The indigenous smart phone industry—both hardware and software—is increasingly harnessing government's post-demonetization e-payment initiatives to create a good value proposition for Indian customers.

A plethora of apps and tools were launched by government to ease the transition to an electronics payments era since November last: agencies like National Payments Corporation of India ( NPCI) and Unique Identification Authority of India (UIDAI) rolled out multiple solutions under the Unified Payments Interface (UPI) and leveraging Aadhaar numbers. But it has been a hassle to use them—because banks were slow to make their own gateways compatible.

From left: Karbonn Executive Director Shashin Devsare and Director Ashish Aggarwal with A.P.Hota, CEO of National Payments Corporation of India, at the launch of BHIM-integrated smart phone, K9 Kavach

From left: Karbonn Executive Director Shashin Devsare and Director Ashish Aggarwal with A.P.Hota, CEO of National Payments Corporation of India, at the launch of BHIM-integrated smart phone, K9 Kavach

Now, 7 months down the road, things have improved: almost all participating banks have completed their end of the payment interface. More usefully the Indian smart phone industry has seen customer value in pre installing such e-payment tools in their handsets. This week has seen two such initiatives:

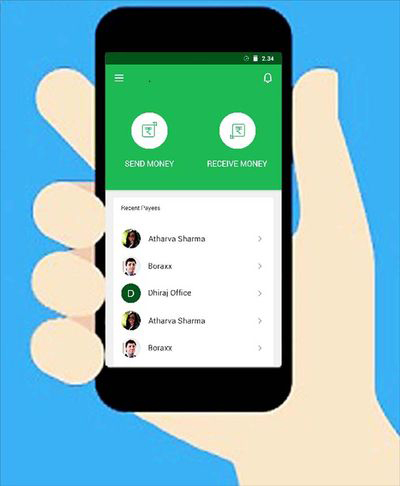

Indian handset maker Karbon has just unveiled India's first smartphone—the K9 Kavach 4G—with the BHIM app (Bharat Interface for Money) pre installed and integrated. The app can be used in multiple Indian languages and scroll down list allows the user to select any of the Indian banks to register.

With a 1.25 GHz Quad Core CPU, 1 GB RAM & 8 GB Storage (expandable up to 32 GB), the 5 inch HD phone offers 5MP front and rear cameras and is fuelled by the latest version of Android 7 (Nougat) OS. It comes with a 2300 mAh battery and the dual SIM phone works with 4G VoLTE networks.

It is arguably one of very few phones in its price band—Rs 5290—that offers a fingerprint scanner. This can be used to secure your banking apps and additionally different fingers can be programmed to open different apps and functions. The finger print scanner also doubles , usefully, as a front camera clicker.

Says A. P. Hota, Managing Director & CEO, National Payments Corporation of India: “Availability of BHIM in multiple languages on Karbonn phones, will cater to people from distinct regions with ease. This strategic partnership is a significant step towards providing acceptance tools for facilitating digital payments in India.”

YES Bank, Indus OS create UPI e-payments platform

Indus OS, the multilingual Indian smartphone operating system has teamed with YES Bank to launch a UPI payment system built into the OS. Indian consumers can access an the UPI payment platform, without the hassle of downloading and storing an external app. They can use the UPI payment platform directly on the SMS/ Messaging and Dialler interface. Phones with this UPI feature built-in are expected to hit the streets in this quarter.

The Indus Keyboard will have a symbol through which users can initiate UPI transactions within the messaging/chatting app. They can directly transfer money to the person they are chatting with by simply clicking the symbol. the user they are messaging/chatting with. This will work on SMS and on third party messaging apps such as WhatsApp. The contacts app on any smartphone running Indus OS will allow users to send money directly to anyone in their contact list.

Says Ritesh Pai, Chief Digital Officer, YES Bank: “We are very excited to partner with Indus OS, the only operating system made for the Indian masses, to make the whole UPI experience more contextual. Integrating UPI into the mobile OS will help in creating multiple use cases for payments and spur the adoption of UPI in our country.”

The UPI facilitation follows on the heels of an earlier launch this year, after Indus OS became the first ever Aadhaar-authenticated OS. It had tied up with Newark, New Jersey-US based Delta ID, a specialist in iris scan technology to put Aadhaar eye-scan interface on Indus -fueled phones. Read The Week story here.