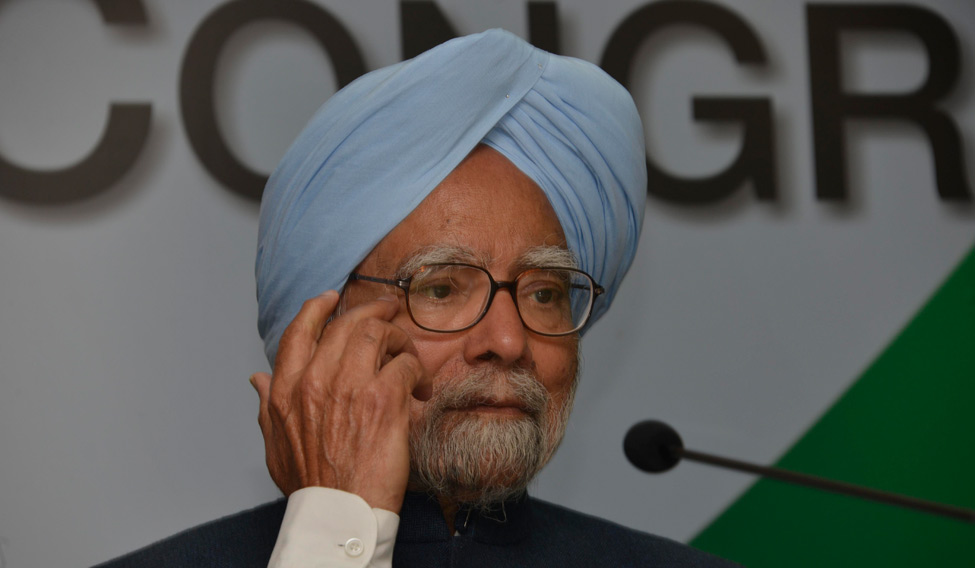

The NDA government should not be "lured into false belief" that the economy is out of the wood, former prime minister Manmohan Singh said today, reacting to the Moody's upgradation of India's sovereign credit rating.

The US-based agency upped India's rating to Baa2 from Baa3 and changed its rating outlook to 'stable' from 'positive', saying the reforms will help stabilise rising levels of debt.

"I am glad that Moody's has done what they have done but we must not be, I think, lured into false belief that we are out of the wood," he said, reacting to a query on Moody's rating, in Kochi.

The economy needed strong purposeful guidance to move forward at the rate which the government itself says they want the country to move, from 8 to 10 per cent, Singh said on the sidelines of a national seminar on 'Macro Economic Developments in India: Policy Perspectives' organised by the Economics Department of St Teresa's College, Ernakulam. His comments came in the wake of Finance Minister Arun Jaitley terming the Moody's upgrade of India's sovereign rating after 13 years as "belated recognition" of reforms undertaken.

Singh also cautioned that the soaring prices of the crude oil could "hurt the fiscal system" of the country.

"Now the crude oil prices are at $62-64 whereas few months ago, they were about 40-45. So it can hurt balance of payment. It can also hurt the fiscal system as well," Singh said.

Asked how different he would have implemented the GST, Singh said there was "undue haste" in implementing the new taxation system and blamed the bureaucracy for its lack of preparedness.

"Both in administration and implementation, I think there is much to be desired and the very fact that the council has met so many times, they have now reduced rates of 211 items." That showed that there was undue haste in implementation and the bureaucracy had not done its homework, he said.

On demonetisation, Singh said that it was not an appropriate response to the blackmoney issue and suggested that the government should simplify tax and administration systems to address it.

The answer to blackmoney problem was to simplify our tax, land registration and the administration systems. That was the only way in which the country could move forward in a society where there was less role for blackmoney generation, Singh said while interacting with students. Singh said he believed that demonetisation was not an appropriate response to the blackmoney problem and demonetisation had caused a lot of distress to farmers, small industrialists and many people died while standing in queues in front of banks to get cash because of the ban of Rs 500 and Rs 1,000 currency notes last year.

Asked about how demonetisation has affected India's economy, Singh said it has put the economy in a state of stagnation. "There are people who believe that the economy will soon recover to its normal speed. I am doubtful. My own feeling is that the next one year, the economy will remain in doldrums and therefore demonetisation has harmed the process of economic development to that extent," he said.

Earlier, in the seminar Singh said the last few decades of rapid economic development have been accompanied by rising income inequality both at the individual and regional levels. "Social mobility in India continues to be restricted, especially among the lower castes and minorities. Recent economic research has pointed out how income inequality in India has grown since independence," he remarked.

Singh said economists have also pointed out how state level regional inequality has also grown in independent India where some states were outperforming the rest. "It is time we pause, step back and recalibrate our macroeconomic thought that will acknowledge both the virtues and pitfalls of free markets," Singh said. He lamented that nature of economic development was not leading to the creation of enough jobs to absorb all the new entrants to the labour force estimated at 10-12 million per annum.

Inequality and joblessness could be extremely dangerous in a diverse nation like India. There were no easy economic solutions for these problems as the world grapples with the dilemma of balancing the benefits and damages caused by globalisation, market failures and domestic imperatives, Singh said. He said the first three decades of India's economic policy focused on nation building through a strong state, developing capabilities in private enterprise and providing strong social foundations for economic development. The next three decades of economic policy have been driven by increased private sector participation and a smaller role for government. "Today we stand at the threshold of another beginning."

Ever since the 2008 global economic crisis, the wisdom of markets as a panacea for all economic issues was under severe doubt, he said. "Markets can fail. They fail often. When they fail, they fail big," Singh said