Financial inclusion is the process of ensuring that every individual in a country has access to financial services. This process has been under way in India since the beginning of the 21st century. However, with the leadership of Prime Minister Narendra Modi since 2014, the process has gathered momentum and is now more successful than ever before.

In 2014, Modi launched the Pradhan Mantri Jan Dhan Yojana (PMJDY) scheme, aimed at ensuring financial inclusion for all sections of society, especially the poor and rural areas. The scheme has been highly successful with the opening of 47.8 crore accounts, with a total balance of more than Rs1.99 lakh crore till March 2023.

The government has also made significant progress in promoting a cashless economy under the Digital India programme. The country witnessed a significant increase in digital payments, with a 55 per cent rise in inter-bank mobile payment transactions in 2020. Initiatives like the Unified Payments Interface (UPI) have made online transactions simpler, faster and more secure. India has rapidly become one of the largest adopters of digital payments in the world.

Another significant institutional step in the journey of financial inclusion has been the introduction of the Pradhan Mantri MUDRA Yojana (PMMY) in 2015, a scheme aimed at providing collateral-free loans up to Rs10 lakh to non-corporate, non-farm small/micro-enterprises. This scheme has been highly successful, with more than 40.82 crore MUDRA loans worth more than Rs23.24 lakh crore being sanctioned as of March 24, 2023.

In 2018, the government launched Ayushman Bharat, a national health protection scheme aimed at providing free health insurance to the poor and vulnerable sections of society. It covers over 50 crore beneficiaries and is one of the largest public health insurance schemes in the world. This scheme is an essential step towards promoting financial inclusion as it enables easy access to quality health care, which is a significant expense for most households.

The Indian government has also focused on enhancing financial literacy among its citizens to promote financial inclusion. The National Centre for Financial Education was launched in 2013 to provide a dedicated platform for financial literacy in India. Additionally, the government has launched various campaigns such as the Digital Financial Literacy Campaign and Swachhata Pakhwada to enhance financial literacy among its citizens.

The government has also promoted the use of technology to promote inclusive growth. The India Post Payments Bank (IPPB), launched in September 2018, operates as a payment bank, and provides access to banking services to customers through its widespread network of post offices. It aims to provide access to financial services to the last mile of rural India. The IPPB is one of the most significant institutional steps towards financial inclusion and has played a crucial role in providing affordable banking services to the unbanked population in India.

The government has also set up the India Inclusive Innovation Fund (IIIF) in 2016 to support early-stage startups that promote financial inclusion by using innovative technology solutions. The IIIF has already funded over 30 startups working towards financial inclusion in areas such as mobile payments, peer-to-peer lending and microfinance.

Also read

- As PM Modi enters 10th year, a look at his legacy and challenges ahead

- 'India is confident, capable, uplifted and empowered': Ashwini Vaishnaw

- The making of a 'Modi'fied India

- 'India no longer sees itself as western-style democracy': Bhupender Yadav

- 'Modi's vision and determination is yielding positive results': Mahendra Nath Pandey

- 'Other states have started following the Haryana model': Khattar

The Covid-19 pandemic has only accelerated India's efforts towards financial inclusion. The government provided direct cash transfers to the poor and vulnerable sections of society under its Pradhan Mantri Garib Kalyan Yojana. Additionally, the government has launched the PM SVANidhi scheme, aimed at providing loans to street vendors affected by the pandemic. Under the scheme, 42.7 lakh loans amounting to Rs5,152.37 crore have been disbursed to street vendors.

In conclusion, India has made significant progress in achieving financial inclusion under the leadership of the prime minister. Various institutional steps have been taken, including the PMJDY, PMMY and Ayushman Bharat schemes, to promote access to financial services among the poor and vulnerable sections of society. The use of technology, the promotion of financial literacy and the launch of innovative programmes like the IPPB and IIIF have also helped in this regard. The pandemic has only accelerated India's efforts towards financial inclusion, and with the government's continued focus on this critical issue, the country is well on its way towards achieving its goal.

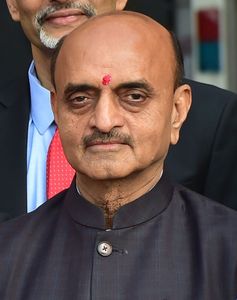

Bhagwat Karad, Union minister of state for finance