The caller was a man, his voice cold and clipped, and exuding authority. On the other end of the line was an American, who had just been told that he was in trouble. “You are on our watch list, since you haven’t disclosed your actual income to the government,” the caller told the American.

The caller had introduced himself as an officer of the Internal Revenue Service, the agency responsible for collecting tax and enforcing tax laws in the US. As far as busting tax evaders was concerned, the IRS had a reputation as being efficient to the point of being aggressive: Its officials had been accused of abusive and intimidating behaviour on more than one occasion.

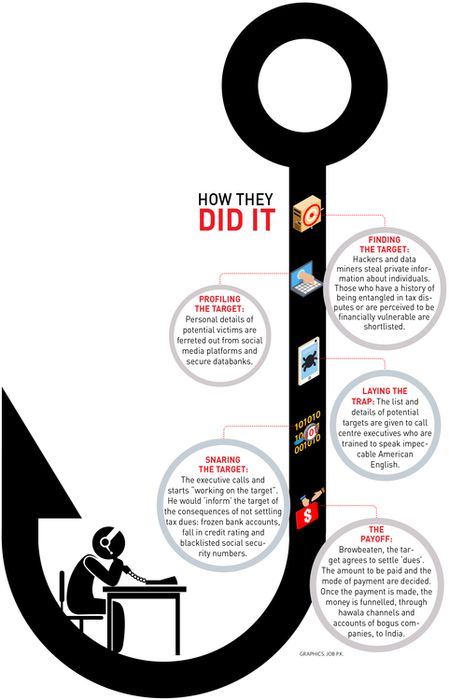

So, as far as the hapless American was concerned, the pushy and persuasive tone of the caller was not entirely out of line. The caller told him that he would have to pay $30,000 to $50,000 to settle the tax issue. Once the amount to be paid and transaction details were decided, the caller hung up.

The American did as he was told. His money, however, did not go to the IRS. Instead, it was funnelled, through hawala channels and accounts of bogus companies, to India. Or, to be precise, one of the several call centres on Mira Road in Thane.

The caller was not from the IRS. He was an Indian in his mid-20s, trained to speak impeccable American English. He was part of a racket that specialised in using call centre infrastructure to swindle Americans. Thanks to hundreds of ‘professionals’ like him working out of several call centres on Mira Road, the racket was making as much as Rs 1 crore a day. It was August, and the call centres had been in operation for nearly 10 months.

It all went bust in October, when the police discovered the racket and began cracking down on it. According to investigators, more than 6,000 Americans in 10 cities have fallen prey to the scam. The police have arrested more than 70 call centre employees and detained more than 800 for questioning. Those arrested have been booked under sections 384 (extortion), 419 (cheating by impersonation) and 420 (cheating) of the Indian Penal Code and other relevant provisions of the Information Technology Act and the Indian Telegraph Act.

The police are on the lookout for a Sagar ‘Shaggy’ Thakkar, the alleged kingpin of the racket, and a Hyder Ali, who is believed to have played a central role in planning the whole scam. Jagdish Kanani, who was allegedly Thakkar’s mentor, was arrested recently from Borivali. Investigators are hopeful that Kanani will lead them to Thakkar. To prevent Thakkar from fleeing the country, lookout notices have been issued to all airports and seaports, said Ashutosh Dumbre, joint commissioner of police in Thane.

An arrested call centre worker, Sufiyaan Mazrooki, told the police that “extensive research” went into acquiring private information about individuals in the US. Apparently, the initial stage of the scam involved data mining and “zeroing in on” potential targets. A team called “Shaggy’s backroom boys”, comprising hackers and data miners, shortlisted individuals who either had a history of being entangled in tax disputes or were perceived to be financially vulnerable. Their personal details were ferreted out from social media platforms such as Facebook and even from secure databanks. The list and details were then passed to call centre executives for “telephonic targeting”.

According to the police, Thakkar had been in the data theft business for the past two years. He had moved from Mumbai to Ahmedabad, where he met Kanani, who allegedly taught him the nitty-gritty of running illegal businesses, cooking the books and laundering money. Those who know him say Thakkar launched a business in Ahmedabad without setting up an office. Apparently, he fared so well that he bought a few luxury cars, hired private security guards and began to be noticed for his flashy lifestyle. One of his associates said Thakkar had bragged to him that he had struck it big in the business of stealing private data and selling it online.

The police say the call centre scam was devised by a core group of at least five individuals, including Thakkar and Kanani. The group allegedly relied on senior executives in the call centre business to recruit and train staff. The list of vulnerable individuals were then handed over to the staff, who made VoIP (Voice over Internet Protocol) calls that were routed in such a way that they appeared to have been dialled from the US.

A call centre executive was supposed to “work on the targets” for days. He would ‘inform’ targets of the consequences of not paying up: frozen bank accounts, fall in credit rating and blacklisted social security numbers. The aim was to boost their sense of apprehension until they agreed to settle their ‘tax arrears’.

Apparently, the scam was run so professionally on a day-to-day basis that even sleuths from the Federal Bureau of Investigation in the US, who are cooperating with the police in Thane, are finding it hard to crack the labyrinth of financial transactions. The involvement of more than one call centre in the scam has also made tracking the money trail difficult. Investigators say Iserve BPO Private Ltd, Lorex Impex Private Ltd, MAC Outsourcing Service and Tech Solutions are some of the call centres being probed.

The police say they have so far identified and traced transactions worth Rs 30 crore. The figure, however, is just a fraction of what the scam is estimated to be worth—Rs 500 crore. For now, the police have laid their snare for the people who could throw light on the magnitude of the scam: Thakkar and his associates.