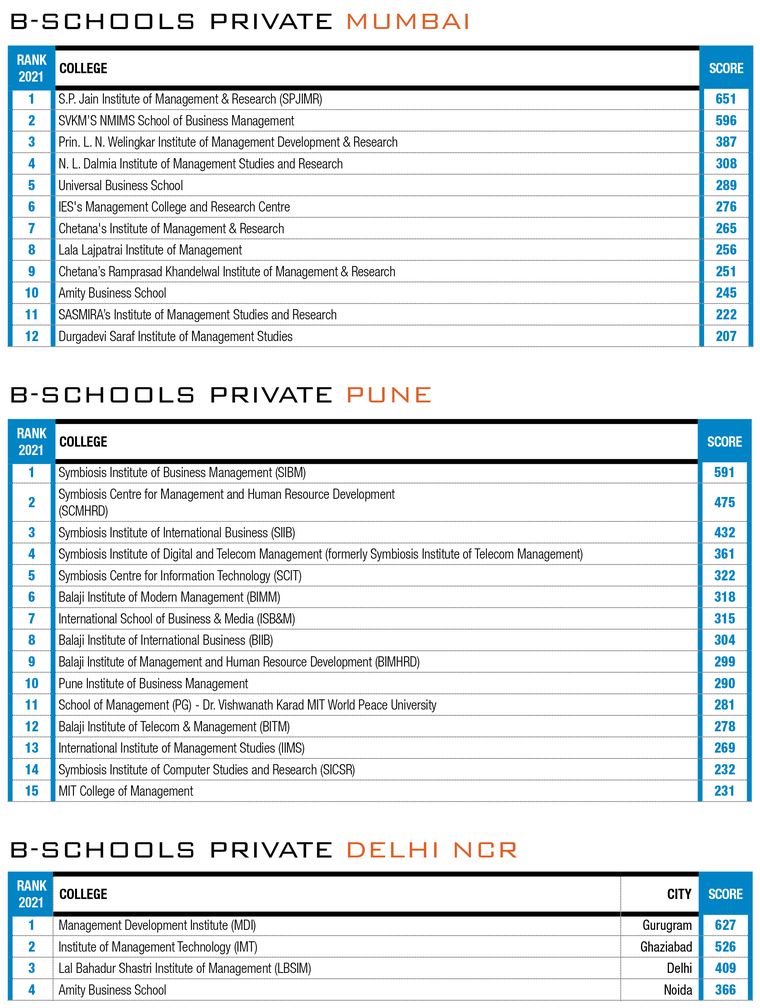

THE WEEK-Hansa Research Best B-Schools Survey 2021

Research methodology

Perceptual opinion collection

A primary survey was conducted in August-September 2021, where 285 academic experts, 470 current students, 320 aspiring students and 40 recruiters from 17 cities in India nominated the best b-schools in the country. The cities selected included all the major education hubs in the country.

A closed-ended questionnaire was given to all the stakeholders, asking them to nominate and rank the top 25 b-schools in India and the top b-schools in their zones.

Perceptual score: Calculated based on the number of nominations received and the actual ranks given to the b-school in the All India category and in its zone, by the various stakeholder segments.

Factual information collection

A dedicated website was created as an interface and the web link was sent to more than 1,400 b-schools, of which 186 responded on time. Four b-schools were rejected because they did not meet the eligibility criteria (the institutes had not passed three batches or had admitted less than 40 per cent of the sanctioned intake). Data from the remaining 182 b-schools was used for the rankings.

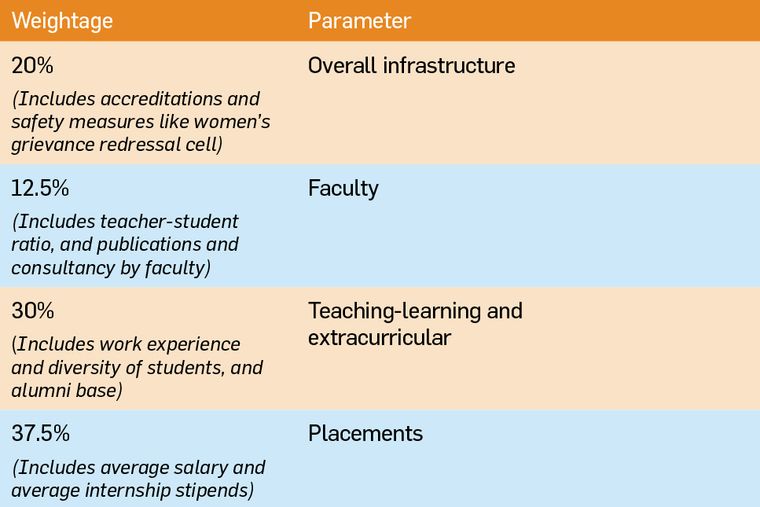

Factual score: Information collected from the b-schools was combined by applying appropriate weights to each parameter as given below:

Ranking methodology

Ranking is based on a composite score derived by combining the perceptual score for the b-school and the factual score.

Some top b-schools could not respond to the survey within the deadline. For them, composite score was derived by combining their perceptual score with an interpolated appropriate factual score based on their position in the perceptual score list.

Some top b-schools, like IIM Calcutta, opted out of the survey and did not want their names to be listed.

Note: Emerging b-schools are institutes established in 2011 and thereafter.