As more and more confident women become breadwinners in the economy and for their homes, safety and security features of a car are the top bets that steer the choice for their next set of wheels.

This and many other interesting revelations were made in what is being called the first ever survey on women car buyers—a steadily growing customer base for automakers.The survey, conducted by Singapore based automotive consulting and research firm, PremonAsia, had interviewed 3,945 women drivers in the 21-45 years age group across 28 cities over April-July 2017.

The cities included are Ahmedabad, Bengaluru, Bhopal, Bhubaneswar, Kozhikode, Chandigarh, Chennai, Coimbatore, Dehradun, Delhi (NCR), Guwahati, Hyderabad, Indore, Jaipur, Kanpur, Kochi, Kolkata, Lucknow, Ludhiana, Mumbai, Nagpur, Nasik, Patna, Pune, Ranchi, Surat, Thiruvananthapuram and Vadodara.

Women aged 21-45 years who are fully or partially involved in the decision making and are the principal user of the car, participated in this survey by market survey agency, Market Sapience, using GPS enabled data collection to ensure data quality in the survey.

"We realised that number of women car buyers which was 1-2 per cent in the 1990s, is 10-20 per cent today. Understanding what women (as car buyers) want is important and will continue to be more important," said Rajiv Lochan, CEO, PremonAsia, while talking to THE WEEK.

As a part of the survey questionnaire, respondents were asked to detail their experience of owning cars across 80 models belonging to 11 brands.

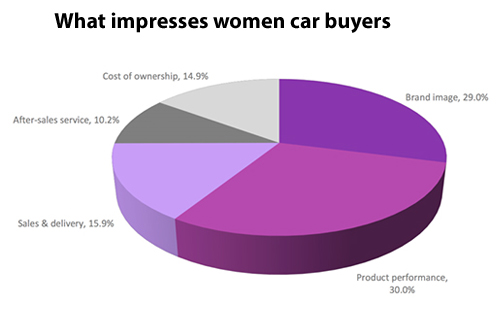

The survey revealed that Honda, Volkswagen and Nissan excel in meeting the expectations of women car buyers’ in India. “These brands were found to provide strong ownership experience to women car buyers. The main driving points were product performance, which emerged as the strongest reason for preference, followed by brand image, after sales service and cost of ownership,” said Lochan.

PremonAsia’s Women automotive buyer study, 2017 found that Honda leads in overall experience of product and cost of ownership, Volkswagen ranks highest on brand image, Nissan does well on after-sales service and Toyota excels in sales & delivery,

Among the top three brands, the most preferred car models were the City sedan by Honda, followed by Polo hatchback from Volkswagen stable and Nissan’s Micra hatchback. “We found women car buyers to be high on product and value perception.”

Interestingly, the survey also found stark disconnect in what men think and what women want, leading to a conclusion that men should not make car buying choices for women. “Men, buying a car on behalf of a female family member or a friend, hold the belief that practical aspects like budget, cost of ownership, ease of parking and fuel efficiency are the key choices for women drivers. Contradicting this myth, the study reveals that women buyers are more discerning in attaching a significantly higher importance to brand and product elements,” said Lochan.

The survey found that despite the prevalent on-tap mobility solutions like Ola and Uber, women car buyers prefer personal transportation as their mobility solution. “In the foreseeable future, personal transport will dominate their mobility choice. The deterrent seems to be perception of lack of personal space, trust and safety.”

The analysis for brand level performance in WABSSM has been represented by their respective leading models measured through the Women Automotive Buyer Index (WABI), a composite measure of ownership experience. Honda City, Volkswagen Polo, and Nissan Micra emerged as the three leading models measured through this index.

"The top ranking brands and their respective models deliver a consistent performance across all aspects of the ownership experience," comments Lochan. "It is not surprising to find that the top-ranking brands enjoy strong advocacy and loyalty among women, with nearly 70 per cent or more of their owners willing to recommend and repurchase these brands."

In addition to the customer evaluations of their ownership experience, this study also examined expectations of features and services that women car buyers expect. Safety, security, and convenience emerged as key expectations in the features and services women buyers seek in their cars.

Live tracking of car’s service through mobile app, pick and drop facility for car service, security alarm system, 24-hour roadside assistance, rear camera and automatic door closing system are strongly desired by women car buyers, the survey found.

Offering visually appealing cars, exciting cars and innovative technology are important drivers of brand perception. Women perceive VW, Honda, and Hyundai positively on these virtues.

The 22-25 years age band is important as most women have learnt driving and have acquired a license. Interestingly, women in smaller cities tend to start learning driving and acquire license sooner than those in metros.

“These trends suggest that the automotive marketer have their task cut out,” observes Lochan. “The gender gap on Indian roads is rapidly decreasing. The prominence of this important target group is going to grow further as women expand their roles in different professions and gain financial independence.”