On September 23, Tata Group announced the merger of seven of its metal companies into Tata Steel. The decision involved months of planning and many rounds of board meetings; the goal is to bring in simplicity and scale.

Simplicity and scale are exactly what Tata Group chairman Natarajan Chandrasekaran wants also for the entire group. Its size is intimidating and complexity baffling―till a while ago, the group had 100-odd companies operating in sectors as diverse as aviation, automobiles, fast moving consumer goods, tea, software, steel, luxury hotels, power and defence equipment. Different companies within the group were fishing in the same waters. Chandrasekaran―who took over the reins of the group in 2017 and is only the third ‘non-Tata’ to lead the 154-year-old group―had to address this. And, he had to do it the Tata way.

Chandrasekaran, who had an illustrious tenure as the CEO of Tata Consultancy Services, did not shy away from the responsibility. On the one hand, he cut losses by selling non-core and loss-making businesses. On the other, he made several big ticket acquisitions. He brought in a cluster-based approach that led to various companies of the group working more closely.

TOGETHER BETTER

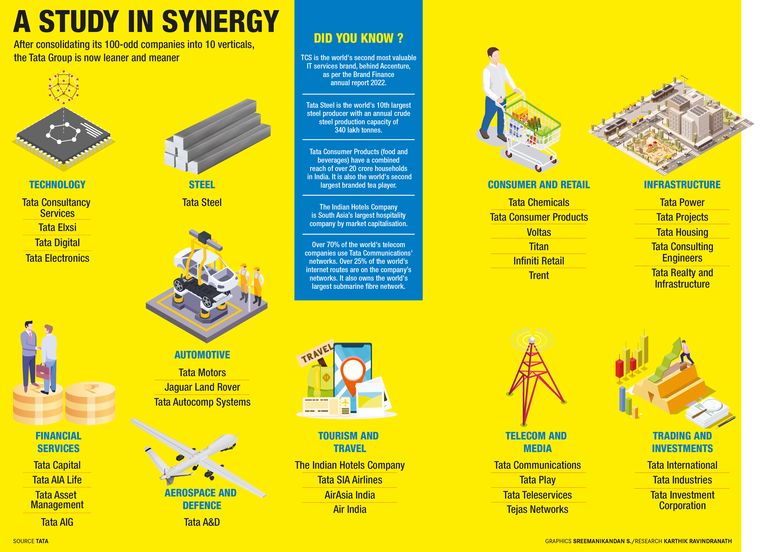

The group now has 30 companies across ten business verticals―technology, steel, automotive, consumer and retail, infrastructure, financial services, aerospace and defence, tourism and travel, telecom and media, and trading and investments. “A lot of our structures are because of legacy issues,” said T.V. Narendran, managing and CEO of Tata Steel. “Many of these companies have been around for a long time and there was a reason for them to exist as independent listed subsidiaries at different points in time. Today, when we look at cost versus benefit, it makes more sense to have a more simplified structure.”

In the year ended in March 2022, Tata Steel was the tenth largest steel producer in the world with an annual crude steel production capacity of 34 million tonnes. It made several acquisitions in the past few years―Bhushan Steel in 2018, Usha Martin in 2019 and Nilachal Ispat Nigam in 2022. As the company is gaining scale, it made sense to merge its upstream and downstream companies, a move that would provide monetary as well as managerial benefits.

The merger will help Tata Steel save on royalty that it pays for the quantum iron ore supplied to Tata Steel Long Products and Tata Steel Mining. “It will also save on other regulatory costs like audits and compliances under various acts, which is costly and time consuming, especially in cases where the size of operations does not justify the regulatory costs,” said Vishal Chandak, research analyst at Motilal Oswal Financial Services.

Then there are the synergistic benefits and savings that will accrue from common IT services, common procurement, lower administrative overheads and fungibility of manpower. Narendran estimates synergy benefits of Rs1,500 crore to Rs2,000 crore.

Consolidation is a theme that has been playing out across Tata Group of late. Tata Chemicals, a leader in salts, had over time built a strong portfolio of pulses and spices as well. Tata Global Beverages was a major player in tea, and Tata Industries was trying its hand at ready-to-eat food products. The consumer business under Tata Chemicals has been merged into Tata Global Beverages to create Tata Consumer Products. Earlier this year, the company took a step further in unlocking synergies by merging the businesses of Tata Coffee, and later Tata SmartFoodz, the ready-to-eat food products maker, from Tata Industries.

R.K. Krishna Kumar, former director of Tata Sons, said there had been a lack of cohesion in the way the various group companies operated, and Chandrasekaran was able to have a vision to simplify the group. “What Chandra did was he saw the need for simplification and in the process one of the major steps he took was the merger of Tata Chemicals’ food and salt business with Tata Consumer Products. His basic idea was synergy, where product-wise, structure-wise and infrastructure-wise there was commonality between companies and products,” he said.

This focused strategy has helped the businesses grow rapidly. For instance, in the year ended on March 31, 2022, Tata Consumer Products’ consolidated revenue was Rs12,425 crore. It was just about Rs6,779 crore in 2016-17.

“You have to shrink to grow,” said Nirmalya Kumar, professor of marketing at Lee Kong Chian School of Business at Singapore Management University. “You shrink some parts where you cannot make a difference and you focus and grow other parts.” Kumar headed Tata Group’s strategy when Cyrus Mistry was the group’s chairman between 2012 and 2016.

The group companies are now working more closely. Tata executives say companies are now complementing each other. The coordination between Tata Motors and Tata Power is a classic example. Tata Motors is a leader in electric vehicles and Tata Power is building charging infrastructure across the country. “Charging infra has always been a chicken-and-egg situation. Tata Power and Tata Motors have resolved it by going together,” said Shailesh Chandra, managing director of Tata Motors Passenger Vehicles and Tata Passenger Electric Mobility. “We work together, we decide which cities we are opening in and therefore where the chargers will be required. As we have seen the data of all our customers, which cities they have purchased, where they move, which highways they are frequenting, we give this information to Tata Power to put the chargers there, so that their utilisation also increases.”

PAINT ME GREEN

While most automobile companies are still strategising their EV plans, Tata Motors is at full throttle with three EV launches in three years and 88 per cent marketshare. It has already sold 45,000 units of the Nexon EV and the Tigor EV. The latest launch of the aggressively priced Tiago EV is expected to keep the momentum going. “The company has been the leader in electric passenger vehicles and has targeted ten models by 2025-26. Considering the strong head-start, there is a high probability that its EV marketshare would be higher than ICE marketshare over the medium term,” said Raghunandhan N.L. of Emkay Global Financial Services.

Tata Power’s growing network of charging stations is aiding this push. It already has some 2,200 public EV charging points installed and plans to scale up. It has also installed 13,000 home chargers.

Tata Power is India’s largest integrated power company, with a generation capacity of 13,735 MW. In 2015, as much as 84 per cent of its power generation capacity was coal-based. This year, it went down to 66 per cent; clean energy accounts for the rest. By 2030, clean energy will make 80 per cent of its capacity, as the company is pursuing major expansion in solar and hybrid clean energy sources. Between 2040 and 2050, it will phase out all coal-based plants, with an aim to become net carbon zero by 2045.

“The future is going to be catalysed by the opportunities in renewable energy across the spectrum, be it utility scale or otherwise, as the global shift to clean energy intensifies,” said Praveer Sinha, managing director and CEO of Tata Power.

Going green is increasingly becoming a key aspect in Tata Group, both from a business and a sustainability perspective. Tata Steel, for instance, is working with startups on carbon capture and usage, and Tata Chemicals has commissioned the UK’s first carbon capture and utilisation facility.

DIGITAL PUSH

In 2019, Tata Sons formed a wholly owned subsidiary, Tata Digital, to incubate new digital businesses. Headed by TCS veteran Pratik Pal, it has made several big-ticket acquisitions in an attempt to gain scale, including that of the online grocery chain BigBasket in 2021.

Tata was already present in the grocery retail business through the StarBazaar supermarket chain and a connected app. However, it was limited to a few states. With the acquisition of BigBasket and the online pharmacy 1mg, suddenly the entire country became a big market for Tata’s retail ambitions.

The group’s pivot to a digital commerce enterprise is in line with Chandrasekaran’s One Tata vision. Various Tata companies were already operating digitally, but in their silos (Star Bazaar, Croma, Westside). The Tata Neu super app, which was launched in April, is a digital marketplace for all of Tata’s consumer brands. “More than stitching together various brands, it is trying to stitch together data of these disjointed customers,” said Abhishek Kumar and Sachin Dixit of JM Financial Institutional Securities.

Tata Neu, which has been downloaded more than one crore times on Android PlayStore, is still a work in progress. For instance, if you want to book flights, only AirAsia India is currently available on the app; Vistara and Air India are not. Tata is working on such problems.

E-commerce is not an easy sector. Tata faces stiff competition from the deep-pocketed Reliance Industries, which has been aggressively pushing its JioMart platform, the Walmart-owned Flipkart, and the global leader Amazon. All three have been expanding heavily into new segments and roping in neighbourhood stores to their platforms.

GLOBALLY LOCAL

Tata Group made many big-ticket acquisitions in the past few years, especially under Ratan Tata―Corus Steel in Europe, Tetley Tea in the UK and Jaguar Land Rover in the UK. It has been expanding organically also―Indian Hotels launched many luxury hotels overseas and TCS opened offices in several countries. Of late, however, the group has doubled down on India.

Tata Steel, for instance, sold the specialty steel business in the UK to Liberty House Group in 2017. The UK business is now just 10 per cent of Tata Steel’s total business; it was 40 per cent a decade ago. In India, on the other hand, the company is planning to double its capacity in a decade.

Also read

- Suzuki Motor, Tata Elxsi open new offshore development centre in Pune focusing on green mobility tech

- Philanthropist Ratan Tata: How Tata built 500-bed hospital in Kerala within 5 months during peak of Covid pandemic

- Ratan Tata passes away: ‘Haven’t met anyone like him; learnt philanthropy from Tata’, remembers Sudha Murty

- Tata Group becomes first Indian conglomerate to cross Rs 30 lakh crore market cap

- Airbus-Tata consortium to manufacture 40 transport aircraft for IAF in India

- 'Makes sense to have simplified structure': T.V. Narendran, MD and CEO, Tata Steel

Watch and jewellery maker Titan Company, the second largest Tata Group company by market capitalisation, is targeting the large population of non-resident Indians in markets like the Middle East, Canada and the US. C.K. Venkataraman, managing director of Titan, said expats were celebrating “Indianness like never before” and jewellery was an integral part of it. Also, the competition in these markets is much less than back home. Titan has a store in Dubai and it plans to open 20 in the next three years in various countries.

Titan, which has 2,040 exclusive outlets, is India’s largest watch and jewellery retailer and it is expanding rapidly to new segments and new locations. Recently it opened jewellery outlets in towns like Bilaspur, Kudal and Dumka. “The small town opportunity is huge,” said Venkataraman. “The number of small towns in India boggles the mind and we are going everywhere to provide exceptional value to customers.”

AIMING HIGH

Tata’s biggest bet, though, is in the aviation sector. The acquisition of Air India, which was founded by J.R.D. Tata in 1932 and later nationalised, has catapulted it into the league of mega carriers with more than 200 aircraft. Tata already operated two airlines―Vistara, in partnership with Singapore Airlines, and the low-cost carrier Air Asia India. It is now the second largest Indian operator in terms of market share (Vistara, AirAsia India and Air India together) and has access to 4,400 domestic and 1,800 international landing slots at domestic airports. It also has 900 slots at foreign airports.

But there are daunting challenges. For one, Air India, AirAsia India and Vistara are all making losses. In 2021-22, Air India reported a net loss of Rs9,556 crore on revenue of Rs19,816 crore. But Campbell Wilson, who was appointed as the managing director and CEO of Air India in May, seems to have a plan. Wilson was earlier the CEO of Scoot, the low-cost arm of Singapore Airlines.

Air India recently announced a five-year transformation plan called Vihaan.AI, which aims to increase its marketshare to at least 30 per cent. It is also looking at adding international routes and putting the airline on a sustainable and profitable growth path. “The transformation has already started―a slew of initiatives in areas like refurbishing cabins, serviceable seats, in-flight entertainment system are already under way,” said Wilson. “We are also adopting proactive maintenance and refining flight schedules to enhance on-time performance.”

Air India currently has 70 narrow-body aircraft, of which 54 are operational. The remaining 16 will return to service by early 2023. Similarly, 10 currently non-operational wide-body aircraft will join the 33 operational ones by early 2023.

The competition is getting stiffer in the domestic aviation industry. Akasa, backed by the late billionaire investor Rakesh Jhunjhunwala, has begun operations, and Jet Airways, which had gone bankrupt, is also set to restart operations under the new owners, the Kalrock-Jalan Consortium.

Turning around businesses in an industry where taxes and operational costs are unreasonably high is a challenge. “Having three airlines, you can say they can integrate them and can get economies of scale. But, because of the different culture and business models of the three airlines, it is going to be very hard to integrate them,” said Nirmalya Kumar.

Tata, it seems, is up for that challenge. Work is already afoot for merging Air Asia India with Air India Express, the low cost arm of Air India. The Competition Commission of India has cleared the proposal. Singapore Airlines said it was in “confidential discussions” with Tata to explore a potential transaction in relation to the securities of Vistara and Air India. “The discussions seek to deepen the existing partnership between SIA and Tata, and may include a potential integration of Vistara and Air India,” it said.

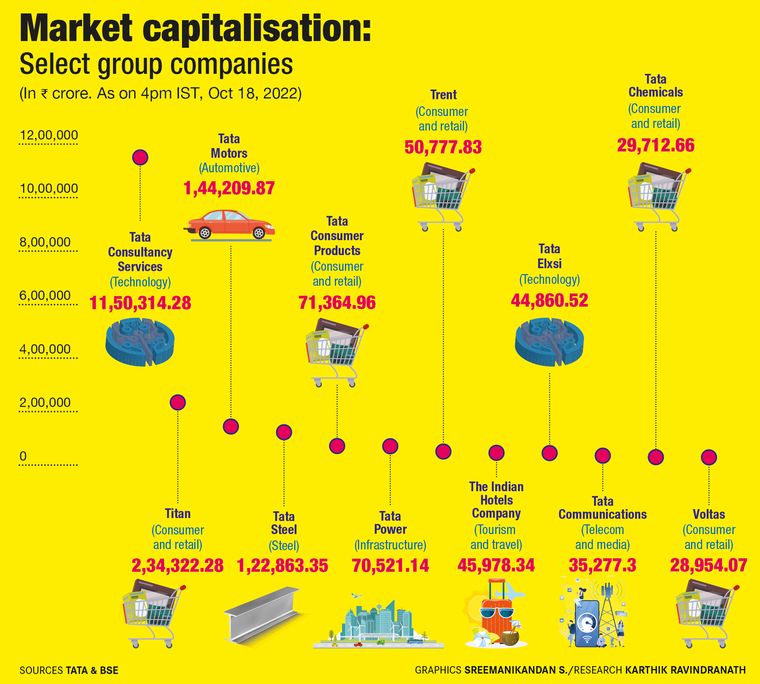

In 2021-22, the revenue of Tata companies stood at $128 billion, or about Rs9.6 lakh crore. It is the country’s largest software exporter, largest truck maker and largest electric vehicle maker. It is also among the largest tea producers, steel makers, carmakers and power generators. A major criticism Tatas have faced for years is that TCS accounts for a bulk of its profits. In 2021-22, however, strong demand and firm steel prices helped Tata Steel displace TCS as the most profitable group company. This year, amid an expected recession in markets like the US and Europe, software exporters are expected to see a slowdown in orders, although a depreciation in the rupee will be a boost.

Navigating a conglomerate through global economic and geopolitical challenges is a tough task. Consolidation and streamlining of its various businesses and reducing debt would be the way ahead for Tata Group.

THE TATA GROUP

Founded

1868 by Jamsetji Tata

Headquarters

Mumbai, India

Presence

100+ countries, across six continents

Majority shareholder

66% of the equity share capital of Tata Sons―promoter of Tata companies―is held by philanthropic trusts

Revenue (2021-2022)

Rs9.6 lakh crore

Employees

9,35,000

Market capitalisation (March 31)

Rs23.6 lakh crore