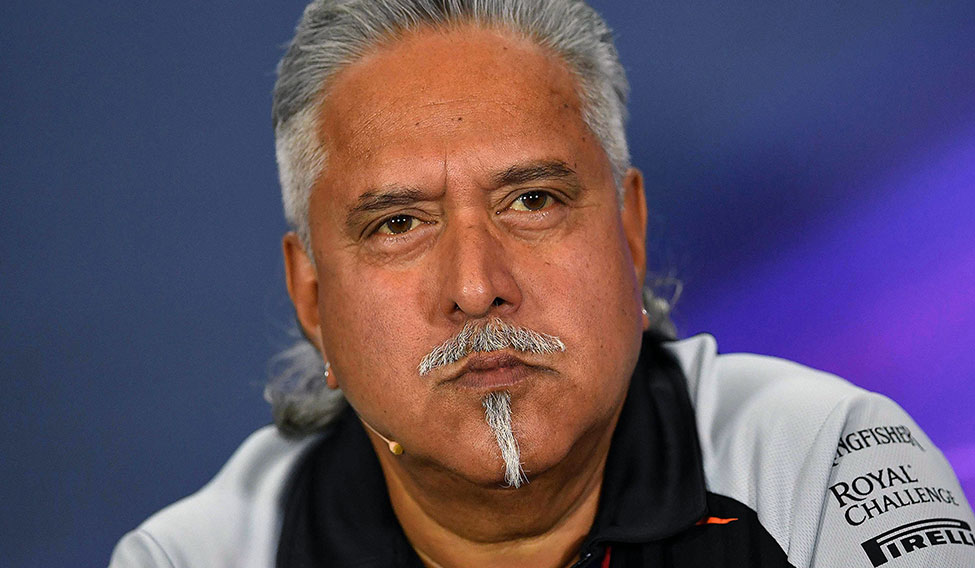

In his many encounters with authorities, Vijay Mallya has come through unscathed on most occasions. However, the law finally seems to be catching up with the embattled liquor baron, with the Enforcement Directorate planning to declare him an absconding offender in a money laundering case and secure a Red Corner Notice against him.

Mallya fled to the UK seven months ago, after his defunct Kingfisher Airlines defaulted on a Rs 6,027 crore bank loan and the lenders moved the Supreme Court for seizure of his passport. He is also accused of diverting a loan worth Rs 900 crore from IDBI Bank, sought for reviving his airline, to a Formula 1 race team he owned.

THE WEEK is in possession of documents that say Mallya, by virtue of being Kingfisher chairman, took the final decision to remit a major portion of the loan money to “outside India”, and he generated proceeds and laundered large chunks of funds. The ED probe is focused on how he harnessed several paper companies to divert funds.

A fast track court in Mumbai on September 22 sent A. Raghunathan, former chief financial of Kingfisher Airlines, to jail for 18 months in a cheque bounce case filed by GMR Hyderabad International Airport Ltd. Raghunathan and UB Group CFO Ravi Nedungadi had appeared before the ED a few months ago.

An ED official said Mallya was not genuine in his efforts to cooperate with the investigation. In fact, many eyebrows were raised when Mallya moved an application in a Delhi court on April 9 saying that he wished to “return to India”. (It pertained to a different case.) The ED official said it could be a “ruse” prompted by the investigating agency’s move to declare him an absconding offender.

“We are moving towards declaring Mallya an absconding accused,” Hiten Venegavkar, prosecution lawyer representing the ED, told THE WEEK. In April, India revoked Mallya’s diplomatic passport, which he possessed by virtue of being a Rajya Sabha member. Venegavkar said the application in the Delhi court expressing his willingness to come back was yet another attempt to dodge the due processes of law. “He can travel with emergency papers back to India,” he said.

The case in the Delhi court was under the Foreign Exchange Regulation Act 1973 (FERA was repealed in 1998 and replaced by Foreign Exchange Maintenance Act) on Mallya’s transactions with Flavio Briatore of Benetton Formula Ltd. It was accused that Mallya entered into an agreement with Benetton for advertising Kingfisher brand on Formula 1 race cars during 1996-98. The requisite permission for this from the Reserve Bank was not sought by Mallya, which amounted to violation of FERA. An approval from the finance ministry was sought on June 19, 1996, which was rejected in 1999. Mallya’s appeal in this case to drop FERA charges was dismissed by the Delhi High Court.

Summonses in the ED case were issued to Mallya on March 10, March 15 and April 2. And, over the past few months, the ED has attached his assets worth Rs 8,014 crore, including farmhouses, bank deposits, flats in Bengaluru and Mumbai, industrial plots in Chennai, coffee estates in Coorg and developed space in UB City in Bengaluru.

Getting Mallya back, however, might not be easy. He has investments in the UK and is said to have influential connections there. The UK had once turned down an Indian request to extradite Mallya. The ED sources, however, said the Indian request then was not exactly turned down, but the UK “had sought certain pieces of extra information on the matter”. Mallya is a registered voter in the UK and he a house in Hertfordshire on the outskirts of London. (Citizens of the Commonwealth who have been residents for more than six months and registered on the rolls can vote in the UK.)

Mallya’s troubles had started even before the ED started tracking his financial misdemeanours. On July 29, 2015, the CBI registered a case [FIR Number: RCBSM2015E006] to investigate the 0900 crore loan from IDBI Bank to Kingfisher Airlines. The ED at a later stage [vide ECIR /03/MBZO/2016 dated January 25, 2016] took up the money laundering probe. Mallya has been declared a proclaimed offender by the ED under section 4 of the Prevention of Money Laundering Act 2002. Also, the Debt Recovery Tribunal accepted an application in March by public sector banks to secure lender’s first rights on $75 million that Mallya was supposed to receive from United Spirits Ltd. The DRT later reserved its orders on the matter.

The Mallya camp is unfazed by the build up against him. Mallya’s lawyer Uday Holla said his client was a minor offender in comparison with other defaulters, who were some of corporate India’s biggest names. That excuse, however, is unlikely provide Mallya any respite.